Global Biopolymer Packaging Market Overview

- The Global Biopolymer Packaging Market is valued at approximately USD 28.8 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for sustainable packaging solutions, stringent regulations targeting plastic waste reduction, and rapid advancements in bio-based material technologies. The adoption of biopolymers—derived from renewable resources—continues to accelerate as businesses and consumers seek alternatives with a lower environmental footprint compared to conventional plastics.

- Key players in this market are concentrated in regions such as North America and Europe, where there is a strong emphasis on sustainability and environmental protection. Countries like the United States and Germany dominate the market due to their advanced technological capabilities, robust manufacturing infrastructure, and proactive government policies that support the development and use of biopolymer materials.

- The Single-Use Plastics Directive (Directive (EU) 2019/904), issued by the European Parliament and Council in 2019, aims to reduce the environmental impact of certain plastic products. This regulation mandates reductions in single-use plastics and encourages the adoption of biodegradable and compostable materials, significantly boosting demand for biopolymer packaging solutions across EU member states. The directive sets product bans, consumption reduction targets, and labeling requirements for plastic-containing products, driving operational changes throughout the packaging value chain.

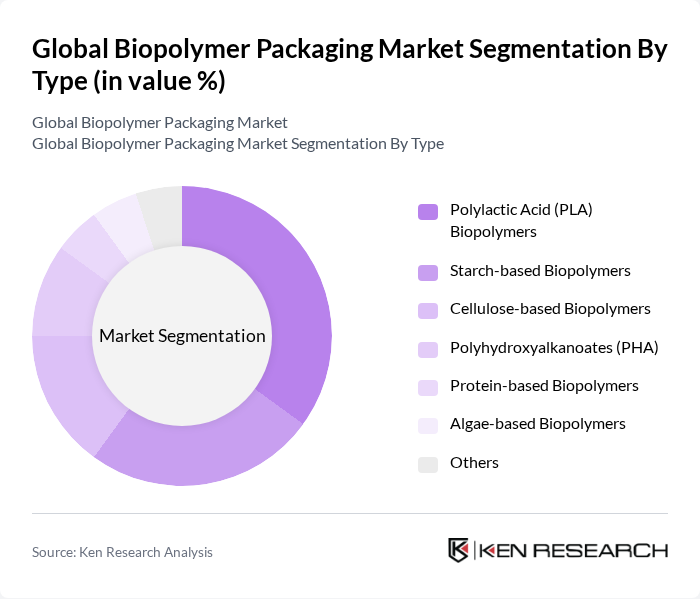

Global Biopolymer Packaging Market Segmentation

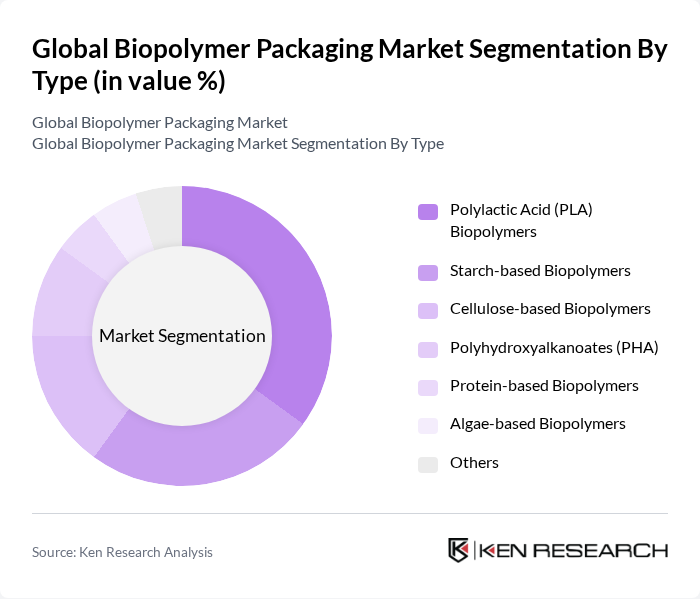

By Type:The biopolymer packaging market is segmented into various types, including Polylactic Acid (PLA) Biopolymers, Starch-based Biopolymers, Cellulose-based Biopolymers, Polyhydroxyalkanoates (PHA), Protein-based Biopolymers, Algae-based Biopolymers, and Others. Among these, Polylactic Acid (PLA) Biopolymers lead the market due to their versatility, ease of processing, and strong consumer preference for biodegradable options. The increasing awareness of environmental issues and regulatory support has driven manufacturers to adopt PLA, making it a preferred choice in packaging applications.

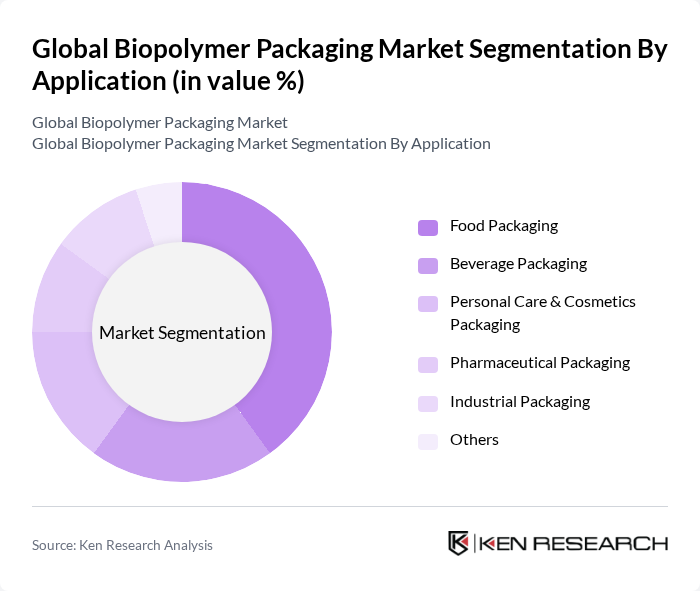

By Application:The applications of biopolymer packaging include Food Packaging, Beverage Packaging, Personal Care & Cosmetics Packaging, Pharmaceutical Packaging, Industrial Packaging, and Others. Food Packaging remains the dominant application segment, driven by the rising demand for sustainable and safe packaging solutions in the food industry. The shift towards organic and natural products, combined with regulatory requirements for food safety and environmental impact reduction, continues to propel the use of biopolymer materials in this segment.

Global Biopolymer Packaging Market Competitive Landscape

The Global Biopolymer Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, NatureWorks LLC, Novamont S.p.A., Biome Bioplastics Ltd., DuPont de Nemours, Inc., Braskem S.A., TotalEnergies Corbion PLA, Mitsubishi Chemical Group Corporation, Green Dot Bioplastics, Inc., FKuR Kunststoff GmbH, TIPA Corp Ltd., BioBag International AS, CJ Biomaterials, Inc., Amcor plc, UPM-Kymmene Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Global Biopolymer Packaging Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Sustainable Packaging:The global shift towards sustainability has led to a significant increase in consumer demand for eco-friendly packaging solutions. In future, the sustainable packaging market is projected to reach $500 billion, with biopolymer packaging accounting for a notable share. This trend is driven by consumers' growing awareness of environmental issues, as 70% of consumers express a preference for brands that utilize sustainable materials, according to a recent industry report.

- Government Regulations Promoting Eco-Friendly Materials:Governments worldwide are implementing stringent regulations to reduce plastic waste, which is expected to drive the adoption of biopolymer packaging. For instance, the European Union's directive to ban single-use plastics in future is anticipated to create a market shift towards biopolymers. In future, it is estimated that over 30 countries will have enacted similar regulations, further incentivizing manufacturers to invest in biopolymer solutions to comply with these policies.

- Advancements in Biopolymer Technology:Technological innovations in biopolymer production are enhancing the performance and cost-effectiveness of these materials. In future, investments in biopolymer research and development are expected to exceed $1 billion, leading to improved properties such as barrier performance and durability. These advancements are crucial for expanding the applications of biopolymers in various sectors, including food packaging, which is projected to grow by 15% annually as a result of these innovations.

Market Challenges

- High Production Costs of Biopolymers:One of the significant challenges facing the biopolymer packaging market is the high production costs associated with biopolymer materials. In future, the average cost of producing biopolymers is estimated to be 20-30% higher than traditional plastics, primarily due to the expensive raw materials and processing technologies involved. This cost disparity poses a barrier to widespread adoption, particularly among price-sensitive consumers and manufacturers.

- Limited Availability of Raw Materials:The supply chain for biopolymer raw materials is still developing, leading to limited availability and potential supply disruptions. In future, it is projected that the demand for biopolymer feedstocks will exceed 5 million tons, while current production levels are only around 3 million tons. This gap can lead to increased prices and supply constraints, hindering the growth of the biopolymer packaging market and limiting manufacturers' ability to meet consumer demand.

Global Biopolymer Packaging Market Future Outlook

The future of the biopolymer packaging market appears promising, driven by increasing consumer awareness and regulatory pressures. As more companies commit to sustainability, the demand for biopolymer solutions is expected to rise significantly. Innovations in biopolymer technology will likely enhance product performance, making them more competitive against traditional plastics. Additionally, the expansion of biopolymer applications across various industries will create new market segments, further solidifying the role of biopolymers in sustainable packaging solutions.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets present significant growth opportunities for biopolymer packaging. Countries in Asia-Pacific, particularly India and China, are experiencing rapid urbanization and increasing consumer demand for sustainable products. In future, the biopolymer packaging market in these regions is expected to grow by 25%, driven by rising disposable incomes and a shift towards eco-friendly packaging solutions.

- Development of Innovative Biopolymer Applications:There is a growing opportunity for the development of innovative applications for biopolymers, particularly in sectors like food and beverage, cosmetics, and pharmaceuticals. In future, the introduction of new biopolymer formulations is expected to create products with enhanced properties, such as improved barrier resistance and biodegradability, which will attract more manufacturers to adopt biopolymer solutions.