Region:Global

Author(s):Dev

Product Code:KRAA1621

Pages:83

Published On:August 2025

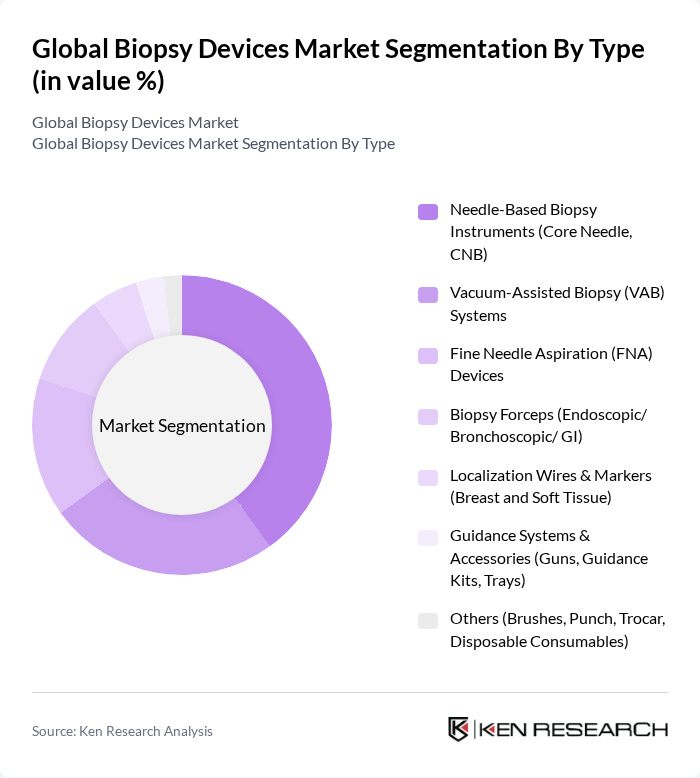

By Type:The biopsy devices market is segmented into various types, including Needle-Based Biopsy Instruments, Vacuum-Assisted Biopsy Systems, Fine Needle Aspiration Devices, Biopsy Forceps, Localization Wires & Markers, Guidance Systems & Accessories, and Others. Among these, Needle-Based Biopsy Instruments, particularly Core Needle Biopsy (CNB), are leading the market due to their effectiveness in obtaining tissue samples with minimal patient discomfort. The demand for these instruments is driven by their accuracy and the growing trend towards outpatient procedures .

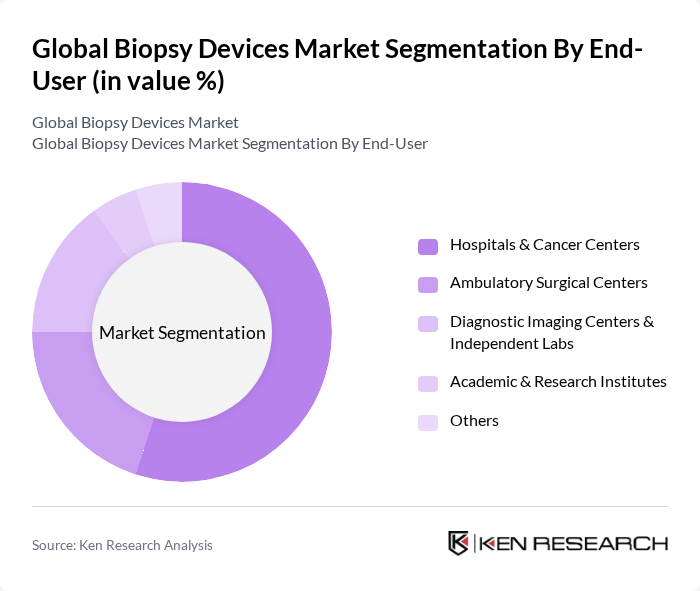

By End-User:The end-user segmentation includes Hospitals & Cancer Centers, Ambulatory Surgical Centers, Diagnostic Imaging Centers & Independent Labs, Academic & Research Institutes, and Others. Hospitals & Cancer Centers dominate this segment due to the high volume of biopsy procedures performed in these settings. The increasing number of cancer cases and the need for accurate diagnosis are driving the demand for biopsy devices in these facilities .

The Global Biopsy Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Becton, Dickinson and Company (BD), Hologic, Inc., Devicor Medical Products, Inc. (Mammotome), Argon Medical Devices, Inc., Cook Medical LLC, Merit Medical Systems, Inc., Stryker Corporation (Treo/Powered Biopsy), Olympus Corporation, FUJIFILM Holdings Corporation, Boston Scientific Corporation, Cardinal Health, Inc. (MedComp/Biopsy Accessories), INRAD Inc., TSK Laboratory International, Medtronic plc (Select ENT/GI biopsy accessories), C.R. Bard, Inc. (Bard Biopsy – now BD) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the biopsy devices market appears promising, driven by technological advancements and an increasing focus on personalized medicine. As healthcare systems invest in innovative diagnostic tools, the integration of artificial intelligence in biopsy procedures is expected to enhance accuracy and efficiency. Furthermore, the growing emphasis on patient-centric care will likely lead to the development of more comfortable and less invasive biopsy options, catering to the evolving needs of patients and healthcare providers alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Needle-Based Biopsy Instruments (Core Needle, CNB) Vacuum-Assisted Biopsy (VAB) Systems Fine Needle Aspiration (FNA) Devices Biopsy Forceps (Endoscopic/ Bronchoscopic/ GI) Localization Wires & Markers (Breast and Soft Tissue) Guidance Systems & Accessories (Guns, Guidance Kits, Trays) Others (Brushes, Punch, Trocar, Disposable Consumables) |

| By End-User | Hospitals & Cancer Centers Ambulatory Surgical Centers Diagnostic Imaging Centers & Independent Labs Academic & Research Institutes Others |

| By Application | Breast Biopsy Lung Biopsy Prostate Biopsy Liver Biopsy Kidney Biopsy Gastrointestinal & Colorectal Biopsy Others (Thyroid, Bone, Skin, Musculoskeletal) |

| By Guidance/Imaging Technique | Ultrasound-Guided Biopsy Stereotactic & Mammography-Guided Biopsy CT-Guided Biopsy MRI-Guided Biopsy Endoscopic & Bronchoscopic-Guided Biopsy Others (Fusion-Guided, X-ray, Fluoroscopy) |

| By Distribution Channel | Direct Sales to Providers Distributors/Dealers Group Purchasing Organizations (GPOs) Online/ E-Procurement Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Tier | Economy (Disposable Biopsy Needles & Forceps) Mid-Range (Reusable Systems & Accessories) Premium (Robotic/Powered & MRI-Compatible Systems) |

| By Automation Level | Manual Semi-Automated (Spring-Loaded Guns) Fully Automated/Powered Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Clinics | 120 | Oncologists, Nurse Practitioners |

| Pathology Laboratories | 100 | Pathologists, Lab Managers |

| Medical Device Distributors | 60 | Sales Representatives, Product Managers |

| Hospitals with Oncology Departments | 100 | Healthcare Administrators, Surgical Teams |

| Research Institutions | 50 | Clinical Researchers, Biomedical Engineers |

The Global Biopsy Devices Market is valued at approximately USD 2.3 billion, driven by factors such as the increasing prevalence of cancer, advancements in biopsy technologies, and a growing demand for minimally invasive procedures.