Region:Global

Author(s):Dev

Product Code:KRAD0445

Pages:99

Published On:August 2025

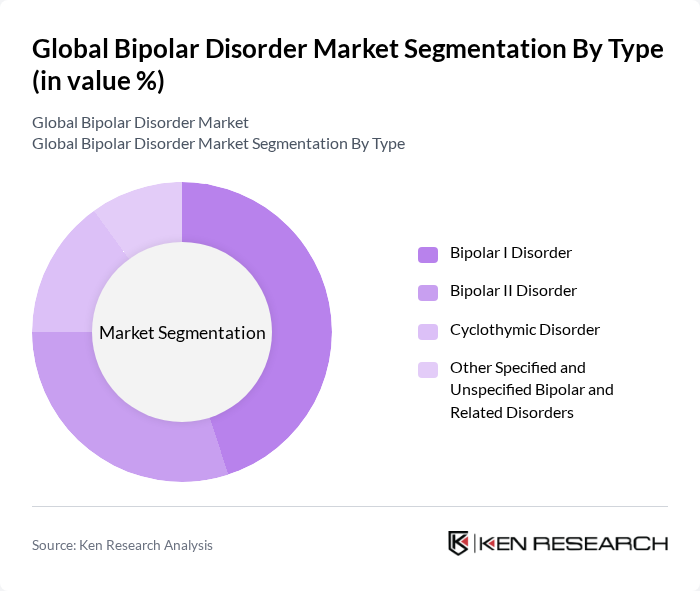

By Type:The bipolar disorder market is segmented into four main types: Bipolar I Disorder, Bipolar II Disorder, Cyclothymic Disorder, and Other Specified and Unspecified Bipolar and Related Disorders. Among these, Bipolar I Disorder is the most prevalent, characterized by manic episodes that can be severe and often require hospitalization. The increasing recognition of the disorder and its impact on individuals' lives has led to a growing demand for effective treatment options.

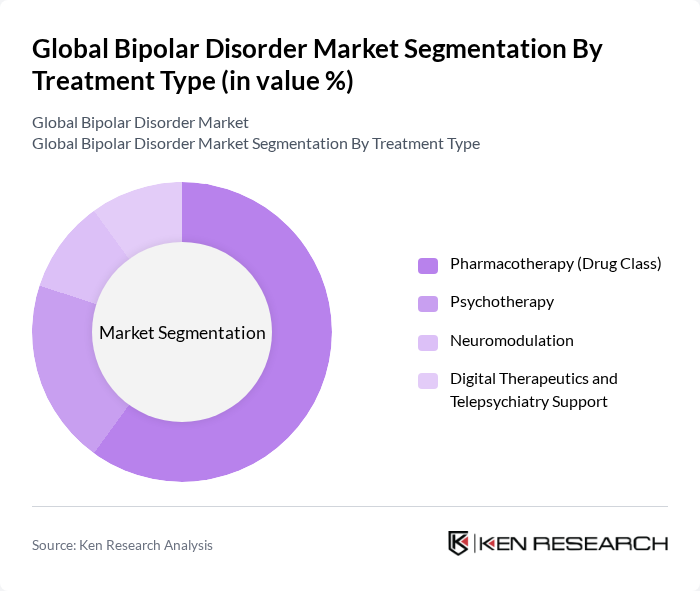

By Treatment Type:This market is also segmented by treatment type, which includes Pharmacotherapy (Drug Class), Psychotherapy, Neuromodulation, and Digital Therapeutics and Telepsychiatry Support. Pharmacotherapy is the leading treatment type, with mood stabilizers and atypical antipsychotics being the most commonly prescribed medications. The increasing acceptance of pharmacological treatments and the development of new drugs are driving this segment's growth. Common drug classes used include mood stabilizers (e.g., lithium, valproate), atypical antipsychotics (e.g., quetiapine, lurasidone, cariprazine), and adjunctive antidepressants with careful monitoring. ; ;

The Global Bipolar Disorder Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson (Janssen Pharmaceuticals), Pfizer Inc., Eli Lilly and Company, AstraZeneca PLC, Novartis AG, GlaxoSmithKline plc, Sanofi S.A., Otsuka Holdings Co., Ltd., H. Lundbeck A/S, Takeda Pharmaceutical Company Limited, Teva Pharmaceutical Industries Ltd., AbbVie Inc., Sumitomo Pharma Co., Ltd., Sunovion Pharmaceuticals Inc. (a Sumitomo Pharma company), Intra-Cellular Therapies, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bipolar disorder market appears promising, driven by ongoing advancements in treatment modalities and increased public awareness. As mental health becomes a priority for healthcare systems worldwide, the integration of mental health services into primary care settings is expected to enhance accessibility. Furthermore, the rise of digital therapeutics and telehealth services will likely provide innovative solutions for patient engagement and adherence, ultimately improving treatment outcomes and expanding market reach in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Bipolar I Disorder Bipolar II Disorder Cyclothymic Disorder Other Specified and Unspecified Bipolar and Related Disorders |

| By Treatment Type | Pharmacotherapy (Drug Class) Mood Stabilizers (e.g., lithium, valproate, lamotrigine) Atypical Antipsychotics Antidepressants (adjunctive, where appropriate) Anxiolytics and Others Psychotherapy (CBT, IPSRT, family-focused therapy) Neuromodulation (ECT, rTMS) Digital Therapeutics and Telepsychiatry Support |

| By Age Group | Children and Adolescents Adults Older Adults |

| By Care Setting | Hospital/Inpatient Outpatient Specialty Clinics Community Mental Health Centers Home/Telehealth |

| By Distribution Channel (for Drugs) | Hospital Pharmacies Retail Pharmacies Online Pharmacies |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| By Unmet Need/Severity | Acute Mania Management Bipolar Depression Management Maintenance/Relapse Prevention Treatment-Resistant Cases |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Psychiatric Treatment Facilities | 120 | Psychiatrists, Clinical Psychologists |

| Pharmaceutical Prescribers | 90 | General Practitioners, Nurse Practitioners |

| Patient Support Groups | 80 | Patients, Caregivers |

| Healthcare Policy Makers | 60 | Health Economists, Policy Analysts |

| Market Research Analysts | 70 | Healthcare Analysts, Market Strategists |

The Global Bipolar Disorder Market is valued at approximately USD 5.1 billion, driven by increased awareness of mental health issues, advancements in treatment options, and a rising prevalence of bipolar disorder worldwide.