Region:Global

Author(s):Dev

Product Code:KRAB0496

Pages:98

Published On:August 2025

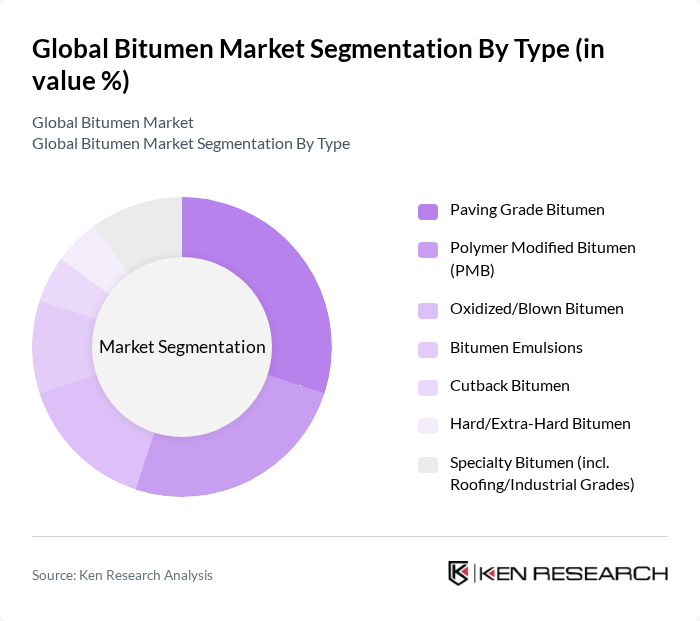

By Type:The market is segmented into various types of bitumen, including Paving Grade Bitumen, Polymer Modified Bitumen (PMB), Oxidized/Blown Bitumen, Bitumen Emulsions, Cutback Bitumen, Hard/Extra-Hard Bitumen, and Specialty Bitumen (including Roofing/Industrial Grades). Each type serves distinct applications and is tailored to meet specific performance requirements.

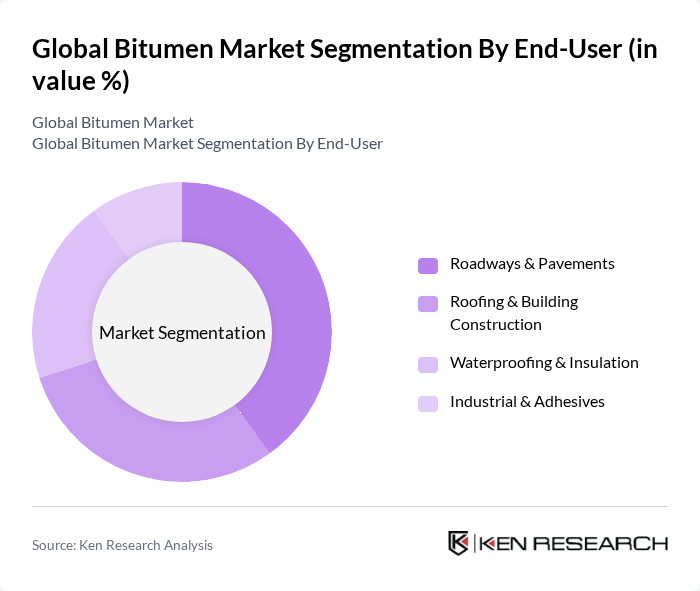

By End-User:The end-user segmentation includes Roadways & Pavements, Roofing & Building Construction, Waterproofing & Insulation, and Industrial & Adhesives. Each segment reflects the diverse applications of bitumen in various industries, driven by specific performance and durability requirements.

The Global Bitumen Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shell Bitumen, BP Bitumen, TotalEnergies, ExxonMobil, Chevron, Nynas AB, Colas (Bouygues Group), Marathon Petroleum, Repsol, Indian Oil Corporation (IOCL), Tiki Tar and Shell India, Asphalt Materials, Inc. (the Heritage Group), Koppers Inc., CRH plc, Tarmac (CRH), Sinopec (China Petroleum & Chemical Corporation), Saudi Aramco (including SATORP), Abu Dhabi National Oil Company (ADNOC), Gazprom Neft, Pasargad Oil Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bitumen market appears promising, driven by ongoing infrastructure projects and technological advancements. As urbanization continues to rise, the demand for high-quality road construction materials will increase. Additionally, the shift towards sustainable practices will likely lead to innovations in bitumen production and recycling technologies. Companies that adapt to these trends and invest in sustainable solutions will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Paving Grade Bitumen Polymer Modified Bitumen (PMB) Oxidized/Blown Bitumen Bitumen Emulsions Cutback Bitumen Hard/Extra-Hard Bitumen Specialty Bitumen (incl. Roofing/Industrial Grades) |

| By End-User | Roadways & Pavements Roofing & Building Construction Waterproofing & Insulation Industrial & Adhesives |

| By Application | Hot Mix Asphalt (HMA) Warm Mix Asphalt (WMA) Cold Mix Asphalt (CMA) Surface Treatments & Chip Seals Roofing Membranes & Shingles Others |

| By Distribution Channel | Direct Sales to Contractors/Governments Distributors & Dealers Traders & Bulk Suppliers Online/Platform-Based Procurement |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Performance Grade (PG) | PG 58-28 PG 64-22 PG 70-28 and above Polymer-Modified PG Grades |

| By Sustainability Attribute | RAP/RAS Content Utilization Warm-Mix Compatible Low-Emission/Low-VOC Formulations Bio- and Fluxed-Modified Bitumen |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Construction Projects | 140 | Project Managers, Civil Engineers |

| Roofing Applications | 100 | Architects, Roofing Contractors |

| Industrial Bitumen Usage | 80 | Procurement Managers, Operations Directors |

| Bitumen Export Markets | 70 | Export Managers, Trade Analysts |

| Bitumen Product Innovations | 60 | R&D Managers, Product Development Specialists |

The Global Bitumen Market is valued at approximately USD 75 billion, driven by increasing demand for road construction, maintenance, and waterproofing materials in the building sector, alongside significant infrastructure projects worldwide.