Region:Global

Author(s):Rebecca

Product Code:KRAB0247

Pages:92

Published On:August 2025

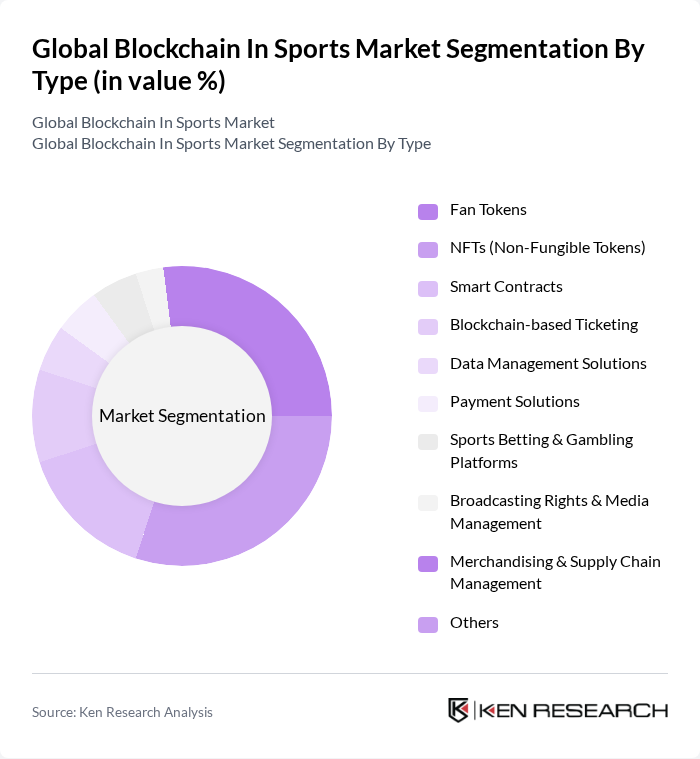

By Type:The market is segmented into Fan Tokens, NFTs (Non-Fungible Tokens), Smart Contracts, Blockchain-based Ticketing, Data Management Solutions, Payment Solutions, Sports Betting & Gambling Platforms, Broadcasting Rights & Media Management, Merchandising & Supply Chain Management, and Others.NFTsandFan Tokensare experiencing the fastest growth due to their ability to create new revenue streams and deepen fan engagement. Blockchain-based ticketing and smart contracts are also gaining traction, driven by the need for secure, transparent, and fraud-resistant transactions in sports.

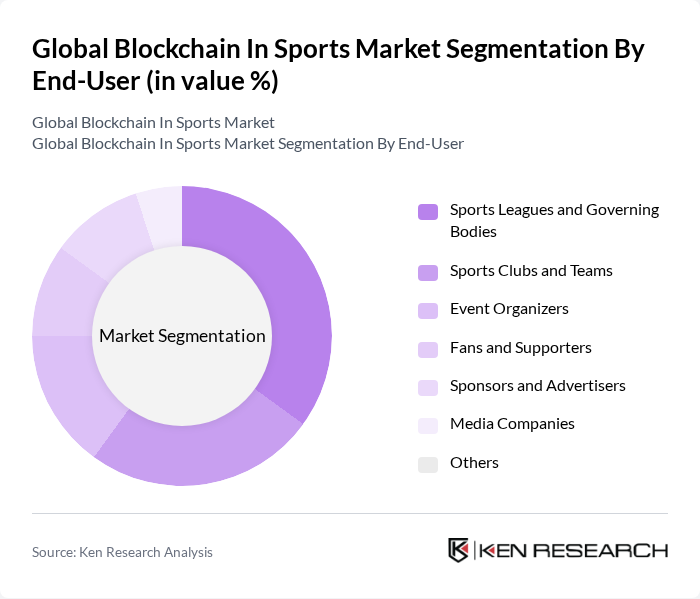

By End-User:The end-users of blockchain technology in sports include Sports Leagues and Governing Bodies, Sports Clubs and Teams, Event Organizers, Fans and Supporters, Sponsors and Advertisers, Media Companies, and Others.Sports Leagues and Governing Bodiesare leading adoption, leveraging blockchain for governance, transparency, and enhanced fan engagement. Sports clubs and teams are increasingly utilizing blockchain for ticketing, merchandising, and loyalty programs, while event organizers focus on secure access and fraud prevention.

The Global Blockchain In Sports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dapper Labs, Socios.com, Chiliz, IBM, ConsenSys, Enjin, Blockparty, FanChain, SportsCastr, Myco, The Sandbox, Rumble Kong League, NFT Gaming Company, ZED RUN, Immutable, Sorare, TopGoal, Algorand, Rally, Candy Digital contribute to innovation, geographic expansion, and service delivery in this space.

The future of blockchain in sports is poised for significant transformation, driven by technological advancements and increasing acceptance among stakeholders. As decentralized finance (DeFi) gains traction, sports organizations are likely to explore innovative financial models that enhance revenue generation. Additionally, the integration of blockchain with emerging technologies, such as artificial intelligence and the Internet of Things, will create new opportunities for operational efficiency and fan engagement, shaping a more interactive sports ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Fan Tokens NFTs (Non-Fungible Tokens) Smart Contracts Blockchain-based Ticketing Data Management Solutions Payment Solutions Sports Betting & Gambling Platforms Broadcasting Rights & Media Management Merchandising & Supply Chain Management Others |

| By End-User | Sports Leagues and Governing Bodies Sports Clubs and Teams Event Organizers Fans and Supporters Sponsors and Advertisers Media Companies Others |

| By Application | Ticketing and Fan Engagement Athlete Contracts and Licensing Broadcasting Rights and Media Management Merchandising and Supply Chain Management Sports Betting and Gambling Data Analytics Sponsorship Management Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Sports Organizations Retail Outlets Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Investment Source | Private Investments Venture Capital Government Grants Crowdfunding Others |

| By Policy Support | Tax Incentives Regulatory Frameworks Funding Programs Industry Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Blockchain in Ticketing Solutions | 100 | Ticketing Managers, Event Coordinators |

| Fan Engagement Platforms | 80 | Marketing Directors, Fan Engagement Managers |

| Merchandise Sales via Blockchain | 70 | Merchandise Managers, E-commerce Directors |

| Data Security in Sports | 60 | IT Security Officers, Compliance Managers |

| Blockchain for Sponsorship Management | 90 | Sponsorship Managers, Business Development Executives |

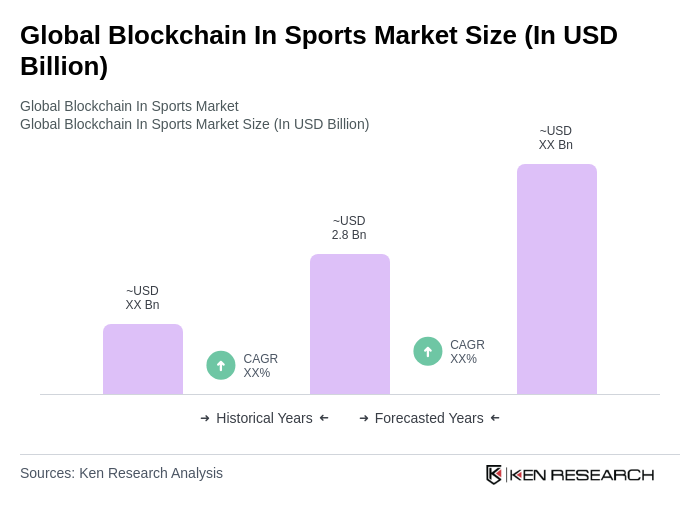

The Global Blockchain In Sports Market is valued at approximately USD 2.8 billion, reflecting significant growth driven by the adoption of blockchain technology for enhancing transparency, security, and efficiency in sports transactions, including ticketing and fan engagement.