Region:Global

Author(s):Dev

Product Code:KRAA1634

Pages:99

Published On:August 2025

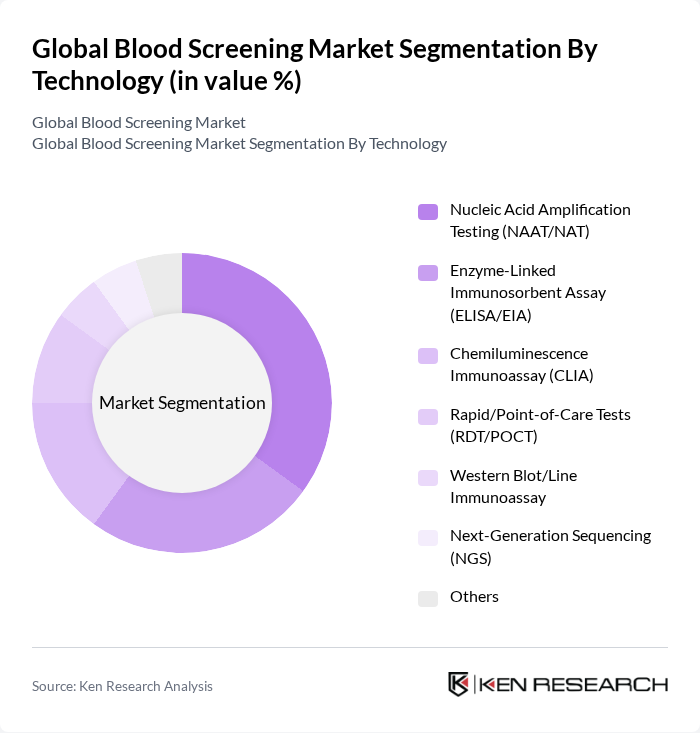

By Technology:The technology segment includes various methods used for blood screening, each with unique advantages and applications. The subsegments are Nucleic Acid Amplification Testing (NAAT/NAT), Enzyme-Linked Immunosorbent Assay (ELISA/EIA), Chemiluminescence Immunoassay (CLIA), Rapid/Point-of-Care Tests (RDT/POCT), Western Blot/Line Immunoassay, Next-Generation Sequencing (NGS), and Others. Among these, NAAT/NAT is currently the leading technology due to its high sensitivity and specificity in detecting viral infections, making it essential for blood safety protocols.

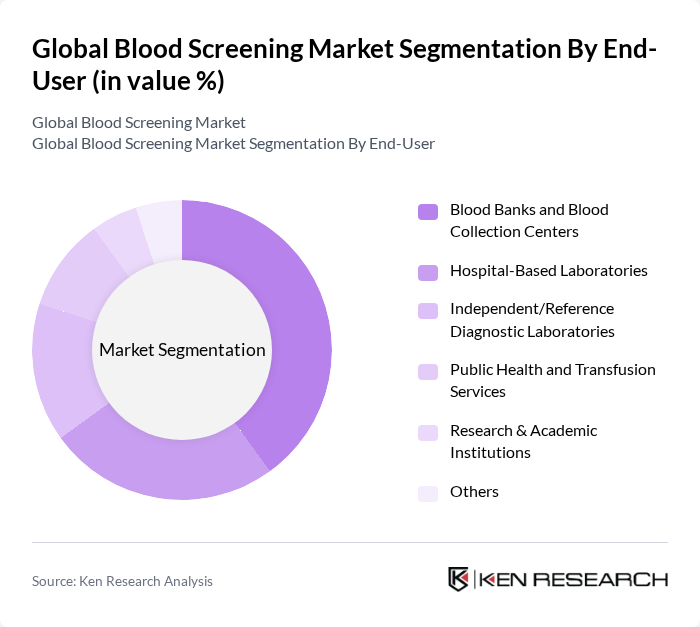

By End-User:The end-user segment encompasses various entities that utilize blood screening technologies, including Blood Banks and Blood Collection Centers, Hospital-Based Laboratories, Independent/Reference Diagnostic Laboratories, Public Health and Transfusion Services, Research & Academic Institutions, and Others. Blood Banks and Blood Collection Centers are the dominant end-users, driven by the increasing need for safe blood supply and the rising number of blood donations, which necessitate rigorous screening processes.

The Global Blood Screening Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, F. Hoffmann-La Roche Ltd (Roche Diagnostics), Siemens Healthineers AG, Grifols, S.A., Bio-Rad Laboratories, Inc., Ortho Clinical Diagnostics (QuidelOrtho Corporation), Hologic, Inc., Becton, Dickinson and Company (BD), Thermo Fisher Scientific Inc., Revvity, Inc. (formerly PerkinElmer, Inc.), QIAGEN N.V., Danaher Corporation (Beckman Coulter; Cepheid), Sysmex Corporation, Abbott Rapid Diagnostics (formerly Alere Inc.), Cerus Corporation, bioMérieux SA, Roche Molecular Systems, Inc., Diasorin S.p.A., Grifols Diagnostic Solutions Inc., Haemonetics Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the blood screening market is poised for significant transformation, driven by technological advancements and increasing awareness of blood safety. As healthcare systems prioritize patient safety, the integration of artificial intelligence and machine learning in diagnostics is expected to enhance screening accuracy and efficiency. Additionally, public-private partnerships are likely to play a crucial role in expanding blood screening programs, particularly in underserved regions, ensuring that safety standards are met and maintained across the globe.

| Segment | Sub-Segments |

|---|---|

| By Technology | Nucleic Acid Amplification Testing (NAAT/NAT) Enzyme-Linked Immunosorbent Assay (ELISA/EIA) Chemiluminescence Immunoassay (CLIA) Rapid/Point-of-Care Tests (RDT/POCT) Western Blot/Line Immunoassay Next-Generation Sequencing (NGS) Others |

| By End-User | Blood Banks and Blood Collection Centers Hospital-Based Laboratories Independent/Reference Diagnostic Laboratories Public Health and Transfusion Services Research & Academic Institutions Others |

| By Application | Infectious Disease Screening (HIV, HBV, HCV, Syphilis, Others) Blood Group Typing & Antibody Screening Transfusion Compatibility (Crossmatch) Testing Pathogen Reduction & Safety Monitoring Others |

| By Product & Service | Reagents & Kits Instruments & Analyzers Software & Informatics Services (Outsourced Screening, Maintenance, Training) Others |

| By Sales Channel | Direct/Institutional Sales Distributor/Dealer Sales Group Purchasing Organizations (GPOs) Online/Procurement Portals Others |

| By Specimen Type | Whole Blood Serum/Plasma Dried Blood Spot (DBS) Others |

| By Price Tier (Indicative for Instruments) | Entry-Level Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Blood Screening Laboratories | 120 | Laboratory Managers, Quality Control Officers |

| Healthcare Providers | 100 | Transfusion Medicine Specialists, Hematologists |

| Blood Donation Organizations | 80 | Blood Bank Directors, Donor Recruitment Coordinators |

| Medical Device Manufacturers | 70 | Product Managers, R&D Engineers |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

The Global Blood Screening Market is valued at approximately USD 3.4 billion, reflecting a significant growth driven by the rising prevalence of infectious diseases, increased awareness of blood safety, and advancements in screening technologies.