Region:Global

Author(s):Dev

Product Code:KRAD7765

Pages:85

Published On:December 2025

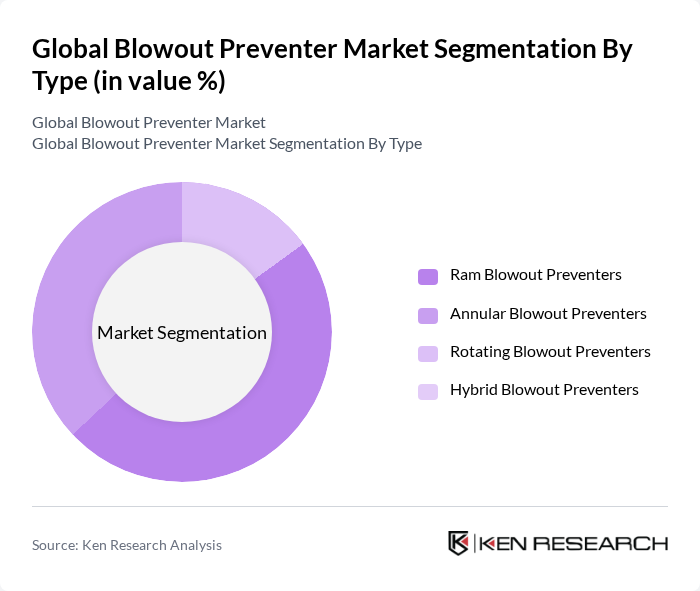

By Type:The blowout preventer market is segmented into four main types: Ram Blowout Preventers, Annular Blowout Preventers, Rotating Blowout Preventers, and Hybrid Blowout Preventers. Among these, Ram Blowout Preventers are the most widely used due to their effectiveness in sealing the wellbore during high-pressure situations. The increasing focus on safety and the need for reliable equipment in drilling operations have led to a higher adoption rate of Ram Blowout Preventers, making them a dominant force in the market.

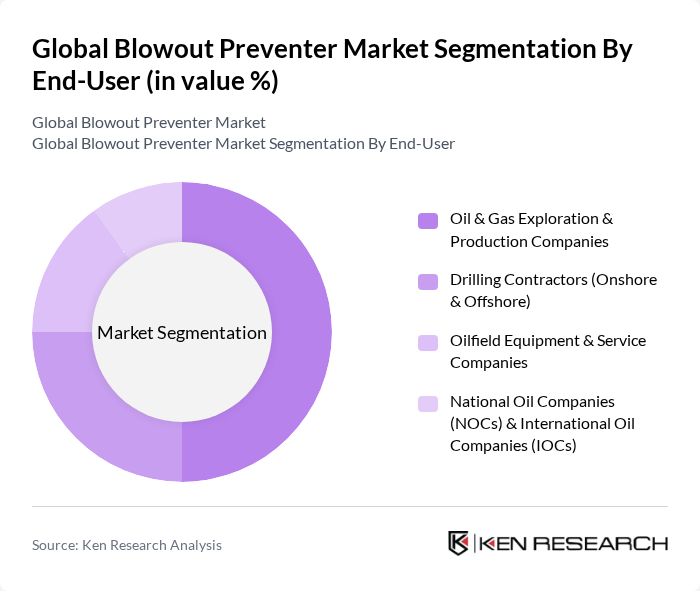

By End-User:The blowout preventer market is segmented by end-user into Oil & Gas Exploration & Production Companies, Drilling Contractors (Onshore & Offshore), Oilfield Equipment & Service Companies, and National Oil Companies (NOCs) & International Oil Companies (IOCs). The Oil & Gas Exploration & Production Companies segment holds a significant share due to the increasing number of exploration activities and the need for enhanced safety measures in drilling operations. This segment's growth is driven by the rising demand for energy and the expansion of drilling activities in both onshore and offshore environments.

The Global Blowout Preventer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schlumberger Limited, Halliburton Company, Baker Hughes Company, NOV Inc. (National Oilwell Varco), Weatherford International plc, Aker Solutions ASA, TechnipFMC plc, Cameron International Corporation (a Schlumberger company), GE Vernova – Oil & Gas (formerly GE Oil & Gas / part of Baker Hughes), Dril-Quip, Inc., NOV Grant Prideco, Subsea 7 S.A., Transocean Ltd., Valaris plc (formerly EnscoRowan plc), Noble Corporation plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the blowout preventer market appears promising, driven by ongoing technological advancements and a growing emphasis on safety in drilling operations. As the industry shifts towards automation and digitalization, the integration of IoT technologies is expected to enhance operational efficiency and safety. Furthermore, the increasing focus on sustainability will likely spur the development of eco-friendly blowout preventers, aligning with global environmental goals and regulations, thus creating a more resilient market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Ram Blowout Preventers Annular Blowout Preventers Rotating Blowout Preventers Hybrid Blowout Preventers |

| By End-User | Oil & Gas Exploration & Production Companies Drilling Contractors (Onshore & Offshore) Oilfield Equipment & Service Companies National Oil Companies (NOCs) & International Oil Companies (IOCs) |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Technology / Control System | Hydraulic-Actuated Blowout Preventers Electro-Hydraulic / Multiplex (MUX) Control Blowout Preventers Automated / Smart Blowout Preventer Systems Conventional Mechanical Blowout Preventers |

| By Application / Location | Onshore Drilling Offshore Drilling – Jack-up Rigs Offshore Drilling – Floating Rigs (Semisubmersible & Drillships) Subsea Wellhead & Completion Operations |

| By Pressure Rating | Up to 10,000 psi ,001 – 15,000 psi Above 15,000 psi |

| By Well Type | Conventional Wells High-Pressure High-Temperature (HPHT) Wells Deepwater & Ultra-Deepwater Wells |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Offshore Drilling Operations | 120 | Drilling Engineers, Project Managers |

| Onshore Oilfield Services | 90 | Operations Supervisors, Safety Managers |

| Manufacturers of Blowout Preventers | 70 | Product Development Engineers, Sales Directors |

| Regulatory Compliance in Oil & Gas | 60 | Compliance Officers, Environmental Managers |

| Research Institutions in Energy Sector | 50 | Research Analysts, Industry Experts |

The Global Blowout Preventer Market is valued at approximately USD 7.4 billion, driven by the increasing demand for safety equipment in oil and gas drilling operations and the rise in offshore drilling projects.