Region:Global

Author(s):Dev

Product Code:KRAB0351

Pages:94

Published On:August 2025

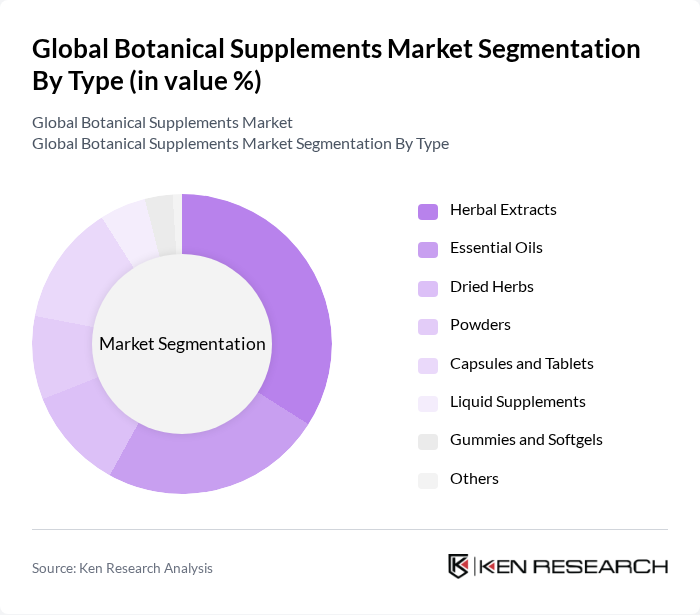

By Type:The botanical supplements market is segmented into herbal extracts, essential oils, dried herbs, powders, capsules and tablets, liquid supplements, gummies and softgels, and others. Herbal extracts remain the most dominant sub-segment, driven by their extensive use in traditional medicine and increasing consumer preference for natural remedies. Essential oils also hold a significant share due to their applications in aromatherapy, personal care, and wellness products. The rising popularity of holistic health and clean-label trends is further propelling demand for these product categories .

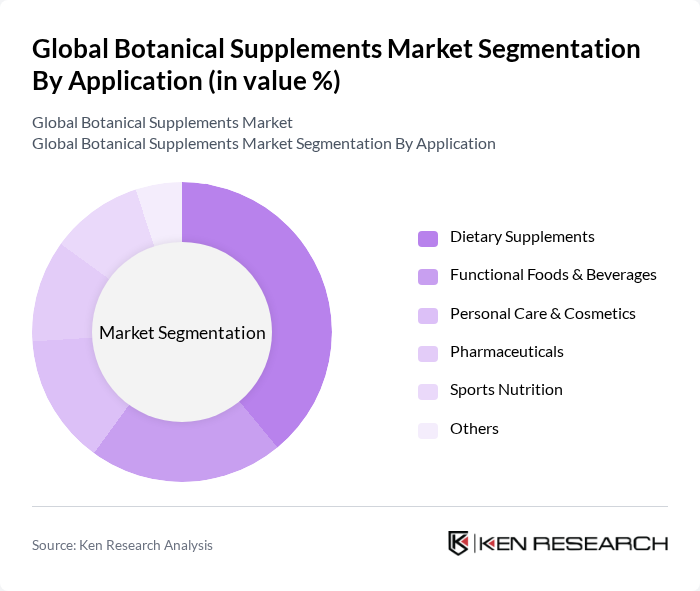

By Application:The applications of botanical supplements include dietary supplements, functional foods and beverages, personal care and cosmetics, pharmaceuticals, sports nutrition, and others. Dietary supplements represent the largest segment, fueled by rising health consciousness and the trend toward preventive healthcare. Functional foods and beverages are gaining momentum as consumers seek to integrate health benefits into daily diets. The growth in fitness, wellness, and clean-label preferences is also driving demand in sports nutrition and personal care applications .

The Global Botanical Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, Nature's Way Products, LLC, Gaia Herbs, Inc., NOW Foods, Solgar Inc., Swanson Health Products, Inc., New Chapter, Inc., NutraBlast, LLC, Nature's Bounty Co., Jarrow Formulas, Inc., Garden of Life, LLC, MegaFood, LLC, Traditional Medicinals, Inc., Dabur India Limited, Ricola AG, Nutraceutical International Corporation, BASF SE, The Himalaya Drug Company, Blackmores Limited, Pharmavite LLC, GNC Holdings, LLC, ChromaDex, Inc., Archer Daniels Midland Company (ADM), Glanbia plc, Bio-Botanica Inc., Botanicalife International of America, Inc., NaturaLife Asia Co., Ltd., Surya Herbal Ltd., MMJ International Holdings contribute to innovation, geographic expansion, and service delivery in this space.

The future of the botanical supplements market appears promising, driven by evolving consumer preferences and technological advancements. As more individuals prioritize health and wellness, the demand for innovative, plant-based products is expected to rise. Additionally, the integration of digital health solutions and personalized nutrition will likely reshape the market landscape, enabling brands to cater to specific consumer needs and preferences, thus enhancing overall market growth and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbal Extracts Essential Oils Dried Herbs Powders Capsules and Tablets Liquid Supplements Gummies and Softgels Others |

| By Application | Dietary Supplements Functional Foods & Beverages Personal Care & Cosmetics Pharmaceuticals Sports Nutrition Others |

| By Distribution Channel | Online Retail/E-commerce Supermarkets/Hypermarkets Health Food Stores Pharmacies/Drug Stores Direct Sales Others |

| By End-User | Adults Seniors/Geriatric Athletes/Fitness Enthusiasts Children Women (Prenatal/Postnatal) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Budget Mid-Range Premium |

| By Packaging Type | Bottles Sachets Blister Packs Pouches Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market for Botanical Supplements | 100 | Store Managers, Category Buyers |

| Online Sales Channels | 80 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Preferences in Health Supplements | 120 | Health-Conscious Consumers, Fitness Enthusiasts |

| Manufacturing Insights | 60 | Production Managers, Quality Control Officers |

| Regulatory Compliance and Challenges | 40 | Regulatory Affairs Specialists, Compliance Managers |

The Global Botanical Supplements Market is valued at approximately USD 48 billion, reflecting significant growth driven by increasing consumer awareness of health and wellness, and a shift towards natural and organic products.