Region:Global

Author(s):Shubham

Product Code:KRAA1707

Pages:96

Published On:August 2025

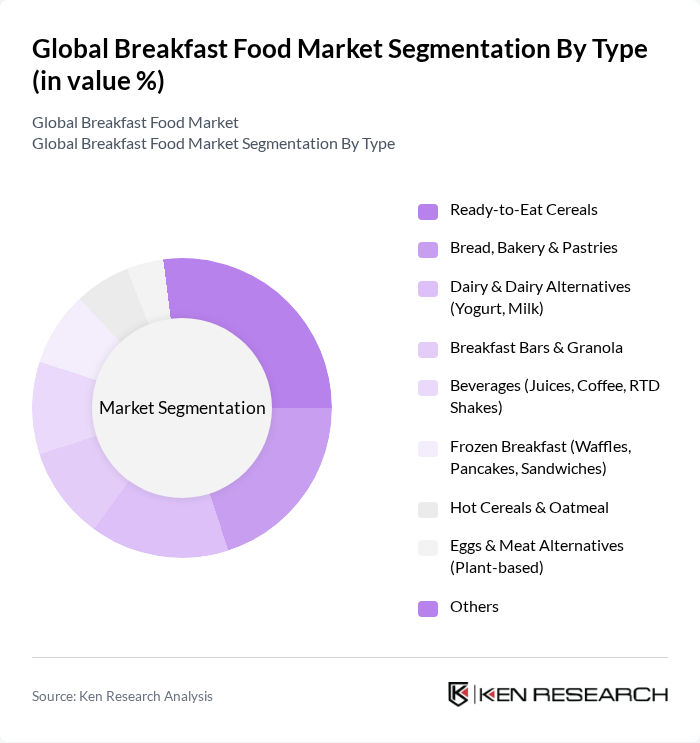

By Type:The breakfast food market can be segmented into various types, including ready-to-eat cereals, bread, bakery & pastries, dairy & dairy alternatives, breakfast bars & granola, beverages, frozen breakfast items, hot cereals & oatmeal, eggs & meat alternatives, and others. Each of these subsegments caters to different consumer preferences and dietary needs.

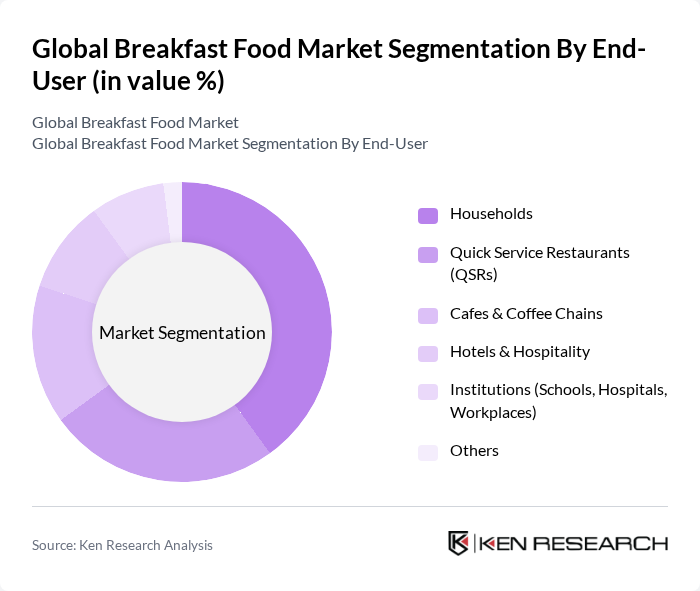

By End-User:The end-user segmentation includes households, quick service restaurants (QSRs), cafes & coffee chains, hotels & hospitality, institutions (schools, hospitals, workplaces), and others. Each segment has unique demands and consumption patterns that influence the overall market dynamics.

The Global Breakfast Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kellogg Company, General Mills, Inc., Nestlé S.A., The Quaker Oats Company (PepsiCo), Post Holdings, Inc., PepsiCo, Inc., Danone S.A., Mondel?z International, Inc., The Kraft Heinz Company, Conagra Brands, Inc., B&G Foods, Inc., TreeHouse Foods, Inc., Blue Diamond Growers, Nature’s Path Foods, Weetabix Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the breakfast food market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, brands are likely to focus on developing innovative, nutritious products that cater to diverse dietary needs. Additionally, the integration of e-commerce platforms will enhance accessibility, allowing consumers to explore a wider range of options. Companies that prioritize sustainability and transparency in their supply chains will likely gain a competitive edge, aligning with consumer values in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Ready-to-Eat Cereals Bread, Bakery & Pastries Dairy & Dairy Alternatives (Yogurt, Milk) Breakfast Bars & Granola Beverages (Juices, Coffee, RTD Shakes) Frozen Breakfast (Waffles, Pancakes, Sandwiches) Hot Cereals & Oatmeal Eggs & Meat Alternatives (Plant-based) Others |

| By End-User | Households Quick Service Restaurants (QSRs) Cafes & Coffee Chains Hotels & Hospitality Institutions (Schools, Hospitals, Workplaces) Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail (E-commerce, D2C) Convenience Stores Specialty & Health Food Stores Foodservice & HoReCa Others |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Boxes & Cartons Pouches & Sachets Tubs & Cups Cans & Bottles Multipacks & Variety Packs Others |

| By Flavor | Sweet Savory Spicy Others |

| By Nutritional Content | High Protein Low/No Sugar Gluten-Free Organic High Fiber/Whole Grain Vegan/Plant-based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Breakfast Preferences | 150 | Household Decision Makers, Health-Conscious Consumers |

| Retail Breakfast Product Sales | 120 | Store Managers, Category Buyers |

| Breakfast Food Manufacturers | 80 | Product Managers, Marketing Directors |

| Health and Nutrition Insights | 60 | Nutritionists, Dietitians, Health Coaches |

| Trends in Breakfast Consumption | 90 | Food Industry Analysts, Market Researchers |

The Global Breakfast Food Market is valued at approximately USD 203 billion, reflecting a significant growth trend driven by consumer demand for convenient and nutritious breakfast options, as well as a shift towards health-conscious eating habits.