Region:Global

Author(s):Shubham

Product Code:KRAC0720

Pages:90

Published On:August 2025

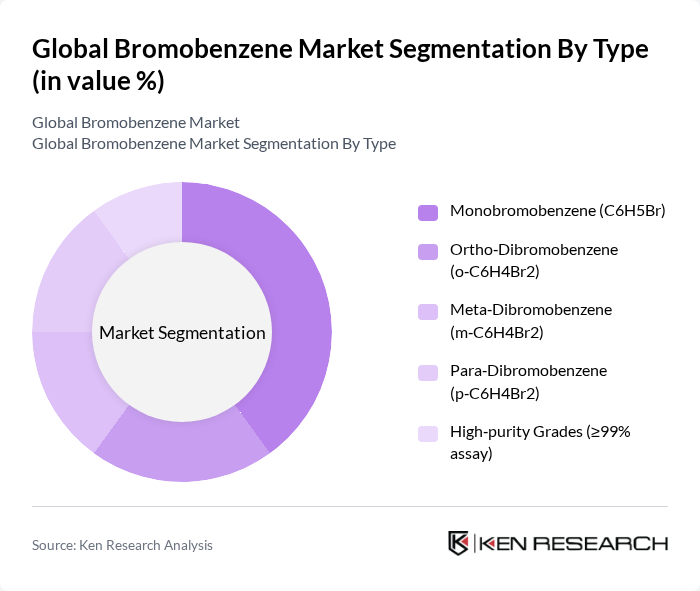

By Type:The bromobenzene market can be segmented into various types, including Monobromobenzene, Ortho-Dibromobenzene, Meta-Dibromobenzene, Para-Dibromobenzene, and High-purity Grades. Each type serves different applications and industries, influencing their market dynamics and consumer preferences.

The Monobromobenzene segment is the leading type in the bromobenzene market, primarily due to its extensive use as a solvent and intermediate in organic synthesis, including for preparing phenylmagnesium bromide and other intermediates used in pharmaceuticals and specialty chemicals. High?purity grades are gaining traction where stricter impurity control is required, including electronics and pharma applications. Growth in drug discovery, API/intermediate outsourcing, and specialty synthesis supports the dominance of Monobromobenzene.

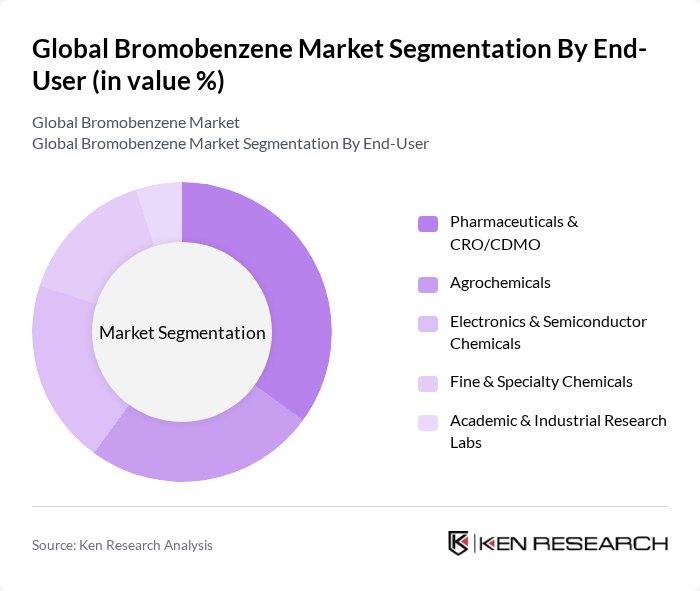

By End-User:The bromobenzene market is segmented by end-user industries, including Pharmaceuticals & CRO/CDMO, Agrochemicals, Electronics & Semiconductor Chemicals, Fine & Specialty Chemicals, and Academic & Industrial Research Labs. Each end-user category has distinct requirements and influences market trends.

The Pharmaceuticals & CRO/CDMO segment is the largest end-user of bromobenzene, driven by demand for Grignard?based routes and intermediates in API and complex molecule synthesis, alongside outsourcing to CDMOs. Agrochemicals remain a major outlet as bromobenzene is used in the synthesis of pesticide intermediates. Electronics applications are supported by tighter solvent purity specifications in semiconductor processes, lifting high?purity demand.

The Global Bromobenzene Market is characterized by a dynamic mix of regional and international players. Leading participants such as Albemarle Corporation, Merck KGaA (including Sigma?Aldrich), Lanxess AG, Aarti Industries Ltd., Shandong Henglian Chemical Co., Ltd., Eastman Chemical Company, Thermo Fisher Scientific Inc., TCI Chemicals (India) Pvt. Ltd., Kanto Chemical Co., Inc., GFS Chemicals, Inc., Acros Organics (part of Thermo Fisher), Toronto Research Chemicals (TRC) Ltd., Alfa Aesar (now Alfa Chemistry brand; owned by Thermo Fisher legacy), BASF SE, CM Fine Chemicals GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bromobenzene market appears promising, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt green chemistry principles, bromobenzene's role in eco-friendly applications is likely to expand. Furthermore, the ongoing digital transformation in supply chains will enhance operational efficiencies, enabling companies to respond swiftly to market demands. The focus on research and development will also foster innovation, ensuring that bromobenzene remains relevant in various applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Monobromobenzene (C6H5Br) Ortho?Dibromobenzene (o?C6H4Br2) Meta?Dibromobenzene (m?C6H4Br2) Para?Dibromobenzene (p?C6H4Br2) High?purity Grades (?99% assay) |

| By End-User | Pharmaceuticals & CRO/CDMO Agrochemicals Electronics & Semiconductor Chemicals Fine & Specialty Chemicals Academic & Industrial Research Labs |

| By Application | Grignard Reagent Synthesis (e.g., phenylmagnesium bromide) Solvent for Organic Reactions Intermediate for Pharmaceuticals (API and advanced intermediates) Intermediate for Agrochemicals Electronic?grade Process Chemicals |

| By Distribution Channel | Direct Sales (producers to industrial buyers) Specialty Chemical Distributors E?commerce/Lab Supply Platforms |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Grade | Pharmaceutical Grade Industrial/Technical Grade Reagent/Analytical Grade |

| By Regulatory Compliance | REACH/CLP (EU) TSCA/OSHA/EPA (US) K-REACH, China MEE, and Other National Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | R&D Managers, Regulatory Affairs Specialists |

| Agrochemical Sector | 80 | Product Development Scientists, Procurement Managers |

| Specialty Chemicals | 70 | Production Supervisors, Quality Control Analysts |

| Environmental Impact Studies | 60 | Environmental Compliance Officers, Sustainability Managers |

| Market Trends and Insights | 90 | Market Analysts, Industry Consultants |

The Global Bromobenzene Market is valued at approximately USD 1.19 billion, based on a five-year historical analysis. This valuation reflects the compound demand driven by its applications in pharmaceuticals, agrochemicals, and electronics.