Region:Global

Author(s):Shubham

Product Code:KRAD0646

Pages:82

Published On:August 2025

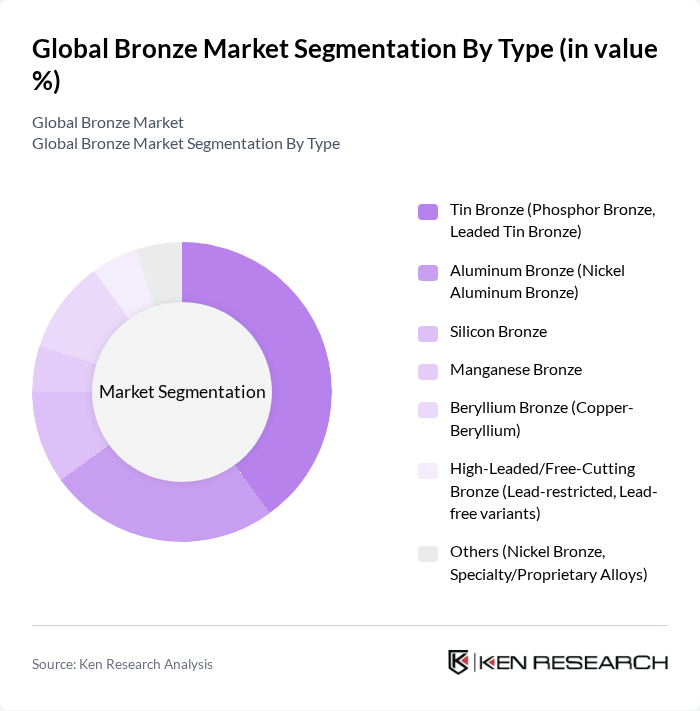

By Type:The bronze market is segmented into various types, including Tin Bronze, Aluminum Bronze, Silicon Bronze, Manganese Bronze, Beryllium Bronze, High-Leaded/Free-Cutting Bronze, and Others. Tin Bronze is widely used owing to wear resistance and machinability in bearings, gears, and electrical connectors, while Aluminum Bronze (including nickel aluminum bronze) is prominent in marine hardware, pumps, propellers, and seawater-facing components due to superior corrosion and biofouling resistance .

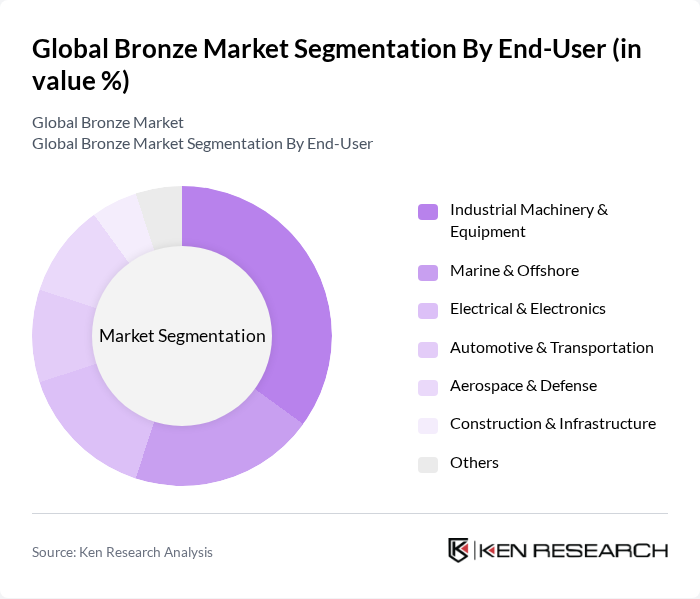

By End-User:The end-user segmentation includes Industrial Machinery & Equipment, Marine & Offshore, Electrical & Electronics, Automotive & Transportation, Aerospace & Defense, Construction & Infrastructure, and Others. Industrial Machinery & Equipment leads, supported by the use of bronze in wear components (bearings, bushings, valve and pump parts) across manufacturing and processing. Electrical & Electronics is significant for connectors, springs, and switches, while Marine & Offshore relies on aluminum bronzes for seawater service .

The Global Bronze Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aurubis AG, KME SE (formerly KME Group S.p.A.), Mitsubishi Materials Corporation, Wieland Group (Wieland-Werke AG), Materion Corporation (for beryllium bronze), National Bronze & Metals, Inc. (NBM Metals), ZOLLERN GmbH & Co. KG, Ningbo Boway Alloy Material Co., Ltd., LDM Brass (Leeuwarder Metaalhandel)/Boliden Bergsöe AB, Mitsubishi Shindoh Co., Ltd. (UACJ Copper Alloy Works), ALBCO Foundry & Machine Co., Inc., Concast Metal Products Co., AMPCO METAL S.A., Lebronze alloys, Copper and Brass Sales, LLC (a ThyssenKrupp Materials NA company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bronze market appears promising, driven by increasing demand across various sectors, particularly construction and automotive. Innovations in alloy production and a shift towards sustainable practices are expected to enhance the market's resilience. Additionally, the growing emphasis on recycling and eco-friendly production methods will likely shape the industry's landscape, fostering a more sustainable approach to bronze manufacturing. As emerging markets continue to develop, they will present new opportunities for growth and expansion in the bronze sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Tin Bronze (Phosphor Bronze, Leaded Tin Bronze) Aluminum Bronze (Nickel Aluminum Bronze) Silicon Bronze Manganese Bronze Beryllium Bronze (Copper-Beryllium) High-Leaded/Free-Cutting Bronze (Lead-restricted, Lead-free variants) Others (Nickel Bronze, Specialty/Proprietary Alloys) |

| By End-User | Industrial Machinery & Equipment Marine & Offshore Electrical & Electronics Automotive & Transportation Aerospace & Defense Construction & Infrastructure (Architectural/Art/Monuments) Others |

| By Application | Bearings & Bushings Gears & Wear Plates Valves, Pumps & Seals Electrical Connectors & Springs Fasteners & Fittings Castings for Marine/Offshore Components (propellers, deck hardware) Architectural & Decorative Items (sculptures, plaques, railings) Others |

| By Distribution Channel | Direct Sales (Mills/Foundries to OEMs) Distributors/Service Centers Online/Inside Sales Wholesale/Stockists Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Commodity Grades Mid-grade Engineering Alloys High-performance/Precision Alloys |

| By Policy Support | Lead-content Regulations & Substitution Incentives Scrap Recycling Mandates/Targets Import/Export Tariffs & Anti-dumping Duties Energy-efficiency/Emissions Compliance Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Bronze Usage | 100 | Project Managers, Procurement Officers |

| Automotive Component Manufacturers | 80 | Production Managers, Quality Control Engineers |

| Electronics and Electrical Applications | 70 | Design Engineers, Product Managers |

| Art and Sculpture Bronze Market | 50 | Artists, Gallery Owners |

| Marine Applications of Bronze | 60 | Marine Engineers, Equipment Suppliers |

The Global Bronze Market is valued at approximately USD 10.2 billion, reflecting a comprehensive analysis over the past five years. This valuation is driven by the extensive industrial applications of bronze, including its use in bearings, bushings, and automotive components.