Region:Global

Author(s):Dev

Product Code:KRAD0587

Pages:97

Published On:August 2025

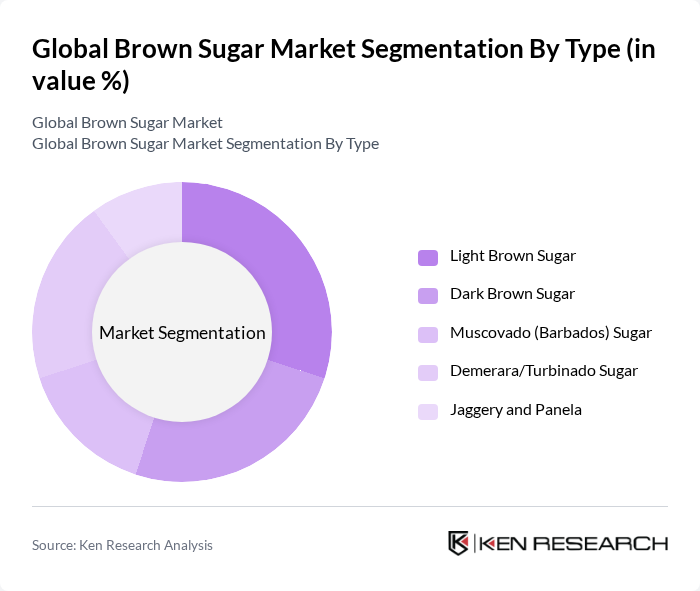

By Type:The brown sugar market is segmented into various types, including Light Brown Sugar, Dark Brown Sugar, Muscovado (Barbados) Sugar, Demerara/Turbinado Sugar, and Jaggery and Panela. Each type has unique characteristics and applications, catering to different consumer preferences and industry needs. Premium and less-refined types such as muscovado and demerara are increasingly positioned for specialty baking and beverages, while light and dark brown sugar remain staple ingredients for mainstream baking and packaged foods.

The Light Brown Sugar segment is currently dominating the market due to its versatility and widespread use in baking and cooking. Its mild flavor and moisture content make it a preferred choice for consumers and manufacturers alike. Dark Brown Sugar follows closely, appealing to those seeking a richer flavor profile. The increasing trend towards natural and organic products has also boosted the popularity of Muscovado and Jaggery, as consumers become more health-conscious and seek alternatives to refined sugars; these variants are frequently highlighted in premium retail and specialty applications.

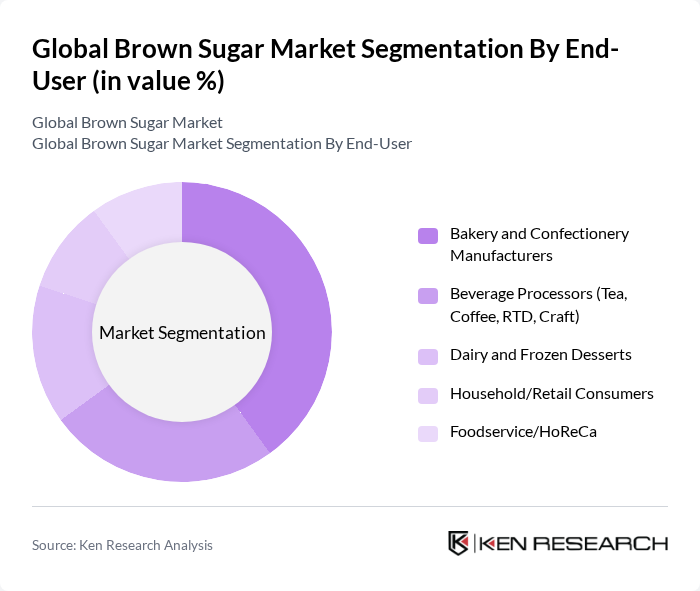

By End-User:The market is segmented by end-user into Bakery and Confectionery Manufacturers, Beverage Processors (Tea, Coffee, RTD, Craft), Dairy and Frozen Desserts, Household/Retail Consumers, and Foodservice/HoReCa. Each segment has distinct requirements and preferences that influence their choice of brown sugar products. Across sources, bakery/confectionery is consistently cited as the leading demand center for brown sugar, followed by beverage uses in specialty coffees/teas and craft beverages.

Bakery and Confectionery Manufacturers are the leading end-users of brown sugar, driven by the growing demand for baked goods and desserts. The versatility of brown sugar in enhancing flavor and moisture content makes it a staple ingredient in this sector. Beverage processors also represent a significant market, as brown sugar is increasingly used in specialty drinks and ready-to-drink beverages. The rise in health-conscious consumers has led to a growing interest in natural sweeteners, benefiting the entire brown sugar market, particularly in premium retail, artisanal bakery, and café channels.

The Global Brown Sugar Market is characterized by a dynamic mix of regional and international players. Leading participants such as ASR Group (American Sugar Refining, Inc.; Domino, C&H, Tate & Lyle Sugars retail), Südzucker AG, Associated British Foods plc (The Billington Food Group; Silver Spoon), Nordzucker AG, Tereos S.A., Wilmar International Limited (Shree Renuka Sugars Ltd.), Louis Dreyfus Company B.V. (LDC), Cosan S.A. (Raízen), Mitr Phol Group, Taikoo Sugar Limited (A Subsidiary of Swire), Imperial Sugar Company (U.S. Sugar Corporation), Wholesome Sweeteners, Inc., Billington’s (The Billington Food Group Limited), Zulka (Sucarmex S.A. de C.V.), Agrana Beteiligungs-AG (AGRANA Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the brown sugar market appears promising, driven by increasing health consciousness and a growing preference for natural sweeteners. As consumers continue to seek healthier alternatives, the demand for organic and sustainably produced brown sugar is expected to rise. Additionally, innovations in product formulations and packaging will likely enhance market competitiveness. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to capture market share and meet evolving consumer preferences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Light Brown Sugar Dark Brown Sugar Muscovado (Barbados) Sugar Demerara/Turbinado Sugar Jaggery and Panela |

| By End-User | Bakery and Confectionery Manufacturers Beverage Processors (Tea, Coffee, RTD, Craft) Dairy and Frozen Desserts Household/Retail Consumers Foodservice/HoReCa |

| By Application | Sweetening and Bulking Flavoring and Color Development (Maillard/Caramel) Preservative and Humectant Fermentation and Brewing Toppings, Sauces, and Glazes |

| By Distribution Channel | B2B (Direct/Contract Sales) Supermarkets/Hypermarkets Specialty and Natural/Organic Stores Online Retail and D2C Wholesalers and Distributors |

| By Packaging Type | Bulk (Sacks, FIBC/Big Bags) Retail Pouches and Boxes Industrial Totes and Drums (Syrups) Recyclable/Eco-Friendly Packaging |

| By Price Range | Economy/Private Label Mid-Range/Branded Premium/Organic/Fairtrade |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 120 | Product Development Managers, Procurement Officers |

| Retail Sector Insights | 90 | Category Managers, Supply Chain Directors |

| Agricultural Producers | 80 | Sugarcane Farmers, Agricultural Consultants |

| Health and Wellness Sector | 70 | Nutritionists, Health Product Developers |

| Export and Import Traders | 60 | Trade Analysts, Logistics Managers |

The Global Brown Sugar Market is valued at approximately USD 24 billion, driven by increasing demand for natural sweeteners and health-conscious consumer preferences. This market growth is supported by trends in premium bakery products and the rise of online retail channels.