Region:Global

Author(s):Geetanshi

Product Code:KRAA0036

Pages:86

Published On:August 2025

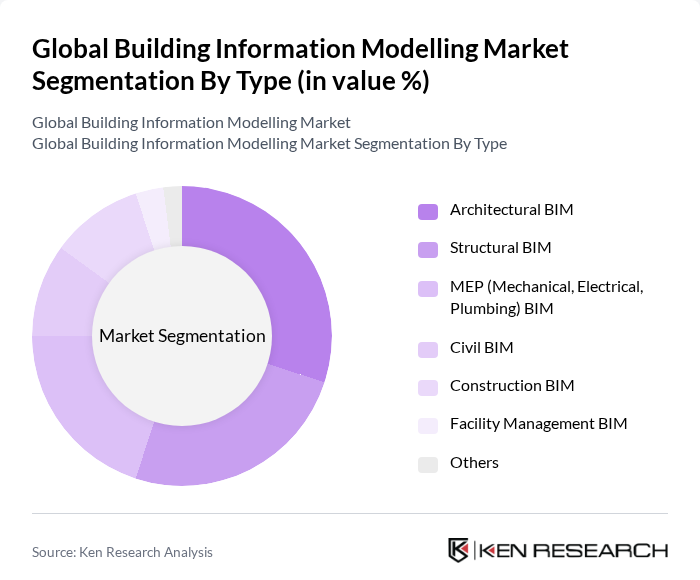

By Type:The market is segmented into various types, including Architectural BIM, Structural BIM, MEP (Mechanical, Electrical, Plumbing) BIM, Civil BIM, Construction BIM, Facility Management BIM, and Others. Each of these sub-segments plays a crucial role in the overall market dynamics, catering to specific needs within the construction and infrastructure sectors .

The Architectural BIM segment is currently dominating the market due to its critical role in the design and visualization phases of construction projects. Architects and designers increasingly rely on BIM to create detailed 3D models that enhance collaboration and communication among stakeholders. The growing trend towards sustainable architecture and energy-efficient designs further fuels the demand for Architectural BIM solutions, making it a key player in the overall market landscape .

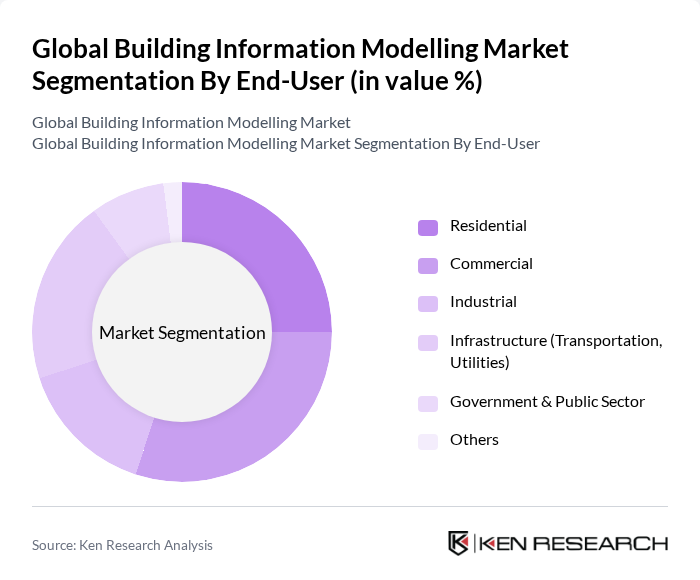

By End-User:The market is segmented by end-users, including Residential, Commercial, Industrial, Infrastructure (Transportation, Utilities), Government & Public Sector, and Others. Each segment has unique requirements and applications for BIM, influencing the overall market dynamics .

The Commercial segment is leading the market, driven by the increasing demand for office spaces, retail establishments, and mixed-use developments. The need for efficient project management and cost control in commercial construction projects has led to a higher adoption of BIM technologies. Additionally, the trend towards smart buildings and integrated facilities management solutions is further propelling the growth of BIM in the commercial sector .

The Global Building Information Modelling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Autodesk, Inc., Bentley Systems, Incorporated, Trimble Inc., Nemetschek SE, Graphisoft SE, Dassault Systèmes SE, Procore Technologies, Inc., RIB Software SE, Vectorworks, Inc., Bluebeam, Inc., Viewpoint, Inc. (now part of Trimble), e-Builder, Inc. (Trimble), PlanGrid, Inc. (Autodesk), Allplan GmbH (Nemetschek Group), Hexagon AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the BIM market appears promising, driven by ongoing technological advancements and increasing regulatory support for digital construction practices. As firms continue to embrace collaborative workflows and lifecycle management, the integration of IoT and AI technologies will enhance BIM capabilities. Furthermore, the expansion into emerging markets will provide new avenues for growth, as these regions increasingly recognize the benefits of adopting modern construction methodologies to improve efficiency and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Architectural BIM Structural BIM MEP (Mechanical, Electrical, Plumbing) BIM Civil BIM Construction BIM Facility Management BIM Others |

| By End-User | Residential Commercial Industrial Infrastructure (Transportation, Utilities) Government & Public Sector Others |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects Mega Projects Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Software Type | D Modeling Software Project Management Software Collaboration & Coordination Software Cost Estimation & Scheduling Software Facility Management Software Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Policy Support | Government Mandates for BIM Usage Tax Incentives Grants for Technology Adoption Standards & Certification Requirements Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Projects | 120 | BIM Managers, Project Architects |

| Infrastructure Development | 100 | Civil Engineers, Project Managers |

| Residential Construction | 80 | Home Builders, Design Consultants |

| Government Infrastructure Initiatives | 70 | Policy Makers, Urban Planners |

| Educational Institutions' BIM Adoption | 50 | Academic Researchers, Curriculum Developers |

The Global Building Information Modelling Market is valued at approximately USD 10 billion, driven by the increasing adoption of digital technologies in construction, enhanced collaboration among stakeholders, and a growing demand for sustainable building practices.