Region:Global

Author(s):Rebecca

Product Code:KRAA2460

Pages:86

Published On:August 2025

By Type:The market is segmented into Crystalline Silicon, Thin-Film, Transparent Photovoltaics, Organic Photovoltaics, and Others. Crystalline Silicon remains the most dominant type due to its high efficiency and widespread use in residential and commercial applications. Thin-Film technology is gaining traction because of its lightweight, flexible characteristics, and suitability for diverse architectural designs. Transparent photovoltaics are emerging as an innovative solution for integrating solar technology into windows and facades, supporting both energy generation and aesthetics , .

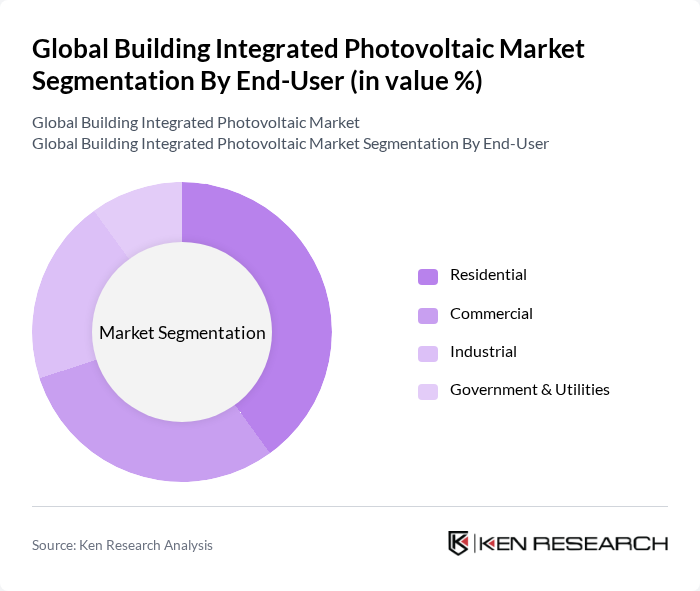

By End-User:The market is categorized into Residential, Commercial, Industrial, and Government & Utilities. The residential segment leads the market, driven by increasing consumer awareness of energy efficiency, the trend toward self-sustaining homes, and supportive government incentives. The commercial sector follows, as businesses aim to reduce operational costs and enhance sustainability. Government and utility projects are also significant, supported by policy mandates and public sector investments in green infrastructure , .

The Global Building Integrated Photovoltaic Market is characterized by a dynamic mix of regional and international players. Leading participants such as First Solar, Inc., SunPower Corporation, Canadian Solar Inc., JinkoSolar Holding Co., Ltd., Trina Solar Limited, LG Electronics Inc., Hanwha Q CELLS, Sharp Corporation, Solaria Corporation, Sika AG, Dow Inc., BASF SE, 3M Company, Saint-Gobain, Tesla, Inc., Onyx Solar Group LLC, AGC Inc., Heliatek GmbH, Ertex Solartechnik GmbH, and Polysolar Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the BIPV market appears promising, driven by increasing urbanization and a growing emphasis on sustainable construction practices. As cities expand, the integration of renewable energy solutions into building designs will become essential. Furthermore, advancements in energy storage technologies are expected to complement BIPV systems, enhancing their viability. The trend towards energy-efficient buildings will likely accelerate, with BIPV playing a crucial role in achieving net-zero energy targets in None and beyond.

| Segment | Sub-Segments |

|---|---|

| By Type | Crystalline Silicon Thin-Film Transparent Photovoltaics Organic Photovoltaics Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Photovoltaic (PV) Thin-Film PV Crystalline Silicon PV Transparent PV Others |

| By Application | Rooftop Installations Facade/Wall Integration Window/Glazing Integration Skylight Integration Utility-Scale Projects |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Feed-in Tariffs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial BIPV Installations | 60 | Facility Managers, Energy Consultants |

| Residential BIPV Solutions | 50 | Homeowners, Solar Installers |

| Industrial BIPV Applications | 40 | Operations Managers, Sustainability Officers |

| Architectural BIPV Integration | 40 | Architects, Urban Planners |

| Government Policy Impact on BIPV | 40 | Policy Makers, Regulatory Affairs Specialists |

The Global Building Integrated Photovoltaic Market is valued at approximately USD 28 billion, reflecting a significant growth trend driven by the demand for sustainable and energy-efficient buildings, advancements in photovoltaic technology, and increasing consumer awareness of environmental sustainability.