Region:Global

Author(s):Rebecca

Product Code:KRAC0249

Pages:82

Published On:August 2025

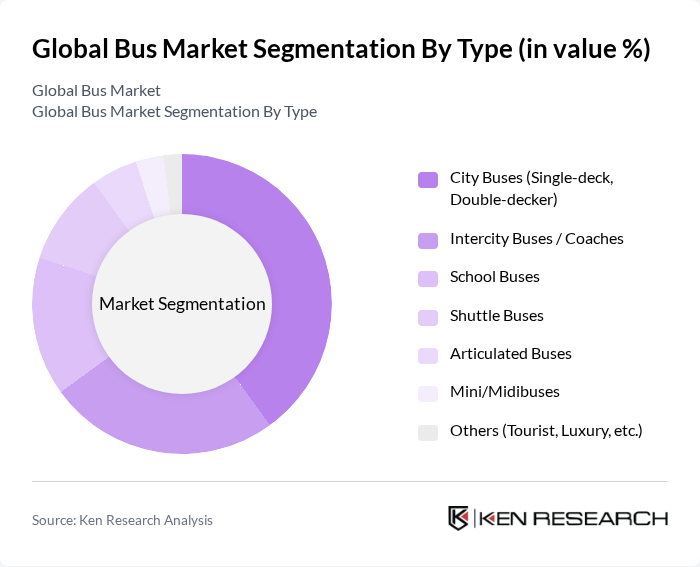

By Type:The bus market can be segmented into various types, including City Buses (Single-deck, Double-decker), Intercity Buses / Coaches, School Buses, Shuttle Buses, Articulated Buses, Mini/Midibuses, and Others (Tourist, Luxury, etc.). Among these, City Buses are the most prominent due to their essential role in urban public transport systems and the ongoing shift toward electric and low-emission fleets. The demand for intercity buses is also significant, driven by the need for long-distance and cross-border travel solutions. School buses and shuttle buses cater to specific user groups, while articulated and mini buses serve niche and flexible mobility markets .

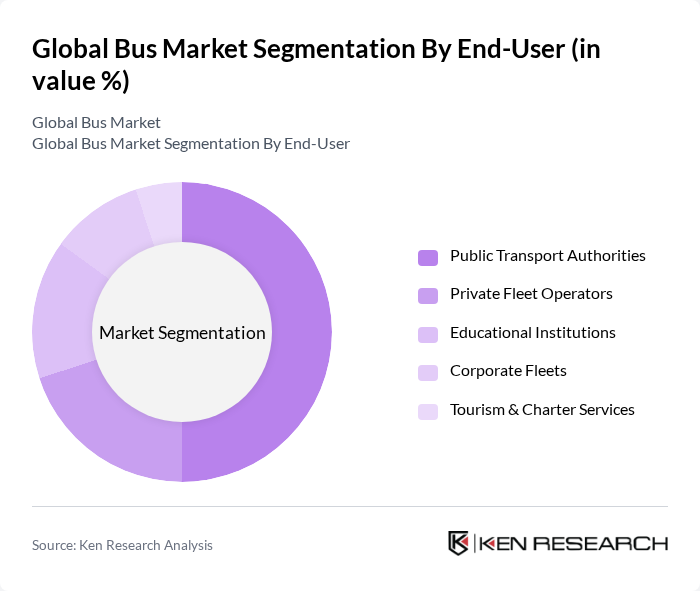

By End-User:The bus market is segmented by end-users, including Public Transport Authorities, Private Fleet Operators, Educational Institutions, Corporate Fleets, and Tourism & Charter Services. Public Transport Authorities are the largest end-users, as they manage the majority of urban bus services and are increasingly focused on fleet electrification and digitalization. Private fleet operators also play a significant role, particularly in intercity, charter, and contract-based services. Educational institutions and corporate fleets contribute to the demand for school and shuttle buses, while tourism services drive the need for luxury and tourist buses, especially in regions with growing tourism and cross-border travel .

The Global Bus Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daimler Truck AG (Mercedes-Benz Buses & Setra), Volvo Group (Volvo Buses), MAN Truck & Bus SE, Scania AB, BYD Company Limited, NFI Group Inc. (New Flyer Industries), Gillig LLC, Blue Bird Corporation, Proterra Inc., Alexander Dennis Limited, Irizar Group, Tata Motors Limited, Ashok Leyland Limited, Hino Motors, Ltd., Wrightbus Limited, Yutong Bus Co., Ltd., Zhengzhou King Long Bus Co., Ltd. (ZK Group), Zhongtong Bus Holding Co., Ltd., Iveco Bus (Iveco Group N.V.), Solaris Bus & Coach sp. z o.o. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bus market appears promising, driven by a growing emphasis on sustainability and technological integration. As urban populations expand, the demand for efficient public transport solutions will rise, prompting further investments in bus infrastructure. Additionally, the shift towards electric and autonomous buses is expected to reshape the market landscape, enhancing operational efficiency and reducing environmental impact. These trends indicate a robust evolution in the bus sector, aligning with global sustainability goals and urban mobility needs.

| Segment | Sub-Segments |

|---|---|

| By Type | City Buses (Single-deck, Double-decker) Intercity Buses / Coaches School Buses Shuttle Buses Articulated Buses Mini/Midibuses Others (Tourist, Luxury, etc.) |

| By End-User | Public Transport Authorities Private Fleet Operators Educational Institutions Corporate Fleets Tourism & Charter Services |

| By Application | Urban Transport Intercity/Long-Distance Transport School Transport Tourism/Leisure Transport |

| By Fuel Type | Diesel Electric Hybrid CNG/LNG Biofuel |

| By Size/Seating Capacity | 30 Seats 50 Seats More than 50 Seats |

| By Distribution Channel | Direct Sales Dealerships Online Sales |

| By Price Range | Budget Buses Mid-Range Buses Premium Buses |

| By Region | North America Europe Asia Pacific Middle East & Africa South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transport Agencies | 100 | Fleet Managers, Operations Directors |

| Private Bus Operators | 80 | Business Owners, Logistics Coordinators |

| Electric Bus Adoption | 50 | Technical Managers, Sustainability Officers |

| Government Transportation Departments | 40 | Policy Makers, Infrastructure Planners |

| Bus Manufacturing Firms | 60 | Product Development Managers, Sales Executives |

The Global Bus Market is valued at approximately USD 53 billion, reflecting a five-year historical analysis. This valuation is influenced by factors such as urbanization, government investments in public transportation, and the growing demand for eco-friendly transport solutions.