Region:Global

Author(s):Rebecca

Product Code:KRAB0251

Pages:98

Published On:August 2025

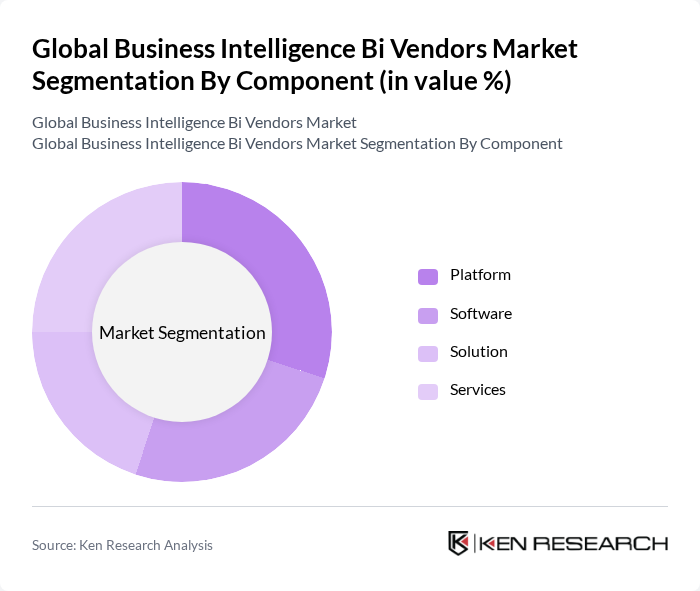

By Component:The components of the market include various elements that contribute to the overall functionality and effectiveness of BI solutions. The primary subsegments are Platform, Software, Solution, and Services. Each of these components plays a crucial role in delivering comprehensive BI capabilities to organizations. Platforms provide the foundational infrastructure for BI, software delivers specialized analytics and reporting tools, solutions offer tailored packages for specific business needs, and services encompass consulting, implementation, and support to maximize BI adoption and value .

The Platform subsegment is currently dominating the market due to the increasing need for integrated solutions that provide real-time data access and advanced analytics capabilities. Organizations are investing heavily in platforms that can support large volumes of data, offer AI-driven analytics, and enable seamless integration with other enterprise systems. The trend towards cloud-based platforms is accelerating, as businesses seek scalable, flexible, and cost-effective solutions to meet evolving analytics needs .

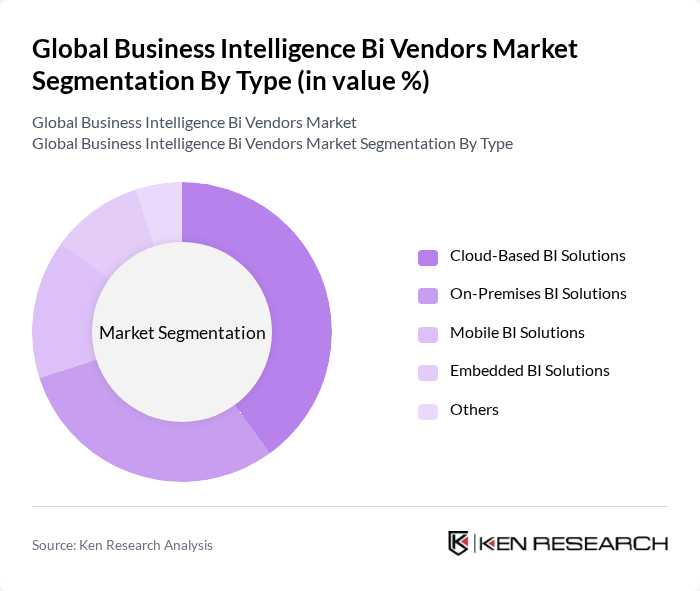

By Type:The market is segmented into various types of BI solutions, including Cloud-Based BI Solutions, On-Premises BI Solutions, Mobile BI Solutions, Embedded BI Solutions, and Others. Each type caters to different organizational needs and preferences, influencing their adoption rates. Cloud-Based BI Solutions offer remote access and scalability; On-Premises BI Solutions provide data control and compliance; Mobile BI Solutions enable analytics on the go; Embedded BI Solutions integrate analytics into business applications; and Others include hybrid and industry-specific BI offerings .

Cloud-Based BI Solutions are leading the market due to their flexibility, scalability, and cost-effectiveness. Organizations are increasingly opting for cloud solutions to facilitate remote access, real-time collaboration, and seamless integration with other cloud-based enterprise applications. The ability to leverage advanced analytics, AI, and machine learning capabilities in cloud environments further enhances their appeal, making them the preferred choice for modern businesses .

The Global Business Intelligence Bi Vendors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation, Tableau Software, LLC (Salesforce), SAP SE, Oracle Corporation, IBM Corporation, QlikTech International AB, Sisense Inc., Domo, Inc., MicroStrategy Incorporated, TIBCO Software Inc., Looker (Google Cloud), SAS Institute Inc., Zoho Corporation Pvt. Ltd., Yellowfin International Pty Ltd., Birst, Inc. (Infor), ThoughtSpot, Inc., Board International S.A., Pyramid Analytics B.V., GoodData Corporation, Information Builders, Inc. (TIBCO) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the BI vendors market appears promising, driven by technological advancements and increasing data utilization across industries. As organizations continue to prioritize data-driven strategies, the demand for innovative BI solutions is expected to rise. The integration of AI and machine learning will enhance analytics capabilities, while the expansion into emerging markets will provide new growth avenues. Additionally, the focus on real-time data analytics will reshape how businesses operate, fostering a more agile and responsive market environment.

| Segment | Sub-Segments |

|---|---|

| By Component | Platform Software Solution Services |

| By Type | Cloud-Based BI Solutions On-Premises BI Solutions Mobile BI Solutions Embedded BI Solutions Others |

| By End-User Industry | Healthcare Retail & e-Commerce Financial Services (BFSI) Manufacturing Government & Public Sector IT and Telecommunications Education Transportation and Logistics Energy and Utilities Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Functionality | Reporting and Querying Data Mining Performance Management Dashboarding Predictive Analytics Data Visualization Others |

| By Pricing Model | Subscription-Based (SaaS) One-Time License Fee Freemium / Usage-Based Managed Service / BI-as-a-Service |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services BI Implementation | 100 | Data Analysts, BI Managers |

| Healthcare Analytics Solutions | 80 | IT Directors, Healthcare Administrators |

| Retail Business Intelligence Tools | 90 | Marketing Managers, Operations Directors |

| Manufacturing Data Insights | 70 | Supply Chain Managers, Production Analysts |

| Telecommunications Data Management | 60 | Network Analysts, BI Managers |

The Global Business Intelligence BI Vendors Market is valued at approximately USD 29 billion, driven by the increasing demand for data-driven decision-making and the rapid adoption of advanced analytics and cloud-based solutions across various industries.