Region:Global

Author(s):Dev

Product Code:KRAC0407

Pages:100

Published On:August 2025

By Type:The market is segmented into various types of maintenance services, including airframe maintenance, engine maintenance, component maintenance, line maintenance, heavy maintenance, modifications and upgrades, and mobile/AOG support services. Each of these subsegments plays a crucial role in ensuring the operational efficiency and safety of business jets. Industry coverage of business jet MRO commonly distinguishes airframe, engine, components/avionics, and line/base maintenance, with retrofit and connectivity upgrades rising in share as operators pursue cabin, avionics, and connectivity modernization .

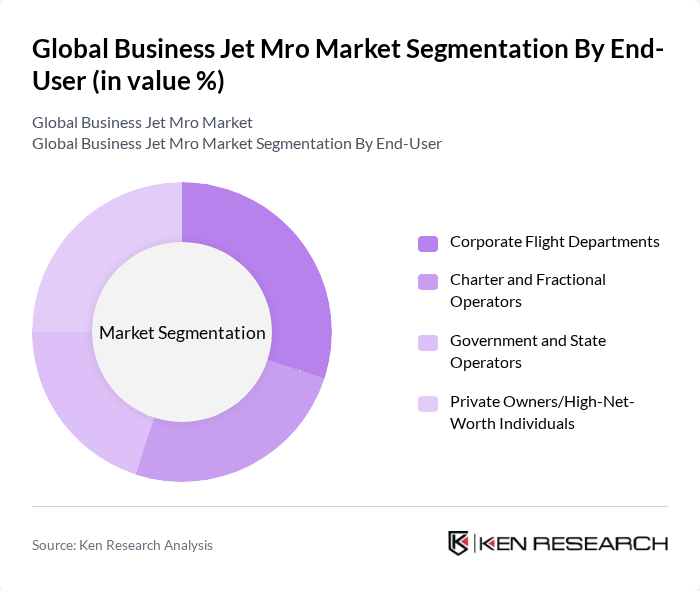

By End-User:The end-user segmentation includes corporate flight departments, charter and fractional operators, government and state operators, and private owners/high-net-worth individuals. Each segment has unique requirements and preferences that influence the type of MRO services they seek. Corporate and fractional operators drive consistent base and heavy maintenance demand, while private owners often emphasize upgrades and interiors; charter operators require high dispatch reliability supported by line maintenance and rapid AOG response .

The Global Business Jet MRO market is characterized by a dynamic mix of regional and international players. Leading participants such as Bombardier Aviation (Bombardier Service Centers), Gulfstream Aerospace Corporation, Dassault Aviation (Dassault Falcon Service), Embraer S.A. (Embraer Executive Jets Services), Textron Aviation Inc. (Cessna & Beechcraft Service), Honeywell International Inc. (Avionics & APU Services), Pratt & Whitney Canada Corp., Rolls-Royce Holdings plc, Lufthansa Technik AG, StandardAero, AAR CORP., Jet Aviation (a General Dynamics company), STS Aviation Group, Air France Industries KLM Engineering & Maintenance, Delta TechOps, SR Technics, Duncan Aviation, West Star Aviation, JETMS (Avia Solutions Group), ExecuJet MRO Services contribute to innovation, geographic expansion, and service delivery in this space .

The future of the business jet MRO market appears promising, driven by technological advancements and an increasing focus on sustainability. As digital MRO solutions gain traction, operators will benefit from enhanced efficiency and reduced operational costs. Furthermore, the integration of predictive maintenance technologies will likely lead to improved aircraft reliability. These trends, coupled with a growing emphasis on eco-friendly practices, will shape the MRO landscape, fostering innovation and collaboration among industry stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Airframe Maintenance (A/B/C/D checks, corrosion control, structural repairs) Engine Maintenance (inspection, hot section, overhaul) Component Maintenance (avionics, landing gear, APU, interiors) Line Maintenance (turnaround checks, defect rectification) Heavy Maintenance (base checks, major structural work) Modifications and Upgrades (avionics retrofits, connectivity, cabin refits, paint) Mobile/AOG Support Services |

| By End-User | Corporate Flight Departments Charter and Fractional Operators Government and State Operators Private Owners/High-Net-Worth Individuals |

| By Service Type | Scheduled Maintenance Unscheduled/AOG Maintenance Overhaul and Refurbishment |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Distribution Channel | Direct Contracts with MRO Providers OEM Service Networks and Portals Brokered/Maintenance Management Providers |

| By Maintenance Provider Type | OEM MROs (airframe, engine, avionics) Independent MROs In-House/Operator-Managed Maintenance |

| By Pricing Model | Fixed-Price Event Time-and-Materials (T&M) Hourly Cost Maintenance Programs (PBH/Power-by-the-Hour) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Business Jet Operators | 140 | Fleet Managers, Operations Directors |

| MRO Service Providers | 100 | Service Line Managers, Technical Directors |

| Aviation Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Business Jet Manufacturers | 80 | Product Development Managers, Sales Executives |

| Industry Analysts and Consultants | 60 | Aviation Analysts, Market Research Consultants |

The Global Business Jet MRO market is valued at approximately USD 24 billion, reflecting a robust demand for maintenance, repair, and overhaul services driven by increasing business aviation needs and advancements in technology.