Region:Global

Author(s):Geetanshi

Product Code:KRAA1314

Pages:82

Published On:August 2025

By Type:The market is segmented into various types of outsourcing services, including IT Outsourcing, HR Outsourcing, Finance and Accounting Outsourcing, Customer Support Outsourcing, Procurement Outsourcing, Legal Process Outsourcing, Analytics / Business Intelligence Outsourcing, and Others. IT Outsourcing remains the most dominant segment, driven by the increasing reliance on technology, the need for businesses to manage their IT infrastructure efficiently, and the rapid adoption of cloud computing and automation tools .

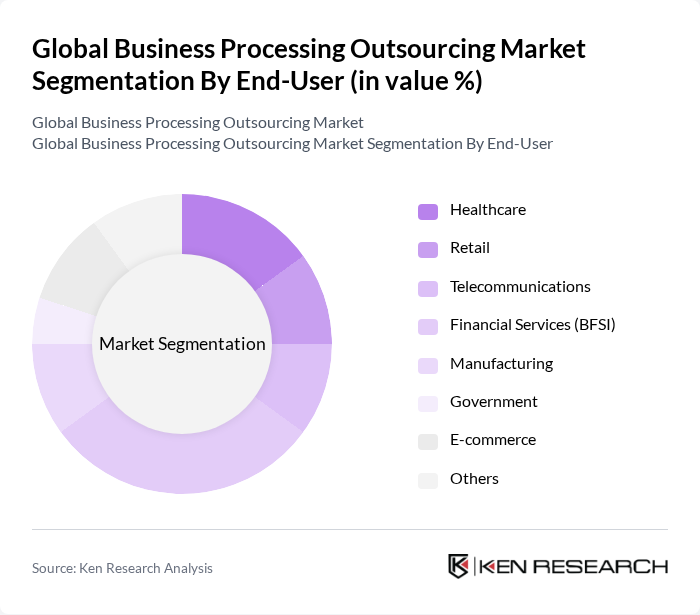

By End-User:The end-user segmentation includes Healthcare, Retail, Telecommunications, Financial Services (BFSI), Manufacturing, Government, E-commerce, and Others. The Financial Services sector is the leading end-user, driven by the need for efficient processing of transactions, regulatory compliance, and the management of customer relationships. The Healthcare and IT & Telecommunications sectors are also experiencing significant growth due to increasing digitalization, regulatory requirements, and the demand for specialized outsourcing solutions .

The Global Business Processing Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture, IBM Corporation, Tata Consultancy Services (TCS), Infosys, Wipro, Genpact, Cognizant, Capgemini, HCL Technologies, DXC Technology, Teleperformance, Sitel Group, Alorica, Concentrix, Atento, EXL Service, WNS (Holdings) Limited, TaskUs, Serco Group plc, Sykes Enterprises (now part of Sitel Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the BPO market is poised for transformation, driven by technological innovations and evolving business needs. As companies increasingly adopt cloud-based solutions, the demand for flexible and scalable outsourcing services will rise. Additionally, the shift towards remote work models is likely to enhance the appeal of BPO, enabling firms to access a global talent pool. These trends will shape the competitive landscape, fostering new partnerships and service offerings that align with customer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | IT Outsourcing HR Outsourcing Finance and Accounting Outsourcing Customer Support Outsourcing Procurement Outsourcing Legal Process Outsourcing Analytics / Business Intelligence Outsourcing Others |

| By End-User | Healthcare Retail Telecommunications Financial Services (BFSI) Manufacturing Government E-commerce Others |

| By Service Model | Onshore Outsourcing Nearshore Outsourcing Offshore Outsourcing Hybrid Outsourcing Others |

| By Industry Vertical | Banking and Financial Services Insurance Travel and Hospitality Education Energy and Utilities Real Estate IT & Telecommunications Others |

| By Delivery Model | Dedicated Delivery Centers Shared Services Cloud-Based Delivery Virtual/Remote Delivery Others |

| By Client Size | Large Enterprises Medium Enterprises Small Enterprises Startups Others |

| By Geographic Focus | North America Europe Asia-Pacific Latin America Middle East and Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| IT Outsourcing Services | 100 | IT Managers, CIOs, Procurement Officers |

| Customer Support BPO | 80 | Customer Service Managers, Operations Directors |

| Finance and Accounting Outsourcing | 60 | Finance Managers, CFOs, Compliance Officers |

| Human Resource Outsourcing | 50 | HR Managers, Talent Acquisition Specialists |

| Healthcare BPO Services | 40 | Healthcare Administrators, Operations Managers |

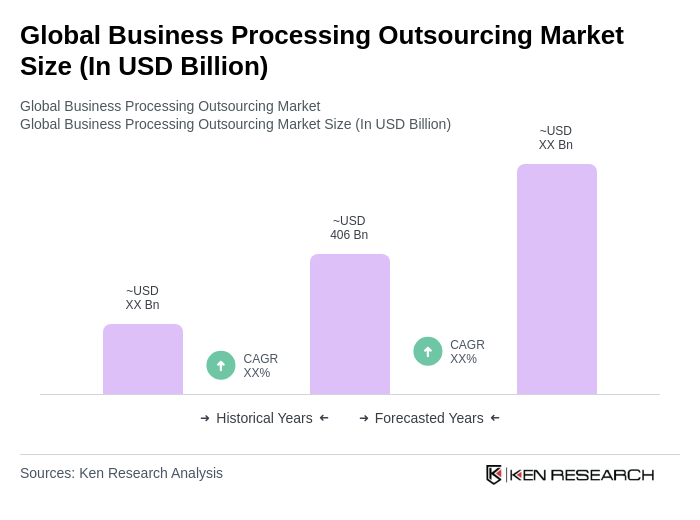

The Global Business Processing Outsourcing Market is valued at approximately USD 406 billion, reflecting significant growth driven by the demand for cost-effective solutions and technological advancements in business processes.