Region:Global

Author(s):Geetanshi

Product Code:KRAC0014

Pages:92

Published On:August 2025

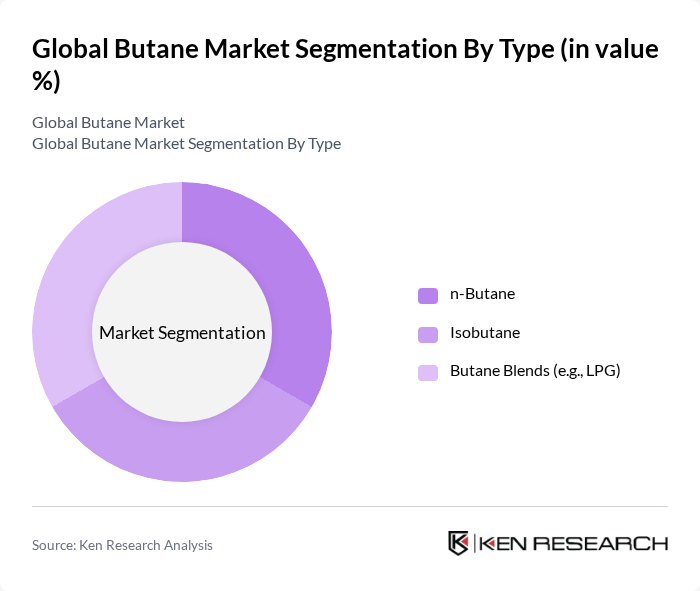

By Type:The butane market is segmented into three main types: n-Butane, Isobutane, and Butane Blends (e.g., LPG). Each type serves distinct applications, with n-Butane primarily used in fuel and petrochemical production, Isobutane utilized in refrigeration and as a propellant, and Butane Blends being widely used in residential heating and cooking .

The n-Butane segment is currently dominating the market due to its extensive use in the petrochemical industry as a feedstock for producing ethylene and butadiene. The increasing demand for these chemicals in various applications, including plastics and synthetic rubber, has significantly boosted the n-Butane market. Additionally, the rise in global energy consumption and the shift towards cleaner fuels have further solidified n-Butane's position as a preferred choice in many industrial processes .

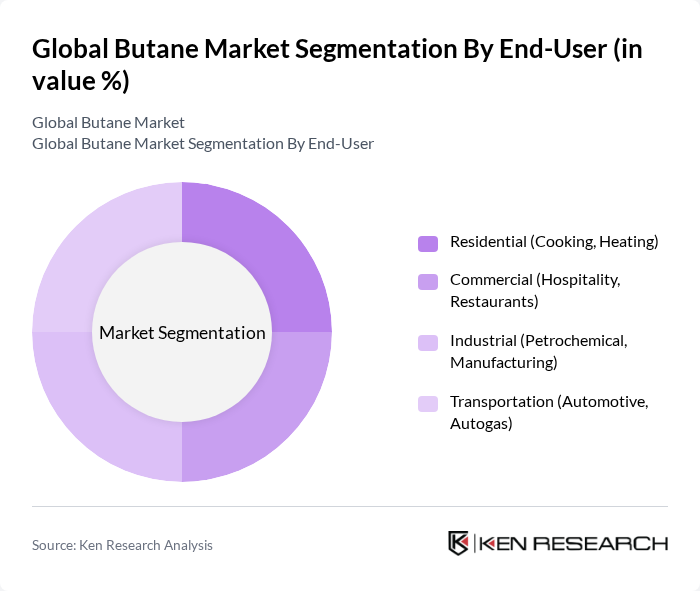

By End-User:The butane market is segmented by end-user into Residential (Cooking, Heating), Commercial (Hospitality, Restaurants), Industrial (Petrochemical, Manufacturing), and Transportation (Automotive, Autogas). Each segment has unique requirements and growth drivers, with residential and industrial sectors being the largest consumers .

The Residential segment is the largest end-user of butane, primarily driven by its use in cooking and heating applications. The growing trend of using LPG for residential purposes, especially in developing countries, has significantly contributed to this segment's growth. Additionally, the increasing focus on energy-efficient and cleaner cooking solutions has further enhanced the demand for butane in residential settings .

The Global Butane Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Corporation, Shell plc, BP p.l.c., TotalEnergies SE, Chevron Corporation, Phillips 66 Company, Repsol S.A., Linde plc, Air Liquide S.A., Sasol Limited, PBF Energy Inc., Hartree Partners, LP, INEOS Group Limited, Targa Resources Corp., The Williams Companies, Inc., China Petroleum & Chemical Corporation (Sinopec), PetroChina Company Limited, ConocoPhillips, Dow Inc., Merck KGaA, Petrogas Company (Egypt), Ashish Chemical (India) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the butane market appears promising, driven by a global transition towards cleaner energy and technological advancements in extraction methods. As countries invest in infrastructure to support cleaner energy initiatives, butane is likely to play a pivotal role in bridging the gap between traditional fossil fuels and renewable energy sources. Furthermore, the increasing focus on sustainability will encourage innovation in butane applications, enhancing its market position in the energy sector.

| Segment | Sub-Segments |

|---|---|

| By Type | n-Butane Isobutane Butane Blends (e.g., LPG) |

| By End-User | Residential (Cooking, Heating) Commercial (Hospitality, Restaurants) Industrial (Petrochemical, Manufacturing) Transportation (Automotive, Autogas) |

| By Application | LPG Production Petrochemical Feedstock (e.g., Ethylene, Butadiene) Refrigerant Aerosol Propellant Fuel for Heating & Cooking |

| By Distribution Channel | Direct Sales (Bulk Supply) Retail Outlets (Cylinders, Bottled Gas) Online Sales Third-Party Distributors |

| By Region | North America (US, Canada) Europe (Germany, France, UK, Spain, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of APAC) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Pricing Strategy | Premium Pricing Competitive Pricing Discount Pricing |

| By Others | Specialty Butane Products Niche Applications |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Heating Applications | 100 | Homeowners, HVAC Technicians |

| Automotive Fuel Usage | 60 | Fleet Managers, Automotive Engineers |

| Industrial Applications | 50 | Plant Managers, Process Engineers |

| Export and Import Dynamics | 40 | Trade Analysts, Customs Officials |

| Alternative Energy Sources | 70 | Energy Policy Makers, Environmental Consultants |

The Global Butane Market is valued at approximately USD 117 billion, driven by increasing demand for liquefied petroleum gas (LPG) in residential and commercial applications, as well as its use as a feedstock in petrochemical industries.