Region:Global

Author(s):Dev

Product Code:KRAD0441

Pages:90

Published On:August 2025

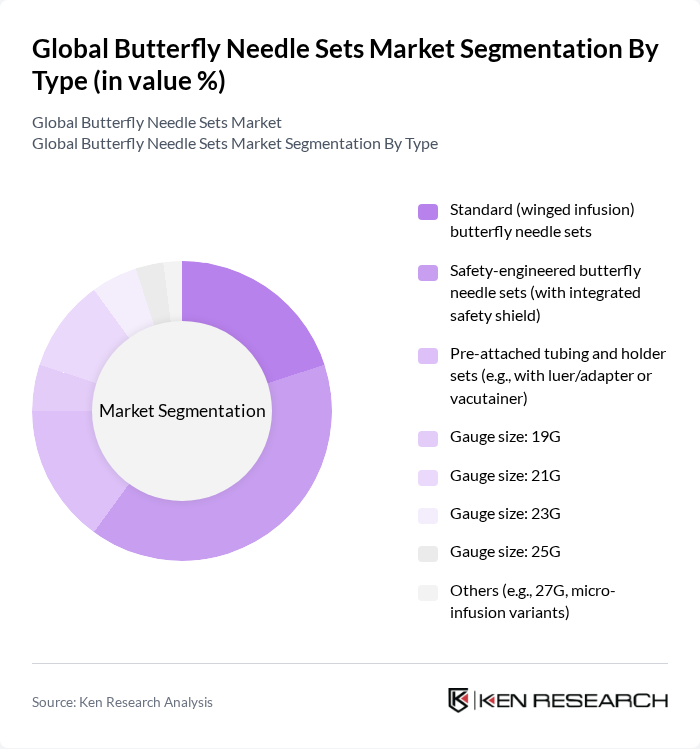

By Type:The market segmentation by type includes various categories such as standard butterfly needle sets, safety-engineered butterfly needle sets, pre-attached tubing and holder sets, and different gauge sizes. Among these, safety-engineered butterfly needle sets are gaining traction due to their ability to reduce the risk of needlestick injuries, which is a significant concern in healthcare settings. The demand for these products is driven by increasing awareness of safety protocols and regulations in hospitals and clinics.

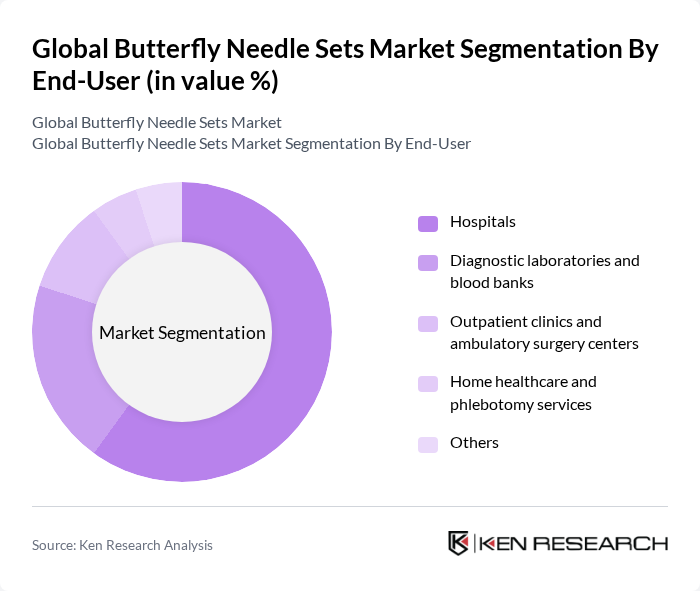

By End-User:The end-user segmentation includes hospitals, diagnostic laboratories, outpatient clinics, home healthcare services, and others. Hospitals are the dominant end-user segment, driven by the high volume of procedures requiring venipuncture and blood collection. The increasing number of outpatient procedures and the growing trend of home healthcare services are also contributing to the demand for butterfly needle sets, as they offer convenience and safety for patients.

The Global Butterfly Needle Sets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Becton, Dickinson and Company (BD), Terumo Corporation, Smiths Medical (ICU Medical, Inc.), Nipro Corporation, Medline Industries, LP, Fresenius Kabi AG, Vygon SA, Medtronic (Covidien), Amsino International, Inc., Halyard Health, Inc. (Owens & Minor, Inc.), Aesculap AG (B. Braun Group), B. Braun Melsungen AG, SOL-Millennium Medical Group, Cardinal Health, Inc., Hindustan Syringes & Medical Devices Ltd. (HMD) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the butterfly needle sets market appears promising, driven by ongoing innovations and a growing emphasis on patient safety. As healthcare systems increasingly prioritize minimally invasive techniques, the demand for specialized devices is expected to rise. Additionally, the integration of smart technology into medical devices will likely enhance functionality and user experience. With a focus on sustainability, manufacturers are also expected to develop eco-friendly products, aligning with global environmental goals and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard (winged infusion) butterfly needle sets Safety-engineered butterfly needle sets (with integrated safety shield) Pre-attached tubing and holder sets (e.g., with luer/adapter or vacutainer) Gauge size: 19G Gauge size: 21G Gauge size: 23G Gauge size: 25G Others (e.g., 27G, micro-infusion variants) |

| By End-User | Hospitals Diagnostic laboratories and blood banks Outpatient clinics and ambulatory surgery centers Home healthcare and phlebotomy services Others |

| By Application | Blood collection and venipuncture IV rehydration and medication delivery Blood transfusion and apheresis access Pediatric and geriatric vascular access Others |

| By Distribution Channel | Direct sales to hospitals and IDNs Medical distributors and group purchasing organizations (GPOs) Online channels and e-procurement platforms Others |

| By Material | Stainless steel needle with polymer wings (PVC/PE/TPU) Safety shield materials (polycarbonate/ABS) Tubing materials (PVC-free/DEHP-free options) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 120 | Procurement Managers, Supply Chain Coordinators |

| Clinical Usage in Emergency Rooms | 90 | Emergency Room Physicians, Nursing Staff |

| Outpatient Clinics and Practices | 80 | Clinic Managers, Healthcare Practitioners |

| Home Healthcare Providers | 60 | Home Care Nurses, Patient Care Coordinators |

| Medical Supply Distributors | 70 | Sales Representatives, Distribution Managers |

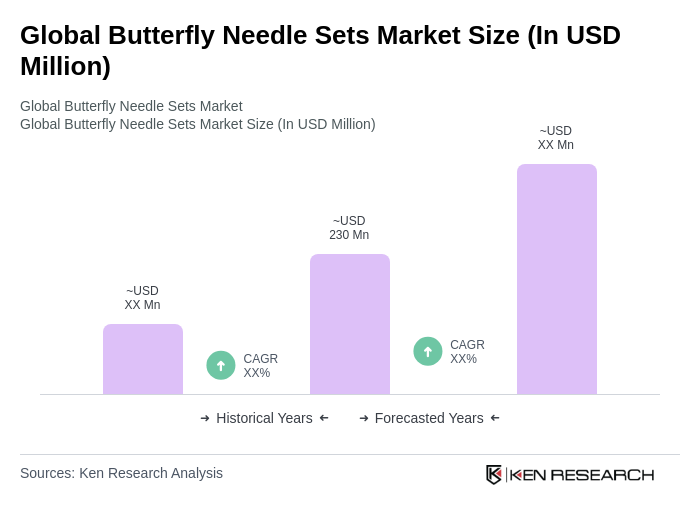

The Global Butterfly Needle Sets Market is valued at approximately USD 230 million, reflecting a five-year historical analysis. This growth is driven by the increasing prevalence of chronic diseases and advancements in safety-engineered winged infusion sets.