Region:Global

Author(s):Shubham

Product Code:KRAD0739

Pages:87

Published On:August 2025

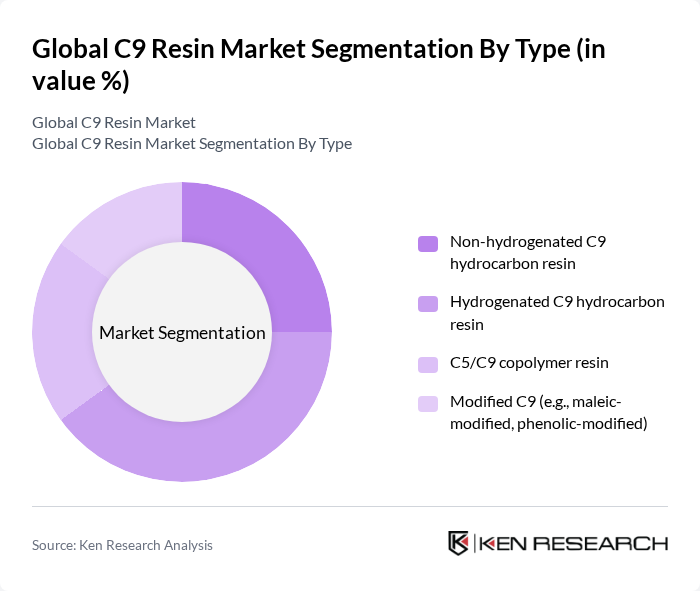

By Type:

The C9 resin market is segmented into four main types: Non-hydrogenated C9 hydrocarbon resin, Hydrogenated C9 hydrocarbon resin, C5/C9 copolymer resin, and Modified C9 (e.g., maleic-modified, phenolic-modified). Among these, the Hydrogenated C9 hydrocarbon resin is currently prominent in high-performance uses due to superior thermal stability, color, and low-VOC compatibility, making it preferred for premium adhesives and coatings; non-hydrogenated C9 remains widely used where cost-performance balance is prioritized . The increasing demand for high-performance materials in automotive and construction is driving preference for hydrogenated variants, which offer enhanced color stability and broader compatibility compared to non-hydrogenated options .

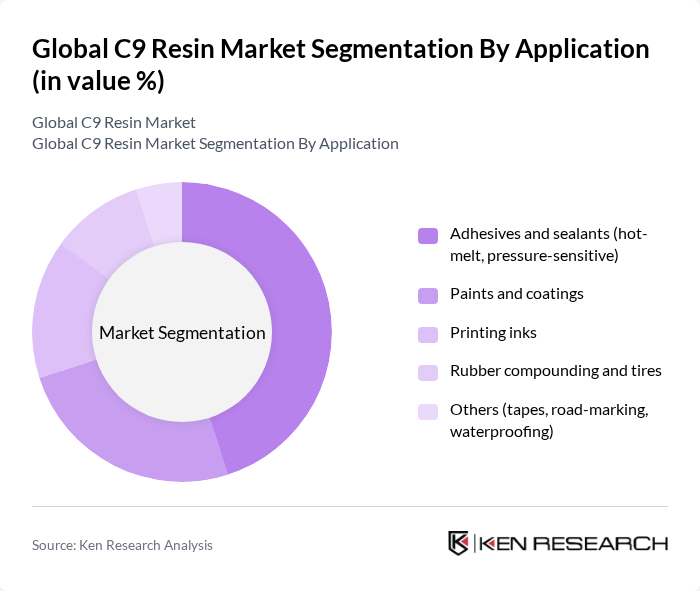

By Application:

The applications of C9 resins are diverse, including adhesives and sealants, paints and coatings, printing inks, rubber compounding and tires, and others such as tapes and waterproofing. The adhesives and sealants segment is the largest due to growing demand in construction and automotive sectors, where strong bonding, heat resistance, and durability are essential; C9 resins act as tackifiers that boost adhesion and cohesion in hot-melt and pressure-sensitive systems . The trend towards eco-friendly adhesives and higher-solids coatings is also boosting development and adoption of lower-VOC and hydrogenated C9 grades, reinforcing their position in regulated markets .

The Global C9 Resin Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Chemical Company, Kolon Industries, Inc., Arakawa Chemical Industries, Ltd., Eastman Chemical Company, Cray Valley (TotalEnergies), Henan Anglxxon Chemical Co., Ltd., Henan Sanjiangyuan Chemical Co., Ltd., Puyang Ruisen Petroleum Resins Co., Ltd., Puyang Tiancheng Chemical Co., Ltd., Shandong Qilong Chemical Co., Ltd., Yitai Ningxia Coal Industry Co., Ltd. (resins unit), Zeon Corporation, Lesco Chemical Limited, Neville Chemical Company, Idemitsu Kosan Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the C9 resin market appears promising, driven by increasing demand for sustainable materials and technological advancements in production processes. As industries shift towards eco-friendly solutions, C9 resin manufacturers are likely to innovate and develop bio-based alternatives. Additionally, the expansion into emerging markets, particularly in Asia-Pacific, will provide new growth avenues, as these regions experience rapid industrialization and urbanization, further enhancing the demand for C9 resin applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Non-hydrogenated C9 hydrocarbon resin Hydrogenated C9 hydrocarbon resin C5/C9 copolymer resin Modified C9 (e.g., maleic-modified, phenolic-modified) |

| By Application | Adhesives and sealants (hot-melt, pressure-sensitive) Paints and coatings Printing inks Rubber compounding and tires Others (tapes, road-marking, waterproofing) |

| By End-User | Packaging and labels Automotive and transportation Building and construction Printing and publishing Footwear and consumer goods |

| By Distribution Channel | Direct sales (producers to OEMs/converters) Authorized distributors Traders and formulators Online/B2B e-commerce |

| By Region | North America Europe Asia Pacific Middle East & Africa Latin America |

| By Price Range | Economy (commodity grades) Standard Premium (water-white/low-odor grades) |

| By Product Form | Flake/pastille Solid block Liquid Powder |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Adhesives Market | 120 | Product Development Managers, Procurement Specialists |

| Construction Sealants Sector | 85 | Project Managers, Materials Engineers |

| Coatings and Paints Industry | 95 | R&D Chemists, Quality Control Managers |

| Packaging Applications | 75 | Supply Chain Managers, Product Managers |

| Adhesives for Consumer Goods | 65 | Marketing Managers, Product Development Leads |

The Global C9 Resin Market is valued at approximately USD 2.0 billion, reflecting sustained demand across various applications such as adhesives, coatings, inks, and rubber, particularly in major industrial regions like North America, Europe, and Asia Pacific.