Region:Global

Author(s):Dev

Product Code:KRAB0463

Pages:83

Published On:August 2025

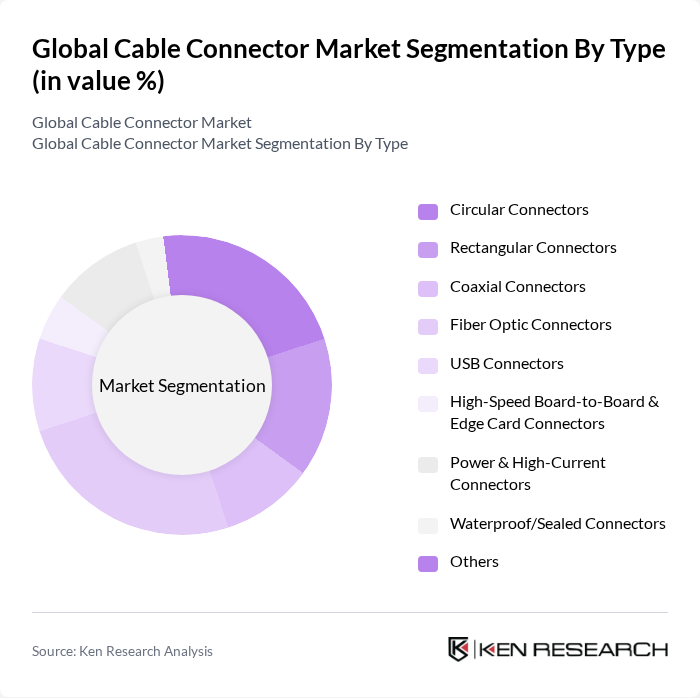

By Type:The market is segmented into various types of connectors, each serving specific applications and industries. The primary types include Circular Connectors, Rectangular Connectors, Coaxial Connectors, Fiber Optic Connectors, USB Connectors, High-Speed Board-to-Board & Edge Card Connectors, Power & High-Current Connectors, Waterproof/Sealed Connectors, and Others. Each type has unique features and benefits that cater to different market needs. Recent demand catalysts include rising adoption of high-speed board-to-board and edge-card interconnects for servers and data centers, broader USB-C standardization in consumer/PC ecosystems, resilient demand for circular and sealed connectors in industrial/EV environments, and accelerating use of fiber connectors in 5G fronthaul/backhaul and FTTx deployments .

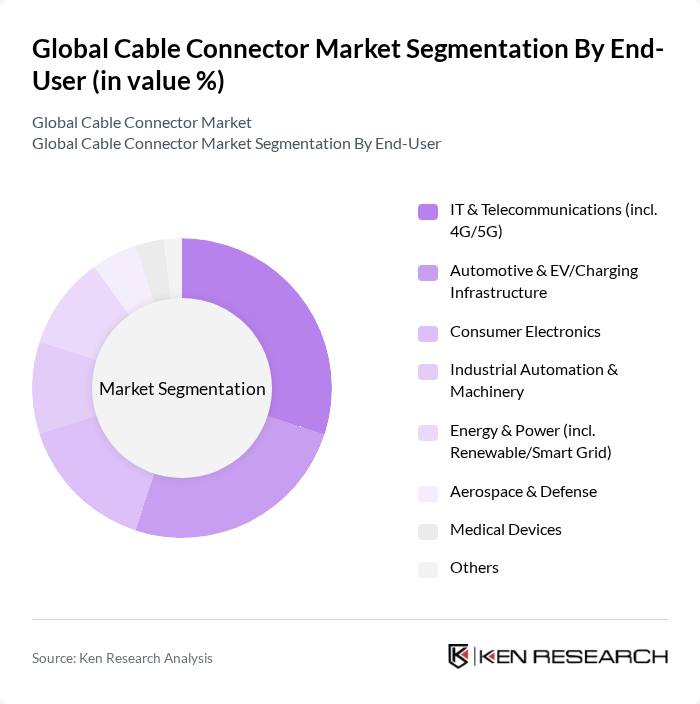

By End-User:The market is also segmented based on end-users, which include IT & Telecommunications, Automotive & EV/Charging Infrastructure, Consumer Electronics, Industrial Automation & Machinery, Energy & Power, Aerospace & Defense, Medical Devices, and Others. Each end-user segment has distinct requirements and growth drivers that influence the demand for cable connectors. Notable drivers include 4G/5G rollouts and fiber deepening in telecom, advanced driver-assistance systems and electrification in automotive/EV charging, miniaturization and high-speed I/O in consumer devices and computing, and Industry 4.0 upgrades in industrial automation .

The Global Cable Connector Market is characterized by a dynamic mix of regional and international players. Leading participants such as TE Connectivity Ltd., Amphenol Corporation, Molex LLC (a Koch Company), Aptiv PLC, 3M Company, Samtec, Inc., Hirose Electric Co., Ltd., Japan Aviation Electronics Industry, Ltd. (JAE), Phoenix Contact GmbH & Co. KG, HARTING Technology Group, Belden Inc., L-com (Infinite Electronics), Rosenberger Hochfrequenztechnik GmbH & Co. KG, Amphenol ICC (Interconnect, Cable & Components), Yazaki Corporation, J.S.T. Mfg. Co., Ltd. (JST), Würth Elektronik GmbH & Co. KG, Smiths Interconnect, Radiall, Fischer Connectors (Hexatronic Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cable connector market appears promising, driven by technological advancements and increasing demand across various sectors. The integration of IoT technologies is expected to enhance connectivity solutions, while the shift towards sustainable materials will likely reshape product offerings. Additionally, as industries increasingly adopt smart grid technologies, the need for innovative connectors will grow, presenting opportunities for manufacturers to develop cutting-edge solutions that meet evolving market needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Circular Connectors Rectangular Connectors Coaxial Connectors Fiber Optic Connectors USB Connectors High-Speed Board-to-Board & Edge Card (e.g., PCIe, mezzanine) Power & High-Current Connectors Waterproof/Sealed (IP67/IP68) Connectors Others |

| By End-User | IT & Telecommunications (incl. 4G/5G) Automotive & EV/Charging Infrastructure Consumer Electronics Industrial Automation & Machinery Energy & Power (incl. Renewable/Smart Grid) Aerospace & Defense Medical Devices Others |

| By Application | Data Centers & Cloud Infrastructure Networking & Telecom Equipment Power Transmission & Distribution Audio/Video & Broadcast Industrial Fieldbus & Robotics EV Powertrain & Charging Others |

| By Distribution Channel | Direct Sales (OEM) Authorized Distributors Online (eCommerce/Mouser/Digi-Key) Retail Stores Others |

| By Material | Plastics/Polymers (e.g., PBT, LCP) Metals (e.g., Copper Alloys, Aluminum) Composite & High-Temperature Materials Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low-End Connectors Mid-Range Connectors High-End/Mil-Aero & Ruggedized Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Cable Connectors | 120 | Network Engineers, Telecom Project Managers |

| Automotive Electrical Connectors | 90 | Automotive Engineers, Procurement Specialists |

| Industrial Cable Connectors | 80 | Manufacturing Managers, Safety Compliance Officers |

| Consumer Electronics Connectors | 100 | Product Designers, Quality Assurance Managers |

| Renewable Energy Connectors | 60 | Energy Engineers, Project Developers |

The Global Cable Connector Market is valued at approximately USD 75 billion, driven by increasing demand for connectivity solutions across various sectors, including telecommunications, automotive, and consumer electronics.