Region:Global

Author(s):Shubham

Product Code:KRAA1893

Pages:97

Published On:August 2025

By Type:The market is segmented into various types, including Cafés/Coffee Shops, Bars & Pubs, Specialty Coffee Shops, Café-Bars (Hybrid Concepts), and Others (Tea houses, dessert cafés). Each of these segments caters to different consumer preferences and occasions, contributing to the overall market dynamics.

The Cafés/Coffee Shops segment is the leading sub-segment, driven by the growing coffee culture and the increasing number of consumers seeking premium coffee experiences. This segment has seen a surge in demand for specialty coffee and unique café atmospheres, appealing to both individual consumers and social gatherings. The trend of remote working has also contributed to the popularity of coffee shops as alternative workspaces, further solidifying their market dominance.

By Customer Type:The market is segmented by customer type into Individual Consumers, Corporate/Business Customers, Tourists and Travelers, and Event/Group Bookings. Each customer type has distinct needs and preferences that influence their choice of cafes and bars.

The Individual Consumers segment holds the largest market share, reflecting the increasing trend of coffee consumption and socializing among individuals. This segment benefits from the rise of coffee culture, where consumers seek unique experiences and high-quality beverages. Additionally, the growing trend of remote work has led to more individuals frequenting cafes for both leisure and work purposes, further enhancing this segment's prominence.

The Global Cafe And Bars Market is characterized by a dynamic mix of regional and international players. Leading participants such as Starbucks Corporation, Dunkin' (Inspire Brands), Costa Coffee (The Coca-Cola Company), Peet's Coffee (JDE Peet's), Tim Hortons (RBI – Restaurant Brands International), JDE Peet's N.V., McDonald's Corporation (McCafé), Panera Bread (JAB Holding), The Coffee Bean & Tea Leaf, Blue Bottle Coffee (Nestlé), Dutch Bros Inc., Lavazza S.p.A., Barista Coffee Company, Gloria Jean's Coffees, Caffè Nero, Pret A Manger, Greggs plc, Luckin Coffee Inc., Café de Coral Group, Whitbread plc (formerly Costa owner; bar concepts) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the café and bar industry in None appears promising, driven by evolving consumer preferences and technological advancements. The integration of digital platforms for ordering and delivery is expected to enhance customer convenience, while the demand for sustainable and organic products will likely shape menu offerings. As urban populations continue to grow, cafes that adapt to these trends will thrive, creating a dynamic environment for innovation and customer engagement in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Cafés/Coffee Shops Bars & Pubs Specialty Coffee Shops Café-Bars (Hybrid Concepts) Others (Tea houses, dessert cafés) |

| By Customer Type | Individual Consumers Corporate/Business Customers Tourists and Travelers Event/Group Bookings |

| By Service Mode | On-premise (Dine-in) Takeaway Delivery (Own app/Third-party) Catering & Events |

| By Product Offering | Coffee & Espresso-based Drinks Tea & Other Non-alcoholic Beverages Alcoholic Beverages (Beer, Wine, Spirits, Cocktails) Food (Snacks, Pastries, Light Meals) Ready-to-Drink/Bottled Beverages & Retail Merchandise |

| By Pricing Tier | Premium Mid-range Budget/Value |

| By Location | High Street/Urban Core Suburban/Neighborhood Transit & Travel Hubs (Airports, Stations) University/Corporate Campuses |

| By Ownership Model | Chain/Franchise Independent |

| By Channel | On-trade Off-trade (RTD, beans/grounds, capsules sold in-store) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Cafe Market | 150 | Cafe Owners, Managers, and Baristas |

| Rural Bar Market | 100 | Bar Owners, Local Distributors, and Customers |

| Franchise vs. Independent Establishments | 80 | Franchise Owners, Independent Operators, and Industry Analysts |

| Consumer Preferences in Beverage Choices | 120 | Regular Customers, Occasional Visitors, and Trendsetters |

| Impact of Health Trends on Cafe Offerings | 90 | Nutritionists, Cafe Menu Developers, and Health-Conscious Consumers |

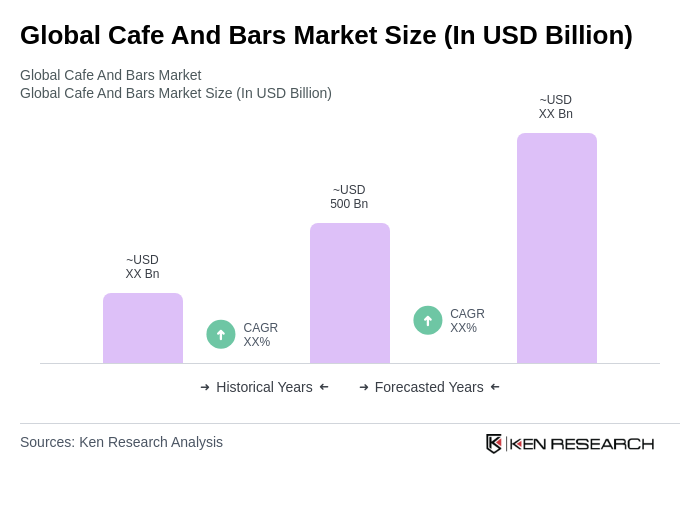

The Global Cafe and Bars Market is valued at approximately USD 500 billion, driven by increasing consumer preferences for coffee and alcoholic beverages, along with a growing trend of socializing in cafes and bars.