Region:Global

Author(s):Dev

Product Code:KRAD0591

Pages:98

Published On:August 2025

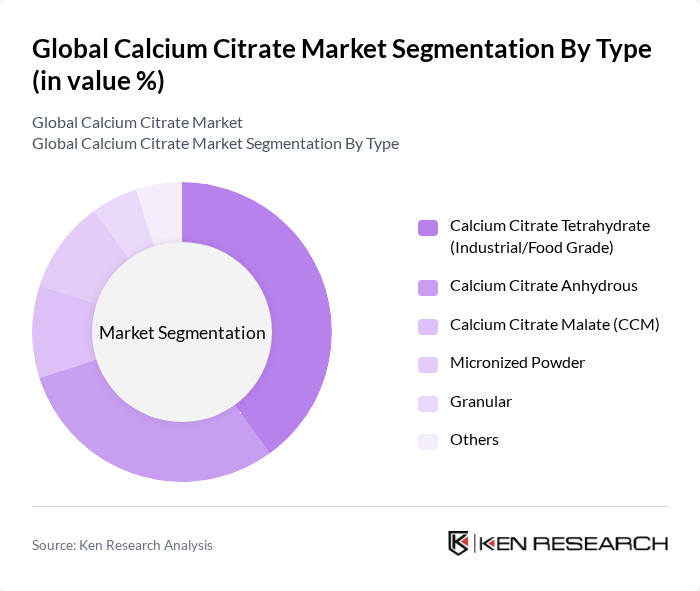

By Type:The calcium citrate market is segmented into various types, including Calcium Citrate Tetrahydrate (Industrial/Food Grade), Calcium Citrate Anhydrous, Calcium Citrate Malate (CCM), Micronized Powder, Granular, and Others. Among these, Calcium Citrate Tetrahydrate is widely used in food and pharma fortification due to good solubility, flow, and compatibility with formulations. Demand for Calcium Citrate Anhydrous is growing in dietary supplements because it delivers higher elemental calcium per unit weight than hydrates, supporting compact tablet/capsule designs favored by health-conscious consumers. Granular and micronized forms support specific processing needs in tablets, powders, and beverage systems across nutraceutical and F&B applications.

By Application:The applications of calcium citrate are diverse, including Dietary Supplements & Nutraceuticals, Food & Beverage Fortification, Pharmaceuticals (APIs, OTC), Agriculture & Animal Nutrition, and Personal Care & Others. The Dietary Supplements & Nutraceuticals segment leads due to rising awareness of bone health and widespread supplementation uptake, while Food & Beverage Fortification remains significant as brands enhance nutrition profiles in beverages, snacks, and bakery categories.

The Global Calcium Citrate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jungbunzlauer Suisse AG, Jost Chemical Co., Gadot Biochemical Industries Ltd., Adani Pharmachem Private Limited, Aditya Chemicals Limited, Dr. Paul Lohmann GmbH & Co. KGaA, Huber Engineered Materials (J.M. Huber Corporation), Tate & Lyle PLC, Shandong Xinhua Pharmaceutical Co., Ltd., Sudeep Pharma Pvt. Ltd., Nirma Limited, Weifang Ensign Industry Co., Ltd., Archer Daniels Midland Company (ADM), FBC Industries, Inc., Balchem Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the calcium citrate market appears promising, driven by increasing health awareness and the growing trend of preventive healthcare. Innovations in product formulations, such as enhanced bioavailability and combination supplements, are expected to attract more consumers. Additionally, the rise of e-commerce platforms is facilitating easier access to calcium citrate products, particularly in emerging markets, where online sales are projected to grow by 25% annually, further expanding market reach and consumer engagement.

| Segment | Sub-Segments |

|---|---|

| By Type | Calcium Citrate Tetrahydrate (Industrial/Food Grade) Calcium Citrate Anhydrous Calcium Citrate Malate (CCM) Micronized Powder Granular Others |

| By Application | Dietary Supplements & Nutraceuticals Food & Beverage Fortification Pharmaceuticals (APIs, OTC) Agriculture & Animal Nutrition Personal Care & Others |

| By End-User | Nutraceutical Manufacturers Food & Beverage Processors Pharmaceutical Companies Contract Manufacturers (CDMOs) Others |

| By Distribution Channel | B2B Direct (Manufacturers to Brands) Distributors/Wholesalers Online B2B Platforms Retail (Finished Supplement Brands) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | kg Bags Drums Bulk (FIBC/IBCs) Bottles/Sachets (Finished Products) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dietary Supplements Market | 150 | Product Managers, Marketing Directors |

| Pharmaceutical Applications | 100 | Regulatory Affairs Specialists, R&D Managers |

| Food & Beverage Sector | 80 | Food Technologists, Quality Assurance Managers |

| Cosmetics Industry | 70 | Formulation Chemists, Brand Managers |

| Retail Distribution Channels | 90 | Supply Chain Managers, Retail Buyers |

The Global Calcium Citrate Market is valued at approximately USD 1.4 billion, driven by increasing demand for dietary supplements, food and beverage fortification, and pharmaceutical applications. This market is expected to grow further as health and wellness trends continue to rise.