Region:Global

Author(s):Shubham

Product Code:KRAD0684

Pages:86

Published On:August 2025

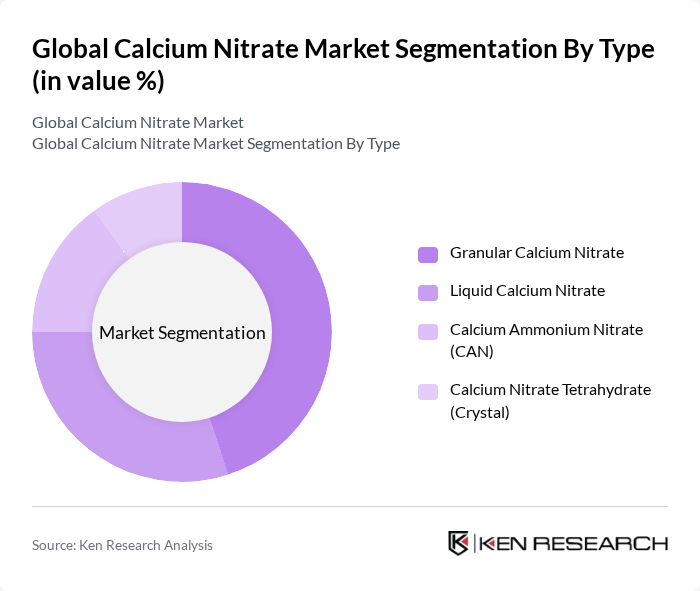

By Type:The calcium nitrate market is segmented into four main types: Granular Calcium Nitrate, Liquid Calcium Nitrate, Calcium Ammonium Nitrate (CAN), and Calcium Nitrate Tetrahydrate (Crystal). Granular Calcium Nitrate is widely used due to its ease of application and effectiveness in various soil types. Liquid Calcium Nitrate is gaining traction for fertigation/drip systems due to rapid plant uptake, while Calcium Ammonium Nitrate is favored for dual nutrient supply. Calcium Nitrate Tetrahydrate is primarily used in specialized and industrial applications such as concrete set acceleration and wastewater treatment.

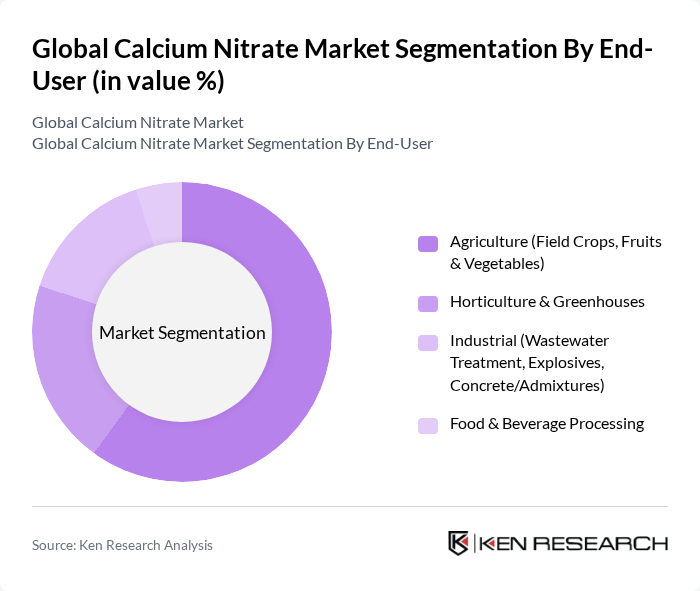

By End-User:The end-user segmentation includes Agriculture (Field Crops, Fruits & Vegetables), Horticulture & Greenhouses, Industrial (Wastewater Treatment, Explosives, Concrete/Admixtures), and Food & Beverage Processing. Agriculture remains the dominant end-user due to yield and quality improvements from nitrate-nitrogen and calcium; horticulture/greenhouses rely on precise nutrient programs; industrial demand is supported by concrete admixtures/accelerators, emulsified explosives, and nutrient source for denitrification in wastewater treatment.

The Global Calcium Nitrate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yara International ASA, Nutrien Ltd., Haifa Group, ICL Group Ltd., Uralchem JSC, OCI Global (OCI Nitrogen), SQM S.A., EuroChem Group AG, K+S Aktiengesellschaft (K+S AG), CF Industries Holdings, Inc., J.R. Simplot Company, GFS Chemicals, Inc., Prathista Industries Limited, Gujarat State Fertilizers & Chemicals Ltd. (GSFC), Grasim Industries Limited (Aditya Birla – Chemicals) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the calcium nitrate market appears promising, driven by increasing agricultural demands and a shift towards sustainable practices. As farmers adopt precision agriculture techniques, the need for high-quality fertilizers like calcium nitrate will grow. Additionally, the expansion of organic farming is likely to create new avenues for calcium nitrate applications, enhancing its role in sustainable agriculture. The market is expected to witness innovations in fertilizer formulations, further solidifying its importance in modern farming.

| Segment | Sub-Segments |

|---|---|

| By Type | Granular Calcium Nitrate Liquid Calcium Nitrate Calcium Ammonium Nitrate (CAN) Calcium Nitrate Tetrahydrate (Crystal) |

| By End-User | Agriculture (Field Crops, Fruits & Vegetables) Horticulture & Greenhouses Industrial (Wastewater Treatment, Explosives, Concrete/Admixtures) Food & Beverage Processing |

| By Application | Fertilizers & Fertigation Concrete Admixtures/Accelerators Wastewater (Denitrification & Odor Control) Explosives (ANFO Emulsions) Refrigeration Brines & Other Industrial Uses |

| By Distribution Channel | Direct (Tenders, Key Accounts, Co-ops) Distributors/Agri-Retail E-commerce/Online Portals |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Standard Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Sector Users | 120 | Farmers, Agronomists, Agricultural Consultants |

| Manufacturers of Fertilizers | 90 | Production Managers, Quality Control Officers |

| Distributors and Suppliers | 70 | Sales Managers, Supply Chain Coordinators |

| Research Institutions | 50 | Researchers, Academics, Industry Analysts |

| Regulatory Bodies | 40 | Policy Makers, Environmental Officers |

The Global Calcium Nitrate Market is valued at approximately USD 1314 billion, driven by increasing fertilizer use in agriculture and horticulture, as well as industrial applications such as concrete admixtures and wastewater treatment.