Region:Global

Author(s):Shubham

Product Code:KRAD0662

Pages:80

Published On:August 2025

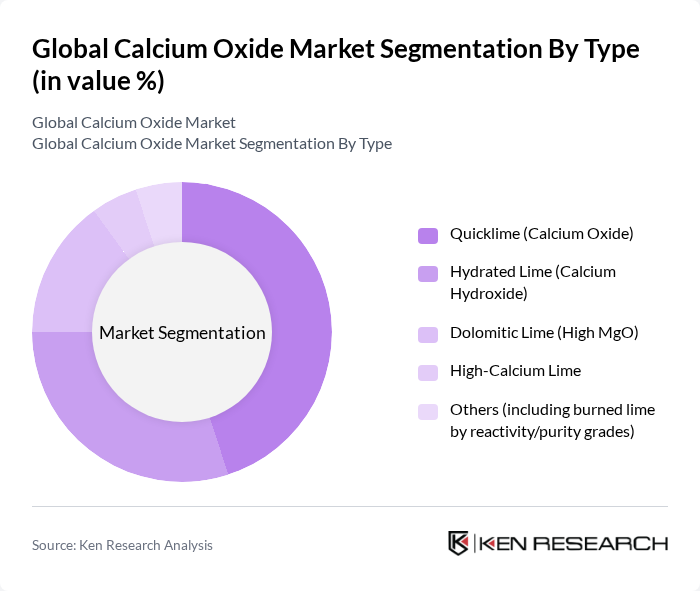

By Type:The calcium oxide market is segmented into various types, including Quicklime (Calcium Oxide), Hydrated Lime (Calcium Hydroxide), Dolomitic Lime (High MgO), High-Calcium Lime, and Others (including burned lime by reactivity/purity grades). Among these, Quicklime is the leading sub-segment due to its extensive use in construction and metallurgical applications. Hydrated Lime follows closely, primarily used in environmental applications such as water treatment and flue gas desulfurization. The demand for Dolomitic Lime is also growing, particularly in agriculture and soil conditioning, as it provides essential nutrients to crops.

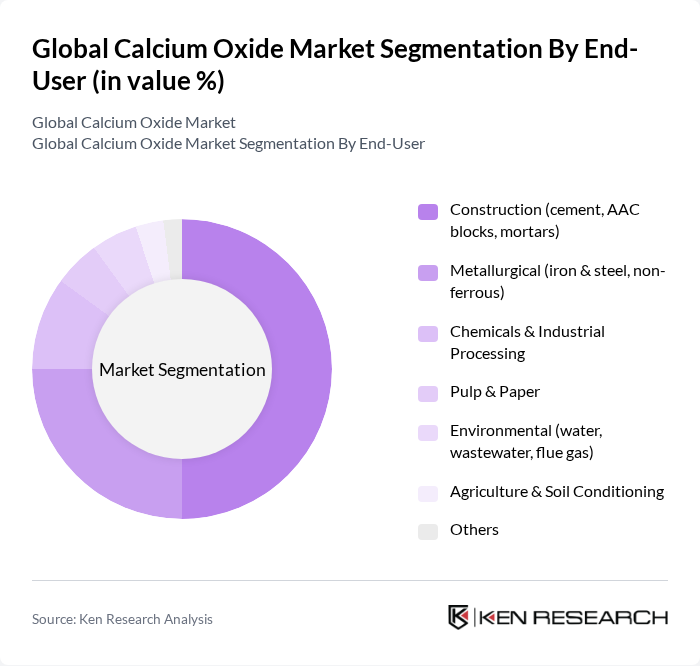

By End-User:The market is segmented by end-user industries, including Construction (cement, AAC blocks, mortars), Metallurgical (iron & steel, non-ferrous), Chemicals & Industrial Processing, Pulp & Paper, Environmental (water, wastewater, flue gas), Agriculture & Soil Conditioning, and Others. The construction sector is the dominant end-user, driven by the increasing demand for cement and concrete in infrastructure projects. The metallurgical industry also plays a significant role, utilizing calcium oxide in steel production and refining processes. Environmental applications are gaining traction due to stricter regulations on emissions and water quality.

The Global Calcium Oxide Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lhoist Group, Carmeuse, Graymont, Schaefer Kalk GmbH & Co. KG, Nordkalk Corporation, Calcinor, Mississippi Lime Company, United States Lime & Minerals, Inc., Linwood Mining & Minerals Corporation, Pete Lien & Sons, Inc., Carmeuse Lime & Stone (North America), Tata Chemicals Ltd. (lime products), Omya AG (for related calcium products), Sibelco (industrial minerals), Imerys (industrial minerals) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the calcium oxide market appears promising, driven by increasing demand across various sectors, particularly construction and environmental applications. Innovations in production technologies are expected to enhance efficiency and reduce costs, while the expansion of emerging markets will provide new growth avenues. Additionally, the rising focus on sustainable practices will likely lead to increased investments in high-purity calcium oxide, further shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Quicklime (Calcium Oxide) Hydrated Lime (Calcium Hydroxide) Dolomitic Lime (High MgO) High-Calcium Lime Others (including burned lime by reactivity/purity grades) |

| By End-User | Construction (cement, AAC blocks, mortars) Metallurgical (iron & steel, non-ferrous) Chemicals & Industrial Processing Pulp & Paper Environmental (water, wastewater, flue gas) Agriculture & Soil Conditioning Others |

| By Application | Cement and Concrete Steelmaking and Slag Formation Water and Wastewater Treatment Flue Gas Desulfurization Glass and Ceramics Pulp Recovery (Causticizing) Sugar Refining & Food Processing Soil Stabilization Others |

| By Distribution Channel | Direct/Contract Sales Industrial Distributors Traders/Resellers Online B2B Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Grade | Technical/Industrial Grade High-Purity/Pharmaceutical Grade Food Grade Steel/Metallurgical Grade Environmental Grade |

| By Product Form | Powder Lumps Pebbles/Granules Milk of Lime (slurry) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Applications | 120 | Project Managers, Procurement Specialists |

| Agricultural Uses of Calcium Oxide | 80 | Agronomists, Farm Managers |

| Environmental Management Solutions | 70 | Environmental Engineers, Compliance Officers |

| Industrial Manufacturing Insights | 90 | Operations Managers, Quality Control Supervisors |

| Research and Development in Chemical Applications | 60 | R&D Directors, Chemical Engineers |

The Global Calcium Oxide Market is valued at approximately USD 8.0 billion, reflecting a significant growth trend driven by increasing demand from construction, metallurgy, and environmental applications, particularly in emerging economies.