Region:Global

Author(s):Shubham

Product Code:KRAB0767

Pages:97

Published On:August 2025

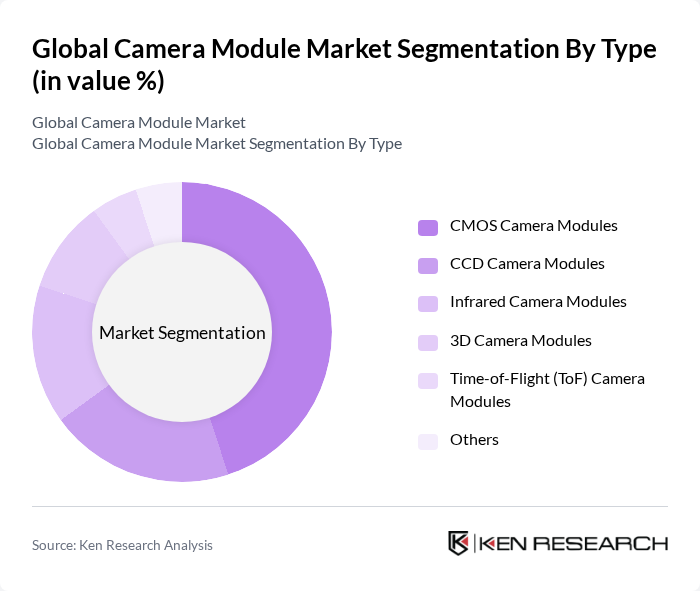

By Type:The camera module market is segmented into various types, including CMOS Camera Modules, CCD Camera Modules, Infrared Camera Modules, 3D Camera Modules, Time-of-Flight (ToF) Camera Modules, and Others. Each of these subsegments serves distinct applications and consumer needs. CMOS Camera Modules are the most widely used due to their cost-effectiveness, lower power consumption, and superior performance in low-light conditions. CCD Camera Modules are preferred for applications requiring high image quality and sensitivity, such as medical imaging and industrial inspection. Infrared Camera Modules are increasingly adopted for security, surveillance, and automotive night vision. 3D and ToF Camera Modules are gaining traction in smartphones, AR/VR, and automotive ADAS for depth sensing and gesture recognition.

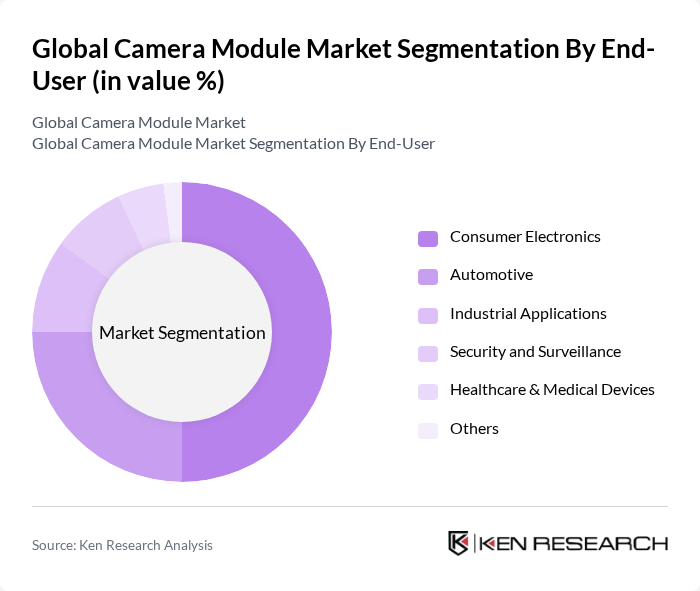

By End-User:The end-user segmentation includes Consumer Electronics, Automotive, Industrial Applications, Security and Surveillance, Healthcare & Medical Devices, and Others. The Consumer Electronics segment is the largest, accounting for approximately half of the market, driven by the high demand for camera modules in smartphones, tablets, and wearables. The Automotive segment is rapidly expanding due to regulatory mandates and the integration of advanced driver-assistance systems (ADAS) and autonomous vehicle technologies. Industrial Applications leverage camera modules for machine vision and automation, while Security and Surveillance benefit from enhanced imaging and monitoring capabilities. Healthcare & Medical Devices utilize camera modules for diagnostic imaging and telemedicine.

The Global Camera Module Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sony Corporation, Samsung Electronics Co., Ltd., OmniVision Technologies, Inc., STMicroelectronics N.V., onsemi (ON Semiconductor Corporation), Canon Inc., Panasonic Corporation, LG Innotek Co., Ltd., Sharp Corporation, Sunny Optical Technology (Group) Co., Ltd., Foxconn Technology Group (Hon Hai Precision Industry Co., Ltd.), Q Technology (Group) Company Limited, Cowell e Holdings Inc., Chicony Electronics Co., Ltd., Luxvisions Innovation Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the camera module market appears promising, driven by technological advancements and increasing integration into various applications. The rise of AI-driven imaging solutions is expected to enhance user experience significantly, while the growing adoption of modular camera systems will provide flexibility and customization options. Additionally, sustainability initiatives will likely shape product development, as manufacturers focus on eco-friendly materials and processes to meet consumer expectations and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | CMOS Camera Modules CCD Camera Modules Infrared Camera Modules D Camera Modules Time-of-Flight (ToF) Camera Modules Others |

| By End-User | Consumer Electronics Automotive Industrial Applications Security and Surveillance Healthcare & Medical Devices Others |

| By Application | Mobile Devices (Smartphones, Tablets) Drones & UAVs Medical Imaging & Diagnostics Smart Home Devices Robotics & Machine Vision Others |

| By Component | Lenses Image Sensors Processors/Controllers Connectors & Substrates Others |

| By Sales Channel | OEM (Original Equipment Manufacturer) Sales Online Retail Offline Retail Direct Sales Others |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms Others |

| By Price Range | Low-End Mid-Range High-End Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smartphone Camera Modules | 150 | Product Managers, R&D Engineers |

| Automotive Camera Systems | 100 | Automotive Engineers, Safety Compliance Officers |

| Security Camera Solutions | 80 | Security System Integrators, Technical Directors |

| Consumer Electronics Market | 120 | Marketing Managers, Sales Directors |

| Industrial Camera Applications | 40 | Manufacturing Engineers, Quality Control Managers |

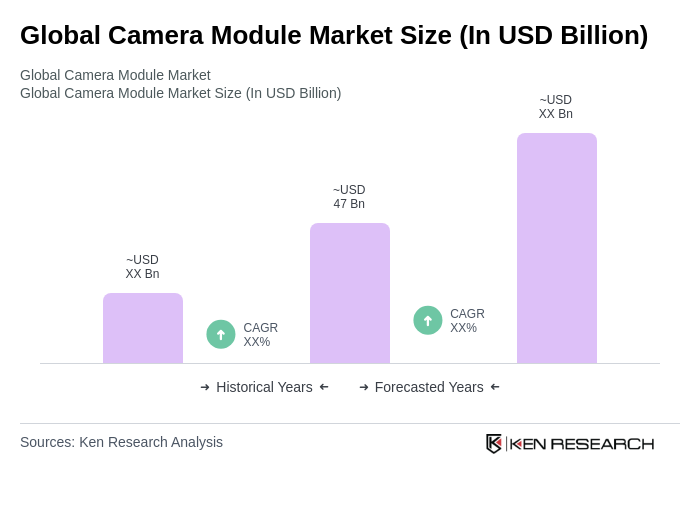

The Global Camera Module Market is valued at approximately USD 47 billion, driven by the increasing demand for high-quality imaging solutions across various sectors, including consumer electronics, automotive, and security applications.