Region:Global

Author(s):Dev

Product Code:KRAC0423

Pages:84

Published On:August 2025

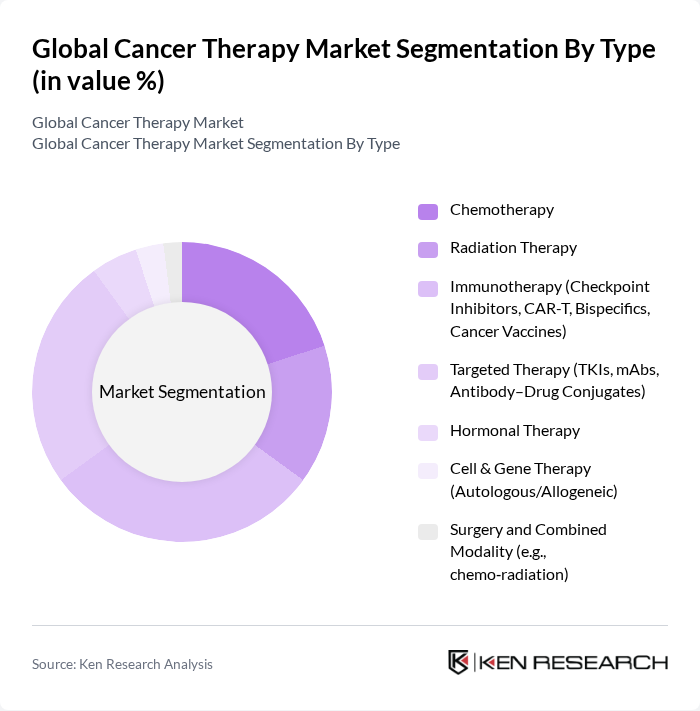

By Type:The cancer therapy market is segmented into various types, including chemotherapy, radiation therapy, immunotherapy, targeted therapy, hormonal therapy, cell & gene therapy, and surgery combined with other modalities. Among these, immunotherapy has gained significant traction due to its effectiveness in treating various cancer types and its ability to harness the body's immune system.

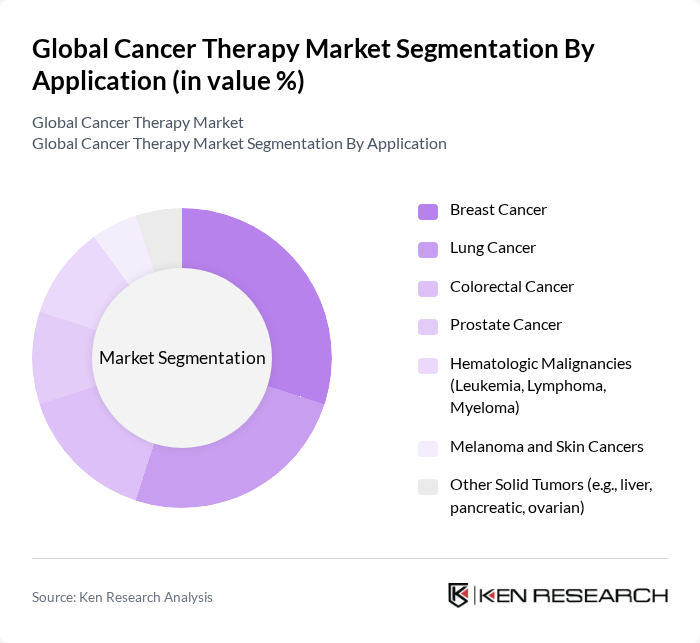

By Application:The applications of cancer therapy include breast cancer, lung cancer, colorectal cancer, prostate cancer, hematologic malignancies, melanoma, and other solid tumors. Breast cancer treatment remains a leading application due to its high incidence rates and ongoing advancements in targeted therapies.

The Global Cancer Therapy Market is characterized by a dynamic mix of regional and international players. Leading participants such as F. Hoffmann-La Roche Ltd, Novartis AG, Merck & Co., Inc., Bristol Myers Squibb, Pfizer Inc., Amgen Inc., AstraZeneca PLC, Johnson & Johnson (Janssen/Johnson & Johnson Innovative Medicine), Gilead Sciences, Inc. (incl. Kite Pharma), Eli Lilly and Company, Sanofi, AbbVie Inc., Takeda Pharmaceutical Company Limited, Bayer AG, Seagen Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cancer therapy market in None is poised for transformative growth, driven by technological advancements and increasing patient demand. As the focus shifts towards personalized medicine, therapies tailored to individual genetic profiles are expected to gain traction. Additionally, the integration of artificial intelligence in treatment planning will enhance precision and efficiency. These trends, coupled with a growing emphasis on patient-centric care, will shape the landscape of cancer treatment, ensuring better outcomes and improved quality of life for patients.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemotherapy Radiation Therapy Immunotherapy (Checkpoint Inhibitors, CAR-T, Bispecifics, Cancer Vaccines) Targeted Therapy (TKIs, mAbs, Antibody–Drug Conjugates) Hormonal Therapy Cell & Gene Therapy (Autologous/Allogeneic) Surgery and Combined Modality (e.g., chemo?radiation) |

| By Application | Breast Cancer Lung Cancer Colorectal Cancer Prostate Cancer Hematologic Malignancies (Leukemia, Lymphoma, Myeloma) Melanoma and Skin Cancers Other Solid Tumors (e.g., liver, pancreatic, ovarian) |

| By End-User | Hospitals Oncology Clinics Academic & Research Institutions Homecare & Ambulatory Infusion Centers Others |

| By Distribution Channel | Direct Sales to Providers Specialty Distributors Online & Specialty Pharmacies Retail Pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Patient Demographics | Age Group Gender Biomarker/Genomic Profile Others |

| By Treatment Setting | Inpatient Outpatient Palliative & Supportive Care Clinical Trial/Expanded Access |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chemotherapy Treatment Insights | 120 | Oncologists, Oncology Nurses |

| Immunotherapy Adoption Rates | 100 | Pharmaceutical Sales Representatives, Clinical Researchers |

| Patient Experience with Targeted Therapies | 80 | Cancer Patients, Patient Advocacy Group Leaders |

| Market Trends in Radiotherapy | 70 | Radiation Oncologists, Medical Physicists |

| Emerging Therapies and Clinical Trials | 90 | Clinical Trial Coordinators, Research Scientists |

The Global Cancer Therapy Market is valued at approximately USD 185 billion, reflecting sustained growth driven by increasing cancer incidence, therapy innovation, and improved access to advanced treatments. This value indicates a significant rise from previous years, exceeding USD 200 billion recently.