Region:Global

Author(s):Geetanshi

Product Code:KRAC0129

Pages:97

Published On:August 2025

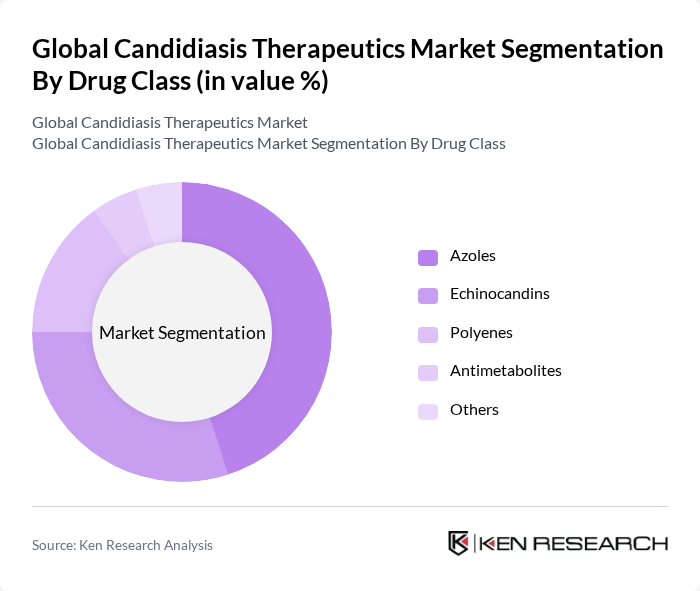

By Drug Class:The drug class segmentation includes various categories of antifungal medications used to treat candidiasis. The primary subsegments are Azoles, Echinocandins, Polyenes, Antimetabolites, and Others.Azolesare widely used due to their effectiveness and broad spectrum of activity against different Candida species.Echinocandinsare gaining traction for their safety profile and efficacy in treating invasive candidiasis, especially in hospital settings.Polyenes, while effective, are less commonly used due to their side effects and toxicity concerns.Antimetabolitesand other classes are niche segments with specific applications, often reserved for refractory or resistant cases .

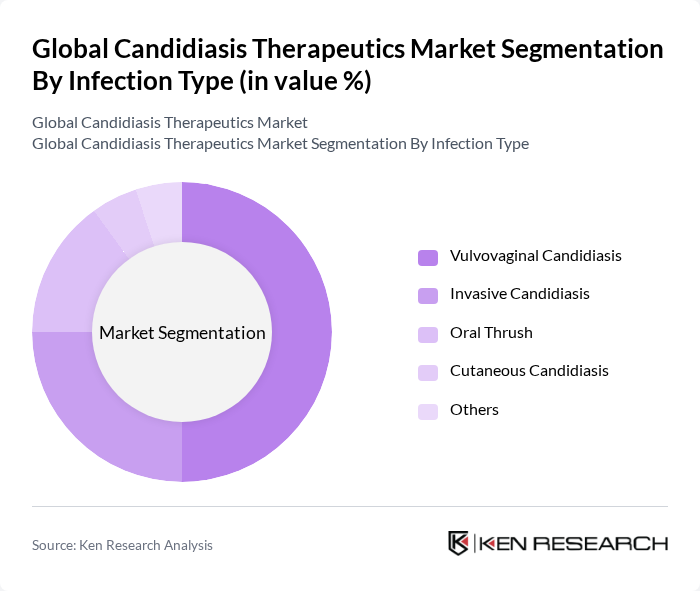

By Infection Type:The infection type segmentation encompasses various forms of candidiasis, including Vulvovaginal Candidiasis, Invasive Candidiasis, Oral Thrush, Cutaneous Candidiasis, and Others.Vulvovaginal candidiasisis the most prevalent type, driven by factors such as hormonal changes, antibiotic use, and diabetes.Invasive candidiasis, while less common, poses significant health risks, particularly in hospitalized and immunocompromised patients.Oral thrushis frequently seen in immunocompromised individuals, including those with HIV/AIDS or undergoing chemotherapy.Cutaneous candidiasisaffects individuals with skin barrier disruptions or chronic conditions. The "Others" category includes less common forms such as systemic and esophageal candidiasis .

The Global Candidiasis Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Merck & Co., Inc., Gilead Sciences, Inc., Astellas Pharma Inc., Novartis AG, Johnson & Johnson, F. Hoffmann-La Roche Ltd., Sanofi S.A., GlaxoSmithKline plc, AbbVie Inc., Amgen Inc., Eli Lilly and Company, Bayer AG, Takeda Pharmaceutical Company Limited, AstraZeneca PLC, Basilea Pharmaceutica Ltd., SCYNEXIS, Inc., Viatris Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the candidiasis therapeutics market is poised for transformation, driven by ongoing innovations in drug development and a shift towards personalized medicine. As healthcare providers increasingly adopt combination therapies tailored to individual patient needs, the efficacy of treatment regimens is expected to improve. Additionally, the integration of telemedicine will enhance patient access to care, particularly in underserved regions, fostering a more inclusive approach to candidiasis management and potentially expanding market reach.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Azoles Echinocandins Polyenes Antimetabolites Others |

| By Infection Type | Vulvovaginal Candidiasis Invasive Candidiasis Oral Thrush Cutaneous Candidiasis Others |

| By End-User | Hospitals Clinics Homecare Settings |

| By Route of Administration | Oral Intravenous Topical |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies |

| By Patient Demographics | Adults Pediatrics Geriatrics |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Treatment Stage | Acute Chronic Recurrent |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers in Infectious Diseases | 80 | Infectious Disease Specialists, General Practitioners |

| Pharmacists and Pharmacy Managers | 60 | Community Pharmacists, Hospital Pharmacy Managers |

| Patients with Candidiasis | 100 | Individuals diagnosed with candidiasis, Caregivers |

| Clinical Researchers in Mycology | 40 | Clinical Trial Investigators, Research Scientists |

| Health Insurance Providers | 40 | Medical Directors, Claims Analysts |

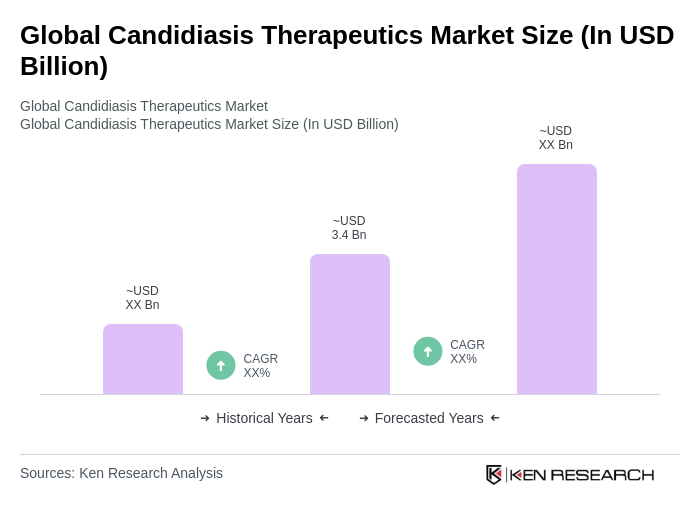

The Global Candidiasis Therapeutics Market is valued at approximately USD 3.4 billion, reflecting a significant growth driven by the increasing prevalence of candidiasis infections and advancements in antifungal drug development.