Region:Global

Author(s):Dev

Product Code:KRAB0364

Pages:81

Published On:August 2025

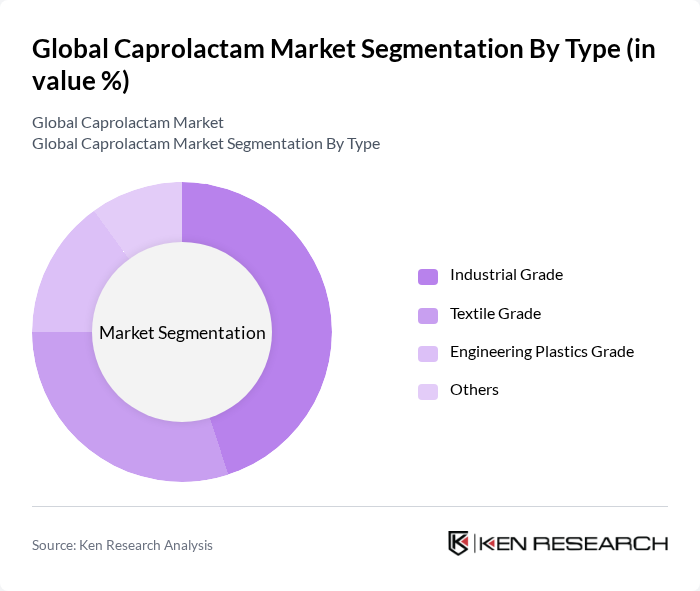

By Type:The market is segmented into Industrial Grade, Textile Grade, Engineering Plastics Grade, and Others. Among these, the Industrial Grade segment is the most dominant due to its extensive use in various industrial applications, including the production of nylon and other synthetic fibers. The demand for high-performance materials in automotive and electrical applications further drives this segment's growth. The Textile Grade segment follows closely, fueled by the increasing demand for nylon fibers in the fashion and apparel industry.

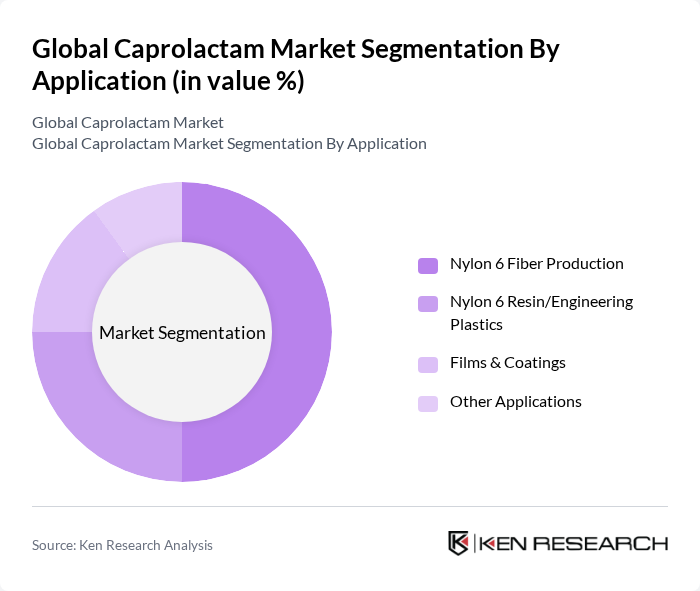

By Application:The applications of caprolactam include Nylon 6 Fiber Production, Nylon 6 Resin/Engineering Plastics, Films & Coatings, and Other Applications such as wire & cable and industrial yarn. The Nylon 6 Fiber Production segment is the leading application, driven by the growing demand for high-strength and lightweight materials in the textile and automotive sectors. The Nylon 6 Resin segment is also significant, as it is widely used in engineering plastics, which are essential for various industrial applications.

The Global Caprolactam Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, UBE Corporation, Lanxess AG, Ascend Performance Materials LLC, China National Chemical Corporation (ChemChina), DSM Engineering Materials (now part of Envalior), Toray Industries, Inc., Sumitomo Chemical Co., Ltd., Fibrant B.V., AdvanSix Inc., Honeywell International Inc., Jiangsu Sihuan Chemical Co., Ltd., Shandong Haili Chemical Industry Co., Ltd., Zhejiang Jianye Chemical Co., Ltd., KuibyshevAzot PJSC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the caprolactam market appears promising, driven by technological advancements and a shift towards sustainable practices. Innovations in production methods, such as the development of bio-based caprolactam, are expected to enhance efficiency and reduce environmental impact. Additionally, the expansion into emerging markets, particularly in Asia-Pacific, will provide new growth avenues as demand for synthetic fibers and automotive components continues to rise, fostering a dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade Textile Grade Engineering Plastics Grade Others |

| By Application | Nylon 6 Fiber Production Nylon 6 Resin/Engineering Plastics Films & Coatings Other Applications (e.g., wire & cable, industrial yarn) |

| By End-User | Textile & Apparel Automotive Electrical & Electronics Industrial Machinery Others |

| By Region | Asia-Pacific Europe North America Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Industry Caprolactam Usage | 120 | Textile Manufacturers, Product Development Managers |

| Automotive Applications of Caprolactam | 90 | Automotive Engineers, Procurement Managers |

| Consumer Goods Sector Insights | 75 | Product Managers, Supply Chain Analysts |

| Research & Development in Chemical Manufacturing | 60 | R&D Directors, Chemical Process Engineers |

| Regulatory Compliance and Caprolactam | 45 | Compliance Officers, Environmental Managers |

The Global Caprolactam Market is valued at approximately USD 16.9 billion, reflecting a robust growth trajectory driven by increasing demand for nylon products across various industries, including textiles, automotive, and electronics.