Region:Global

Author(s):Geetanshi

Product Code:KRAA2320

Pages:82

Published On:August 2025

By Type:The car sharing market is segmented into Round-trip Car Sharing, One-way Car Sharing, Peer-to-Peer (P2P) Car Sharing, Free-floating Car Sharing, Corporate Car Sharing, Electric Vehicle Car Sharing, Luxury Car Sharing, and Others. Each type addresses distinct consumer needs, with digital platforms and mobile applications playing a pivotal role in enhancing accessibility and user experience .

The Round-trip Car Sharing segment remains the largest, favored for its convenience and cost-effectiveness, particularly among users who require vehicles for specific durations and intend to return them to the original location. This model is especially prevalent in urban areas, where ease of access and short-term mobility are priorities. One-way Car Sharing is gaining momentum, driven by consumer demand for flexibility and seamless travel. The proliferation of user-friendly mobile apps and digital booking platforms continues to accelerate the adoption of both models .

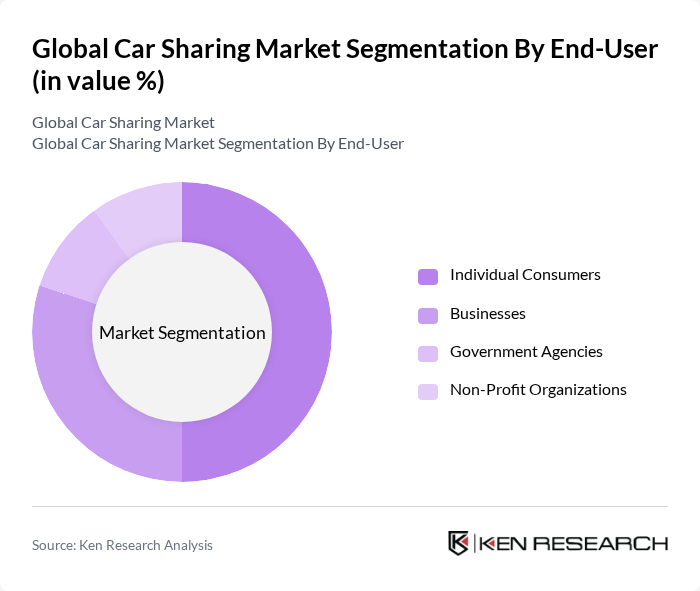

By End-User:The market is segmented by end-user into Individual Consumers, Businesses, Government Agencies, and Non-Profit Organizations. Each segment demonstrates unique usage patterns and requirements, shaping their engagement with car-sharing services .

Individual Consumers represent the largest end-user segment, propelled by the growing demand for affordable, flexible urban mobility solutions and the shift away from private vehicle ownership. Businesses are increasingly adopting car-sharing for employee mobility and to optimize fleet management costs. Government agencies and non-profit organizations are leveraging car-sharing to support sustainable transportation initiatives and reduce their carbon footprint .

The Global Car Sharing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zipcar, Turo, Getaround, Share Now, Enterprise CarShare, Cambio Mobilitätsservice GmbH & Co. KG, DriveNow, Communauto, GreenMobility, GIG Car Share, Orix Auto, Cityhop, Ekar, Modo Co-operative, and DiDi Global Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the car sharing market appears promising, driven by technological advancements and changing consumer preferences. As urban populations continue to grow, the demand for flexible transportation solutions will likely increase. Innovations in mobile technology and electric vehicles will enhance user experience and sustainability. Additionally, partnerships with local governments to integrate car sharing with public transport systems will create a more cohesive urban mobility landscape, further solidifying the role of car sharing in future transportation networks.

| Segment | Sub-Segments |

|---|---|

| By Type | Round-trip Car Sharing One-way Car Sharing Peer-to-Peer (P2P) Car Sharing Free-floating Car Sharing Corporate Car Sharing Electric Vehicle Car Sharing Luxury Car Sharing Others |

| By End-User | Individual Consumers Businesses Government Agencies Non-Profit Organizations |

| By Vehicle Type | Sedans SUVs Vans Electric Vehicles Luxury Vehicles |

| By Pricing Model | Pay-per-use Subscription-based Hourly Rates Daily Rates |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Duration of Use | Short-term Rentals Long-term Rentals |

| By Fleet Ownership | Company-owned Fleets Partner-owned Fleets Hybrid Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Car Sharing Users | 100 | Frequent Users, Occasional Users |

| Car Sharing Service Providers | 50 | CEOs, Operations Managers |

| Urban Planners and Policy Makers | 40 | City Officials, Transportation Planners |

| Environmental Impact Analysts | 40 | Sustainability Experts, Researchers |

| Potential Users (Non-users of Car Sharing) | 60 | Urban Residents, Commuters |

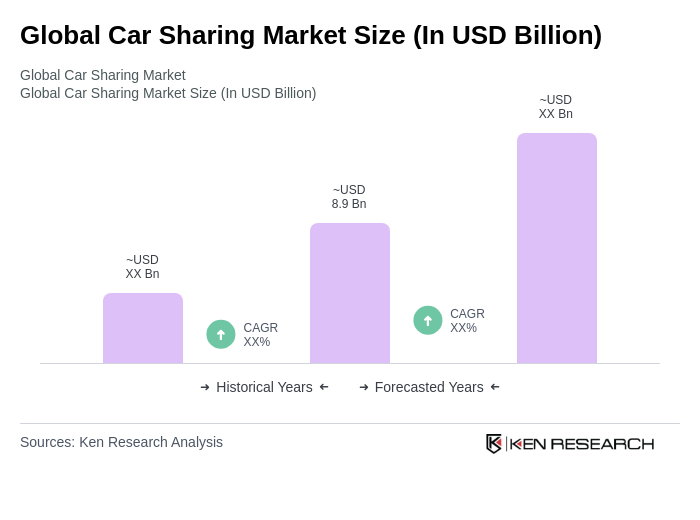

The Global Car Sharing Market is valued at approximately USD 8.9 billion, reflecting significant growth driven by urbanization, environmental awareness, and the rising costs of vehicle ownership, prompting consumers to seek flexible transportation solutions.