Region:Global

Author(s):Rebecca

Product Code:KRAA1348

Pages:81

Published On:August 2025

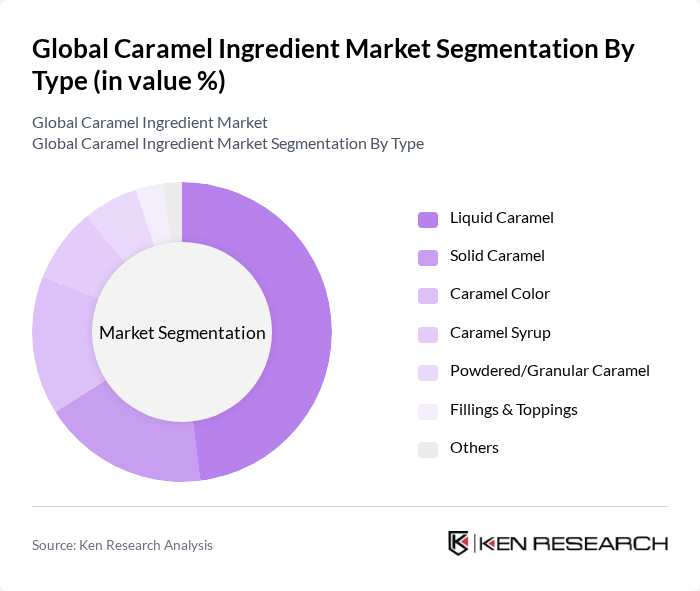

By Type:The caramel ingredient market is segmented into various types, including Liquid Caramel, Solid Caramel, Caramel Color, Caramel Syrup, Powdered/Granular Caramel, Fillings & Toppings, and Others. Among these, Liquid Caramel is the most dominant sub-segment due to its versatility and widespread use in beverages, desserts, and gourmet cooking. The increasing trend of using liquid caramel in premium bakery and beverage products has further solidified its market leadership. Caramel Color also represents a significant share, especially in beverage and processed food applications .

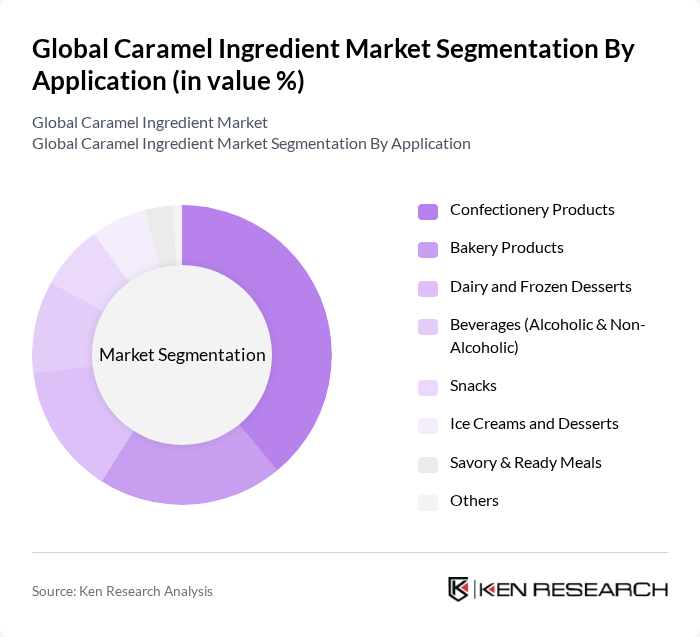

By Application:The applications of caramel ingredients span across various sectors, including Confectionery Products, Bakery Products, Dairy and Frozen Desserts, Beverages (Alcoholic & Non-Alcoholic), Snacks, Ice Creams and Desserts, Savory & Ready Meals, and Others. The Confectionery Products segment leads the market, driven by high demand for caramel in candies, chocolates, and sweet treats. The bakery sector also represents a substantial share, reflecting the popularity of caramel as a flavoring and coloring agent in baked goods. The expansion of ready-to-eat and convenience foods, along with indulgent snacking trends, further propels these segments .

The Global Caramel Ingredient Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Incorporated, Archer Daniels Midland Company (ADM), Kerry Group plc, Tate & Lyle PLC, Sethness-Roquette, Nigay S.A., Sensient Technologies Corporation, Döhler Group, Bakels Group, Puratos Group, The Hershey Company, Nestlé S.A., Barry Callebaut AG, Frito-Lay (PepsiCo, Inc.), and Lotus Bakeries NV contribute to innovation, geographic expansion, and service delivery in this space.

The future of the caramel ingredient market in None appears promising, driven by evolving consumer preferences and technological advancements. As health-conscious consumers increasingly seek natural and organic options, manufacturers are likely to innovate their product lines to meet these demands. Additionally, the rise of e-commerce platforms is expected to facilitate broader distribution channels, allowing for greater market penetration. Companies that adapt to these trends will likely capture significant market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Caramel Solid Caramel Caramel Color Caramel Syrup Powdered/Granular Caramel Fillings & Toppings Others |

| By Application | Confectionery Products Bakery Products Dairy and Frozen Desserts Beverages (Alcoholic & Non-Alcoholic) Snacks Ice Creams and Desserts Savory & Ready Meals Others |

| By End-User | Food Industry Beverage Industry Dairy Industry Pharmaceutical Industry Foodservice/HoReCa Others |

| By Distribution Channel | Direct Sales (B2B) Retail Stores Online Sales Distributors/Wholesalers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Confectionery Manufacturers | 100 | Product Development Managers, R&D Directors |

| Beverage Producers | 60 | Flavor Technologists, Beverage Formulators |

| Bakery Product Developers | 50 | Quality Assurance Managers, Production Supervisors |

| Food Ingredient Suppliers | 40 | Sales Managers, Supply Chain Coordinators |

| Retail Sector Buyers | 50 | Category Managers, Procurement Specialists |

The Global Caramel Ingredient Market is valued at approximately USD 3.1 billion, reflecting a robust growth trajectory driven by increasing demand across various food and beverage applications, including confectionery, bakery, and dairy products.