Region:Global

Author(s):Dev

Product Code:KRAA1555

Pages:81

Published On:August 2025

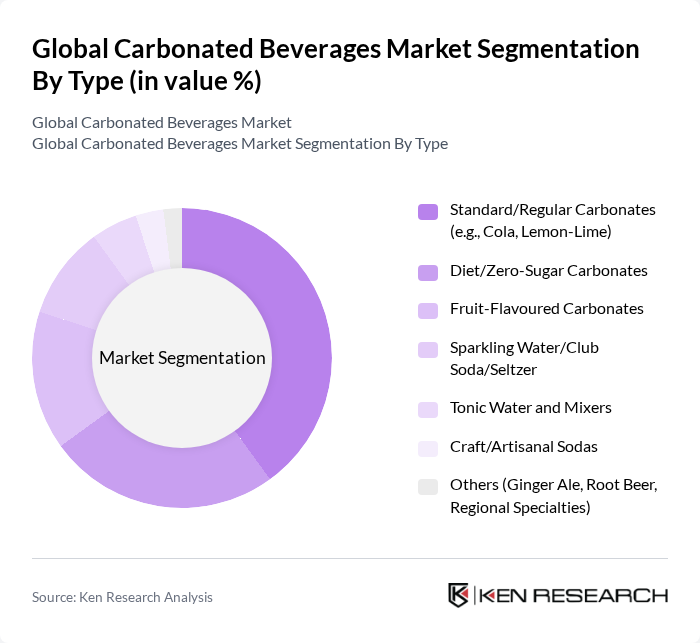

By Type:The carbonated beverages market can be segmented into various types, including Standard/Regular Carbonates, Diet/Zero-Sugar Carbonates, Fruit-Flavoured Carbonates, Sparkling Water/Club Soda/Seltzer, Tonic Water and Mixers, Craft/Artisanal Sodas, and Others. Among these,Standard/Regular Carbonatescontinue to dominate the market due to their longstanding popularity, ubiquitous distribution, and strong brand equity in core flavors like cola and lemon-lime across retail and foodservice channels .

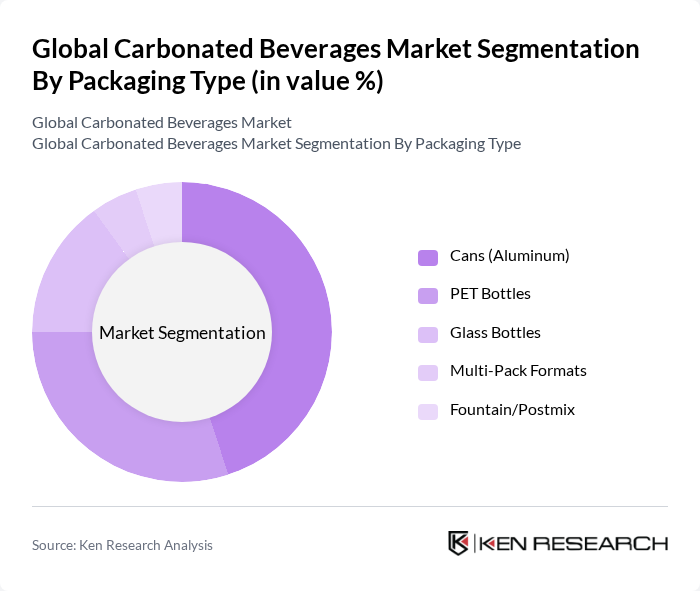

By Packaging Type:The market is also segmented by packaging type, which includes Cans (Aluminum), PET Bottles, Glass Bottles, Multi-Pack Formats, and Fountain/Postmix.Cansare widely used for carbonated beverages because of convenience, portability, and high recyclability; sustainability initiatives by beverage companies and packaging suppliers continue to support aluminum’s circularity positioning .

The Global Carbonated Beverages Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Coca-Cola Company, PepsiCo, Inc., Keurig Dr Pepper Inc., Monster Beverage Corporation, Red Bull GmbH, Suntory Beverage & Food Limited, Britvic plc, A.G. BARR p.l.c., National Beverage Corp. (LaCroix), Refresco Group N.V., Coca?Cola Europacific Partners plc, Pepsi Bottling Ventures LLC, Asahi Group Holdings, Ltd. (Wilkinson, Mitsuya Cider), Thailand Beverage Public Company Limited (est Cola), JAB Holding Company (Caleb’s Kola, craft mixers) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the carbonated beverages market appears promising, driven by evolving consumer preferences and innovative product offerings. As health-conscious trends continue to rise, brands are likely to focus on developing low-calorie and sugar-free options to cater to this demographic. Additionally, the expansion into untapped markets, particularly in Africa and Asia, presents growth potential, as these regions are experiencing rapid urbanization and increasing disposable incomes, further fueling demand for carbonated beverages.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard/Regular Carbonates (e.g., Cola, Lemon-Lime) Diet/Zero-Sugar Carbonates Fruit-Flavoured Carbonates Sparkling Water/Club Soda/Seltzer Tonic Water and Mixers Craft/Artisanal Sodas Others (Ginger Ale, Root Beer, Regional Specialties) |

| By Packaging Type | Cans (Aluminum) PET Bottles Glass Bottles Multi-Pack Formats Fountain/Postmix |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail and Quick Commerce Foodservice/HoReCa (On-premise, QSR) Vending and Other Channels |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Consumer Demographics | Age Group (Children, Teenagers, Adults, Seniors) Gender Income Level Lifestyle Preferences (Health-conscious, Indulgence, On-the-go) |

| By Flavor Profile | Cola Citrus (Lemon-Lime, Orange) Berry Tropical Botanical/Herbal (e.g., Ginger, Tonic, Tea-based) Others |

| By Price Range | Economy Mid-Range Premium Super-Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Outlet Managers | 120 | Store Managers, Category Buyers |

| Consumer Preferences | 140 | Regular Carbonated Beverage Consumers |

| Distribution Channel Insights | 100 | Logistics Coordinators, Supply Chain Managers |

| Health and Wellness Trends | 80 | Nutritional Experts, Health Coaches |

| Marketing Strategies | 90 | Marketing Directors, Brand Managers |

The Global Carbonated Beverages Market is valued at approximately USD 480500 billion, reflecting steady demand and resilience amid portfolio diversification. This valuation is supported by multiple industry sources and historical analyses over the past five years.