Region:Global

Author(s):Dev

Product Code:KRAC0563

Pages:81

Published On:August 2025

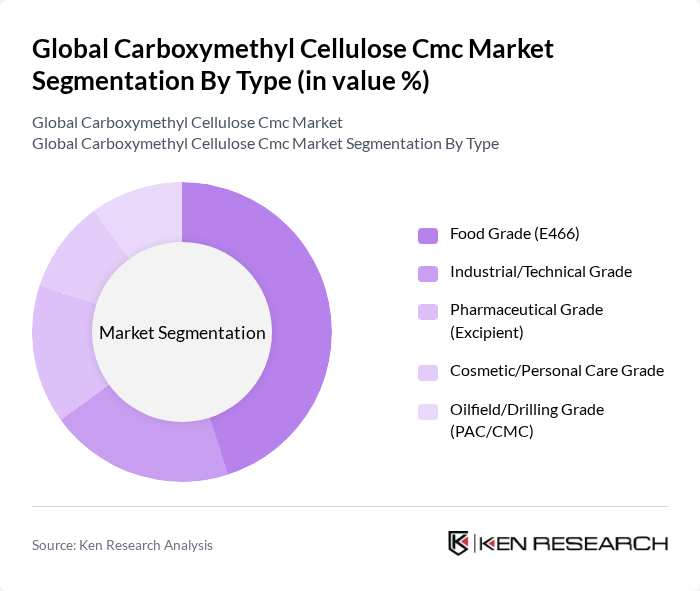

By Type:The market is segmented into Food Grade (E466), Industrial/Technical Grade, Pharmaceutical Grade (Excipient), Cosmetic/Personal Care Grade, and Oilfield/Drilling Grade (PAC/CMC). Food Grade CMC remains the most widely used type due to its role as a thickener, stabilizer, and fat replacer in dairy, bakery, beverages, and gluten-free/low-fat products, aligned with clean-label and plant-based formulation trends. Increasing demand for multifunctional additives in processed and convenience foods continues to support food-grade CMC adoption.

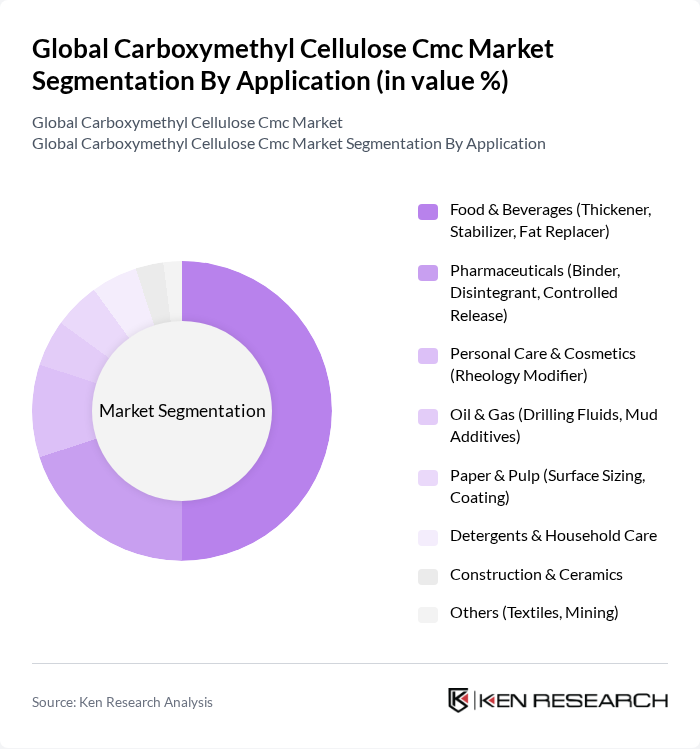

By Application:The applications of CMC span Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, Oil & Gas, Paper & Pulp, Detergents & Household Care, Construction & Ceramics, and Others. Food & Beverages leads, reflecting the need for texturizing, water-binding, and stabilization in dairy analogs, sauces, bakery, and beverages, including gluten-free and reduced-fat products. Pharmaceuticals is a major use area where CMC functions as a binder, disintegrant, and viscosity modifier in oral and topical formulations; Personal Care leverages CMC as a rheology modifier and film-former in skincare, haircare, and oral care. Oil & Gas uses CMC in drilling fluids as a viscosifier and fluid-loss control agent; paper, detergents, and ceramics represent additional steady end uses.

The Global Carboxymethyl Cellulose Cmc Market is characterized by a dynamic mix of regional and international players. Leading participants such as CP Kelco U.S., Inc., Ashland Inc., Nouryon (formerly AkzoNobel Specialty Chemicals), Lotte Fine Chemical Co., Ltd., Daicel Corporation, WeiFang Lude Chemical Co., Ltd., SINOCMC Co., Ltd., DKS Co. Ltd., Chongqing Lihong Fine Chemicals Co., Ltd., Anqiu Eagle Cellulose Co., Ltd., Zibo Hailan Chemical Co., Ltd., Qingdao Sinocmc Chemical Co., Ltd., Dow (The Dow Chemical Company), Nippon Paper Industries Co., Ltd., J.M. Huber Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the carboxymethyl cellulose market appears promising, driven by increasing applications across diverse industries. The demand for sustainable and eco-friendly products is expected to shape market dynamics, with companies focusing on developing biodegradable CMC alternatives. Additionally, technological advancements in production processes are likely to enhance efficiency and reduce costs, making CMC more accessible. As consumer preferences shift towards health-conscious and environmentally friendly options, the market is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Food Grade (E466) Industrial/Technical Grade Pharmaceutical Grade (Excipient) Cosmetic/Personal Care Grade Oilfield/Drilling Grade (PAC/CMC) |

| By Application | Food & Beverages (Thickener, Stabilizer, Fat Replacer) Pharmaceuticals (Binder, Disintegrant, Controlled Release) Personal Care & Cosmetics (Rheology Modifier) Oil & Gas (Drilling Fluids, Mud Additives) Paper & Pulp (Surface Sizing, Coating) Detergents & Household Care Construction & Ceramics Others (Textiles, Mining) |

| By End-User | Food & Beverage Manufacturers Pharmaceutical Companies Personal Care & Cosmetics Manufacturers Oilfield Service Companies Paper & Packaging Producers Detergent & Home Care Producers Others |

| By Distribution Channel | Direct (Producer to Industrial Customer) Distributors/Agents Online/B2B Platforms Retail/Specialty Chemical Stores Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Bags/Sacks (20–25 kg) Drums Bulk Containers/Big Bags Others |

| By Price Range | Low Price Medium Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Industry Applications | 100 | Food Technologists, Quality Assurance Managers |

| Pharmaceutical Sector Usage | 80 | Regulatory Affairs Specialists, R&D Scientists |

| Personal Care Products | 70 | Product Development Managers, Marketing Managers |

| Industrial Applications | 60 | Manufacturing Engineers, Supply Chain Managers |

| Research Institutions | 40 | Academic Researchers, Industry Analysts |

The Global Carboxymethyl Cellulose (CMC) market is valued at approximately USD 1.7 billion, with estimates ranging from USD 1.64 to 1.99 billion based on recent analyses. This growth is driven by its applications in various industries, including food, pharmaceuticals, and personal care.