Region:Global

Author(s):Shubham

Product Code:KRAD0658

Pages:89

Published On:August 2025

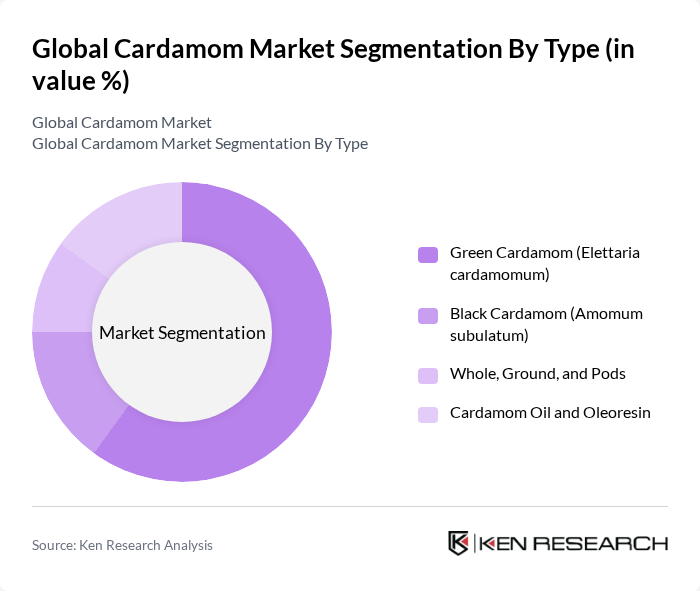

By Type:The cardamom market is segmented into various types, including Green Cardamom (Elettaria cardamomum), Black Cardamom (Amomum subulatum), Whole, Ground, and Pods, and Cardamom Oil and Oleoresin. Green cardamom is the most widely used type due to its versatile flavor profile and applications in both sweet and savory dishes. Black cardamom is established in regional cuisines across South and East Asia for smoky, savory applications. Cardamom oil and oleoresin are key inputs in flavors, fragrances, and aromatherapy, with usage in beverages, confectionery, and personal care concentrates .

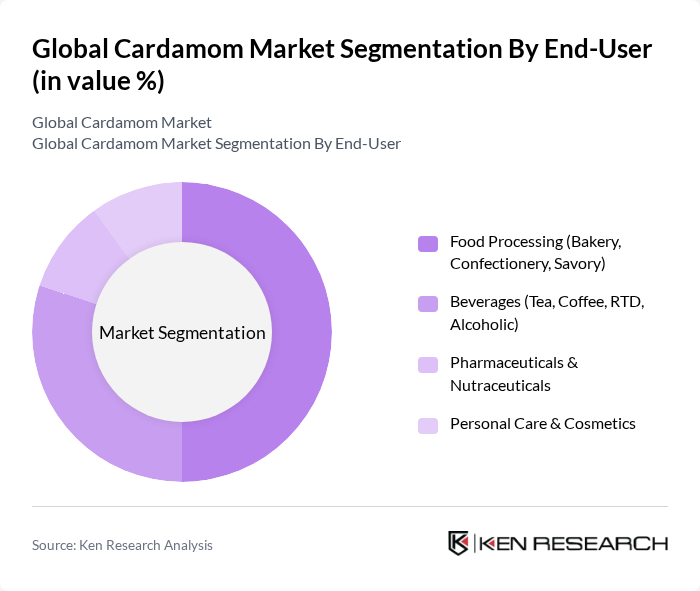

By End-User:The end-user segmentation includes Food Processing (Bakery, Confectionery, Savory), Beverages (Tea, Coffee, RTD, Alcoholic), Pharmaceuticals & Nutraceuticals, and Personal Care & Cosmetics. The food and beverage categories together account for the bulk of demand, with food processing using cardamom for flavor and aroma across bakery, confectionery, and savory items, and beverages leveraging cardamom in specialty teas and coffee blends. Natural-origin preferences also support use in nutraceutical and personal care formulations where cardamom extracts and oils are applied for flavor, fragrance, and wellness-positioned products .

The Global Cardamom Market is characterized by a dynamic mix of regional and international players. Leading participants such as McCormick & Company, Inc., Olam International Limited (ofi – Olam Food Ingredients), Synthite Industries Ltd., AVT Natural Products Ltd., DS Group (Rajnigandha/Pass Pass; spices division), Eastern Condiments (UAE/India), Everest Food Products Pvt. Ltd., MDH (Mahashian Di Hatti Pvt. Ltd.), Badia Spices, Inc., The Spice House, Spice Islands (B&G Foods), Frontier Co-op (including Simply Organic), SABR Brands (The Spice Market/Spice Jungle), Jayanti Herbs & Spice (Jayanti Group), House of Spices (India) Inc. (U.S.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cardamom market appears promising, driven by increasing consumer interest in natural and health-oriented products. As the food and beverage industry continues to innovate, cardamom is likely to find new applications, particularly in health supplements and organic products. Additionally, the rise of e-commerce platforms is expected to enhance market accessibility, allowing producers to reach a broader audience. These trends indicate a dynamic market landscape, fostering growth opportunities for cardamom stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Green Cardamom (Elettaria cardamomum) Black Cardamom (Amomum subulatum) Whole, Ground, and Pods Cardamom Oil and Oleoresin |

| By End-User | Food Processing (Bakery, Confectionery, Savory) Beverages (Tea, Coffee, RTD, Alcoholic) Pharmaceuticals & Nutraceuticals Personal Care & Cosmetics |

| By Application | Culinary & Household Industrial Flavoring & Fragrances Medicinal & Therapeutic Others |

| By Distribution Channel | Online Retail & D2C Supermarkets/Hypermarkets Specialty Spice Stores & Gourmet Retail Foodservice/HoReCa |

| By Region | Asia-Pacific Middle East & Africa Europe North America Latin America |

| By Price Range | Premium (Large size/AAA grades, organic) Mid-Range (mixed grades) Budget (small/FAQ grades) |

| By Packaging Type | Bulk (jute/poly sacks, drums for oils) Retail Packs (pouches, jars) Eco-Friendly & Recyclable Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardamom Producers | 120 | Farm Owners, Agricultural Managers |

| Spice Distributors | 90 | Supply Chain Managers, Sales Directors |

| Culinary Experts | 60 | Chefs, Food Critics |

| Retail Buyers | 70 | Purchasing Managers, Category Managers |

| Exporters | 50 | Export Managers, Trade Analysts |

The Global Cardamom Market is valued at approximately USD 810 million, based on a five-year historical analysis. This figure primarily reflects the value of green cardamom, with broader estimates varying across different sources.