Region:Global

Author(s):Geetanshi

Product Code:KRAB0114

Pages:92

Published On:August 2025

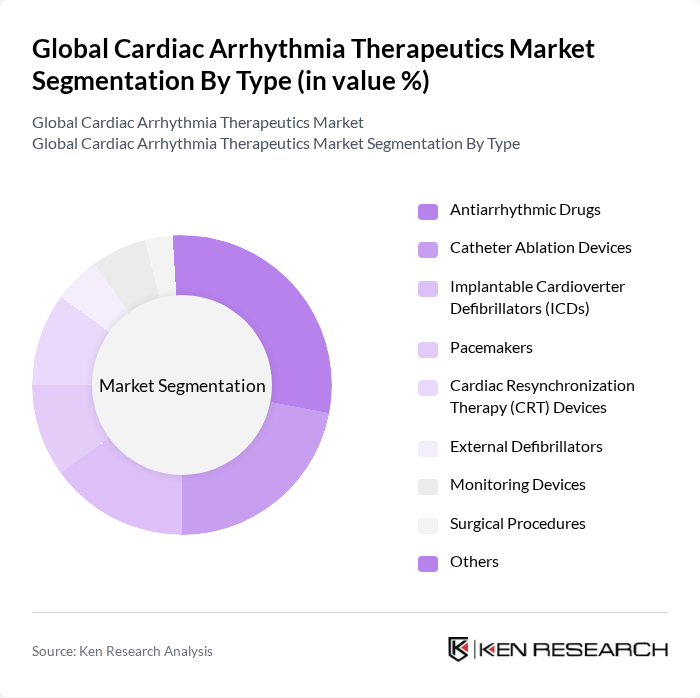

By Type:The market is segmented into Antiarrhythmic Drugs, Catheter Ablation Devices, Implantable Cardioverter Defibrillators (ICDs), Pacemakers, Cardiac Resynchronization Therapy (CRT) Devices, External Defibrillators, Monitoring Devices, Surgical Procedures, and Others. Among these, Catheter Ablation Devices and Antiarrhythmic Drugs are the leading segments. Catheter ablation is increasingly adopted due to its effectiveness in treating atrial fibrillation and other arrhythmias, while antiarrhythmic drugs remain widely used for both acute and chronic management. The adoption of advanced ablation technologies and the growing use of minimally invasive procedures are notable trends, alongside the continued importance of pharmacological therapy for arrhythmia management .

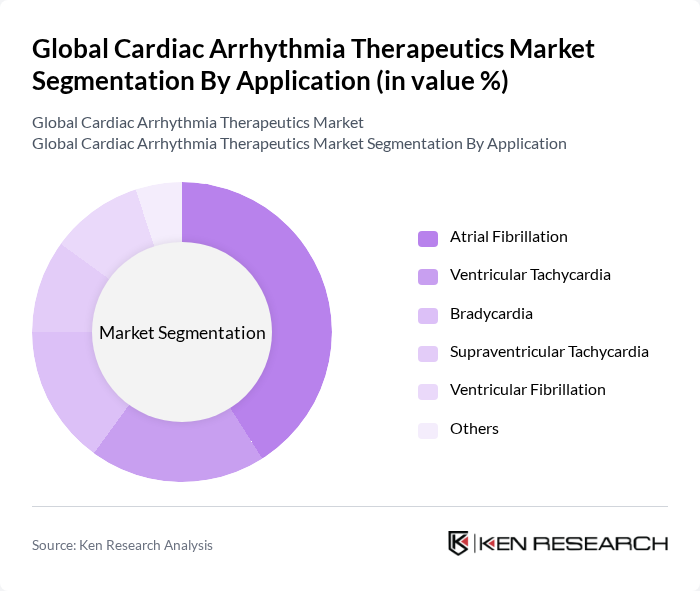

By Application:The applications of cardiac arrhythmia therapeutics include Atrial Fibrillation, Ventricular Tachycardia, Bradycardia, Supraventricular Tachycardia, Ventricular Fibrillation, and Others. Atrial Fibrillation is the dominant application segment, driven by its high prevalence and the increasing number of patients seeking treatment. The growing awareness of the risks associated with untreated atrial fibrillation, such as stroke, has led to a surge in demand for effective therapeutic options. Ventricular arrhythmias and bradycardia also represent significant segments, with ongoing innovation in device-based therapies and pharmacological management .

The Global Cardiac Arrhythmia Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Boston Scientific Corporation, Medtronic plc, Johnson & Johnson (Biosense Webster), Biotronik SE & Co. KG, Siemens Healthineers AG, Koninklijke Philips N.V. (Philips Healthcare), Stryker Corporation, B. Braun Melsungen AG, Zoll Medical Corporation, AtriCure, Inc., Cardiac Science Corporation, Edwards Lifesciences Corporation, LivaNova PLC, Mylan N.V., Teva Pharmaceutical Industries Ltd., Pfizer Inc., Sanofi, Upsher-Smith Laboratories, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cardiac arrhythmia therapeutics market appears promising, driven by ongoing advancements in technology and a growing emphasis on preventive care. As healthcare providers increasingly adopt telemedicine solutions, patient engagement and monitoring will improve, leading to better management of arrhythmias. Additionally, the integration of personalized medicine is expected to enhance treatment efficacy, tailoring therapies to individual patient needs and potentially transforming the therapeutic landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Antiarrhythmic Drugs Catheter Ablation Devices Implantable Cardioverter Defibrillators (ICDs) Pacemakers Cardiac Resynchronization Therapy (CRT) Devices External Defibrillators Monitoring Devices Surgical Procedures Others |

| By Application | Atrial Fibrillation Ventricular Tachycardia Bradycardia Supraventricular Tachycardia Ventricular Fibrillation Others |

| By End-User | Hospitals Cardiac Clinics Ambulatory Surgical Centers Home Care Settings Research Institutions Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Hospital Pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Patient Demographics | Age Group Gender Comorbidities |

| By Treatment Setting | Inpatient Outpatient Emergency Care Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiac Device Manufacturers | 60 | Product Managers, R&D Directors |

| Pharmaceutical Companies | 50 | Market Access Managers, Clinical Research Leads |

| Healthcare Providers | 80 | Cardiologists, Electrophysiologists |

| Patient Advocacy Groups | 40 | Patient Representatives, Program Coordinators |

| Health Insurance Providers | 40 | Policy Analysts, Underwriters |

The Global Cardiac Arrhythmia Therapeutics Market is valued at approximately USD 7 billion, reflecting significant growth driven by the increasing prevalence of cardiac arrhythmias, advancements in medical technology, and a growing aging population susceptible to heart-related conditions.