Region:Global

Author(s):Rebecca

Product Code:KRAB0236

Pages:85

Published On:August 2025

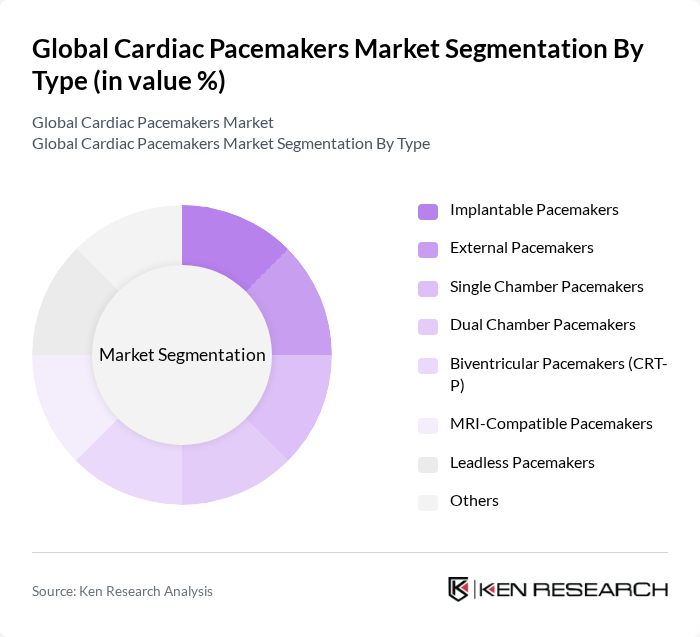

By Type:The market is segmented into various types of pacemakers, including implantable, external, single chamber, dual chamber, biventricular, MRI-compatible, leadless, and others. Among these, implantable pacemakers are the most widely used due to their effectiveness in treating bradycardia and other heart rhythm disorders. The demand for advanced technologies, such as leadless pacemakers and MRI-compatible devices, is also increasing as they offer benefits like reduced infection risk, improved patient comfort, and compatibility with modern imaging techniques .

By End-User:The end-user segmentation includes hospitals, cardiac clinics, ambulatory surgical centers, and home healthcare. Hospitals are the leading end-users due to their capacity to provide comprehensive cardiac care and advanced surgical procedures. The increasing number of cardiac surgeries and the need for continuous monitoring of patients post-surgery contribute to the dominance of hospitals in this segment. Cardiac clinics and ambulatory surgical centers are also significant, driven by the trend toward outpatient procedures and specialized cardiac care .

The Global Cardiac Pacemakers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, BIOTRONIK SE & Co. KG, LivaNova PLC, MicroPort Scientific Corporation, Osypka Medical GmbH, Lepu Medical Technology (Beijing) Co., Ltd., ZOLL Medical Corporation (Asahi Kasei Corporation), MEDICO S.p.A., Pacetronix Limited, Cordis (Cardinal Health, Inc.), Shree Pacetronix Ltd., EBR Systems, Inc., Impulse Dynamics N.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cardiac pacemakers market in None appears promising, driven by ongoing technological innovations and an increasing focus on patient-centric care. As healthcare systems evolve, the integration of digital health technologies will enhance monitoring and management of cardiac conditions. Additionally, the shift towards minimally invasive procedures is expected to improve patient outcomes and satisfaction, further propelling market growth. The emphasis on personalized medicine will also play a crucial role in tailoring treatments to individual patient needs, ensuring better health management.

| Segment | Sub-Segments |

|---|---|

| By Type | Implantable Pacemakers External Pacemakers Single Chamber Pacemakers Dual Chamber Pacemakers Biventricular Pacemakers (CRT-P) MRI-Compatible Pacemakers Leadless Pacemakers Others |

| By End-User | Hospitals Cardiac Clinics Ambulatory Surgical Centers Home Healthcare |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Conventional Pacemakers Advanced Pacemakers Remote Monitoring Pacemakers |

| By Application | Bradycardia Arrhythmia Management Heart Failure Treatment Syncope Management |

| By Implant Site | Endocardial Epicardial |

| By Investment Source | Private Investments Public Funding Venture Capital |

| By Policy Support | Government Subsidies Tax Incentives Research Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiologist Insights | 100 | Cardiologists, Electrophysiologists |

| Hospital Procurement Practices | 60 | Procurement Managers, Finance Managers |

| Patient Experience with Pacemakers | 50 | Pacemaker Patients, Caregivers |

| Market Trends from Sales Representatives | 40 | Sales Representatives, Product Managers |

| Regulatory Perspectives | 40 | Regulatory Affairs Specialists, Compliance Officers |

The Global Cardiac Pacemakers Market is valued at approximately USD 5.5 billion, driven by the increasing prevalence of cardiovascular diseases, advancements in pacemaker technology, and a growing geriatric population.