Region:Global

Author(s):Rebecca

Product Code:KRAB0267

Pages:93

Published On:August 2025

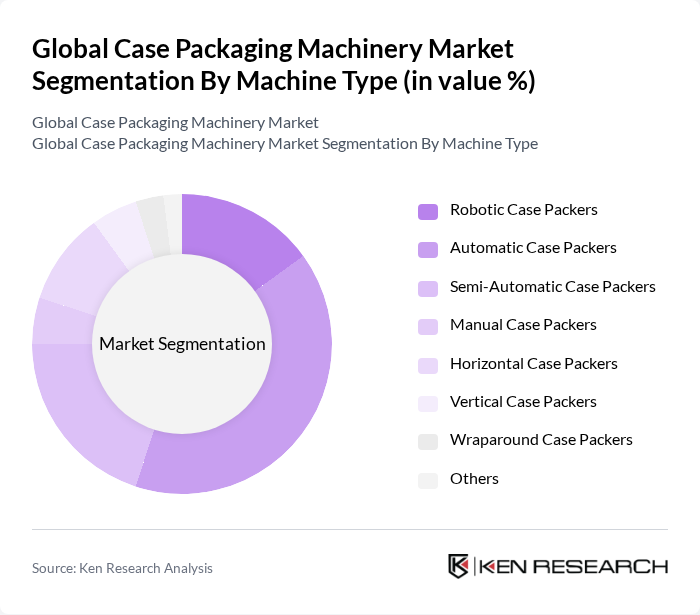

By Machine Type:The machine type segmentation includes Robotic Case Packers, Automatic Case Packers, Semi-Automatic Case Packers, Manual Case Packers, Horizontal Case Packers, Vertical Case Packers, Wraparound Case Packers, and Others. Among these, Automatic Case Packers are leading the market due to their efficiency and ability to handle high packaging volumes, which is essential for industries such as food and beverages. The ongoing trend toward automation, the adoption of Industry 4.0 technologies, and the need for faster, more flexible production lines are driving demand for these machines. Robotic and smart case packers are also gaining traction as manufacturers seek to reduce labor costs and increase precision .

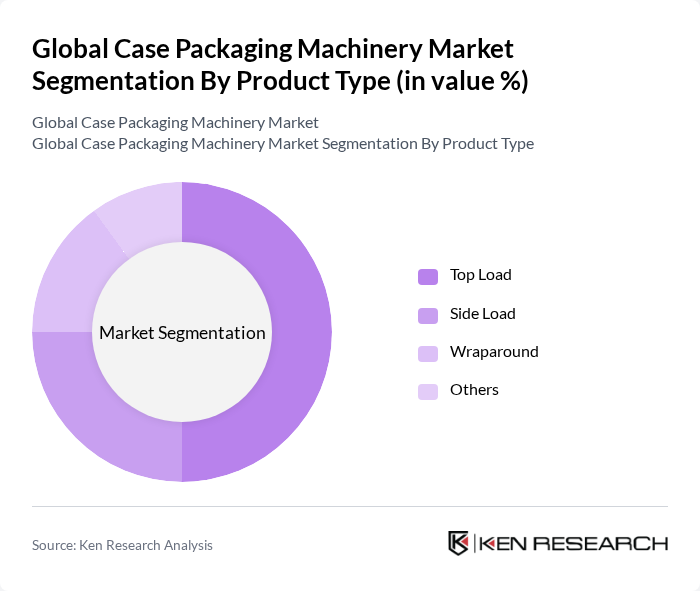

By Product Type:This segmentation includes Top Load, Side Load, Wraparound, and Others. The Top Load segment is currently dominating the market due to its versatility and ease of use in various packaging applications. It is particularly favored in the food and beverage industry, where quick and efficient packaging is crucial. The growing trend of e-commerce is also contributing to the demand for Top Load packaging solutions, as they are well-suited for shipping and retail display. Additionally, the adoption of automated and smart top load systems is increasing to meet higher throughput requirements and minimize manual handling .

The Global Case Packaging Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bosch Packaging Technology (Syntegon Technology GmbH), Krones AG, Tetra Pak International S.A., Schneider Packaging Equipment Co., Inc., Aetna Group (Robopac), ProMach, Inc., Duravant LLC, A-B-C Packaging Machine Corporation, Somic America, Inc., AFA Systems Ltd., Cama Group, ACG Worldwide, Schubert Group (Gerhard Schubert GmbH), Multivac Sepp Haggenmüller SE & Co. KG, and Coesia S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the case packaging machinery market appears promising, driven by technological advancements and evolving consumer preferences. As automation and smart technologies become more prevalent, manufacturers will increasingly adopt Industry 4.0 practices, enhancing operational efficiency. Additionally, the focus on sustainability will continue to shape product development, with companies investing in eco-friendly materials and processes. This dynamic environment presents opportunities for innovation and growth, positioning the market for significant advancements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Machine Type | Robotic Case Packers Automatic Case Packers Semi-Automatic Case Packers Manual Case Packers Horizontal Case Packers Vertical Case Packers Wraparound Case Packers Others |

| By Product Type | Top Load Side Load Wraparound Others |

| By End-User Industry | Food and Beverages Pharmaceuticals Personal Care and Cosmetics Household Care Consumer Goods Electronics Others |

| By Application | Retail Packaging Industrial Packaging E-commerce Packaging Export Packaging Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Customization Level | Standard Solutions Customized Solutions Turnkey Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Packaging Machinery | 100 | Production Managers, Quality Assurance Managers |

| Beverage Packaging Solutions | 80 | Operations Managers, Supply Chain Managers |

| Pharmaceutical Packaging Equipment | 60 | Regulatory Affairs Managers, R&D Managers |

| Consumer Goods Packaging Technologies | 70 | Product Managers, Marketing Managers |

| Sustainable Packaging Innovations | 50 | Sustainability Managers, Innovation Managers |

The Global Case Packaging Machinery Market is valued at approximately USD 690 million, driven by the increasing demand for efficient packaging solutions across various industries, including food and beverages, pharmaceuticals, and consumer goods.