Region:Global

Author(s):Shubham

Product Code:KRAA8776

Pages:86

Published On:November 2025

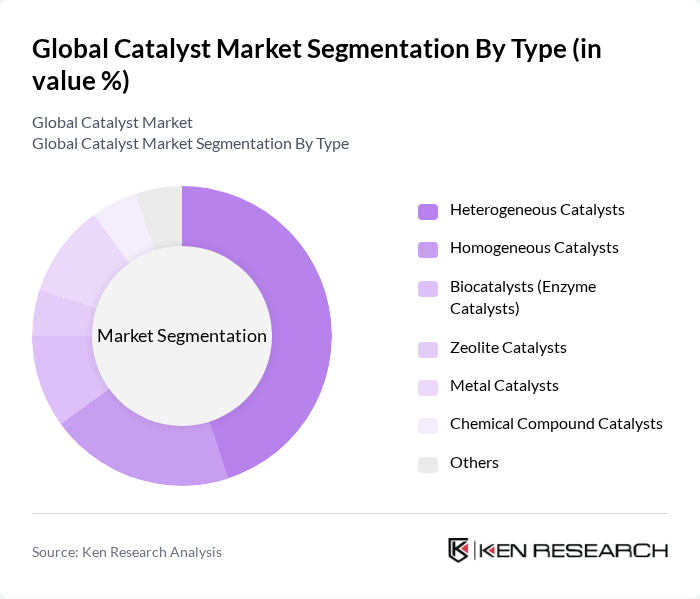

By Type:The catalyst market is segmented into heterogeneous catalysts, homogeneous catalysts, biocatalysts, zeolite catalysts, metal catalysts, chemical compound catalysts, and others. Heterogeneous catalysts maintain dominance due to their extensive use in petroleum refining, chemical synthesis, and environmental applications. Their surface-level reaction facilitation drives efficiency and broad industry adoption, especially in large-scale continuous processes.

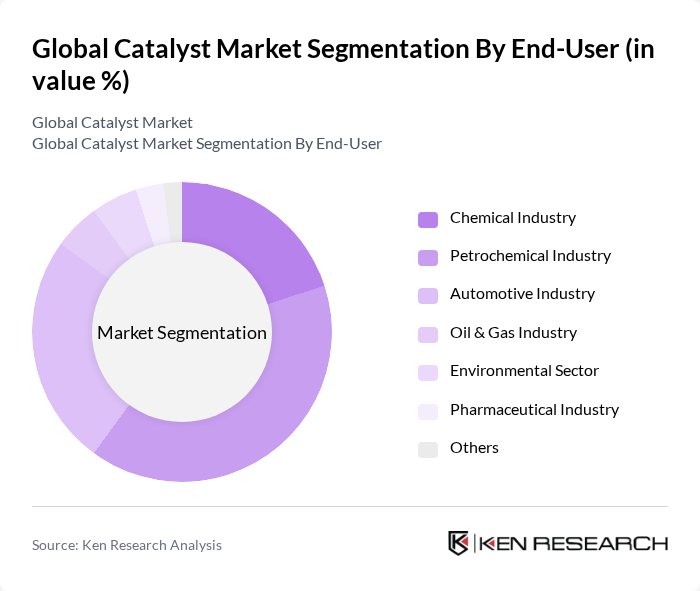

By End-User:The catalyst market is segmented by end-user industries, including the chemical industry, petrochemical industry, automotive industry, oil & gas industry, environmental sector, pharmaceutical industry, and others. The petrochemical industry leads due to high catalyst demand in refining and chemical production. The automotive sector remains significant, driven by stricter emission standards and the adoption of advanced catalytic converters. Environmental and pharmaceutical sectors are experiencing increased catalyst utilization for pollution control and drug synthesis, respectively.

The Global Catalyst Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Johnson Matthey Plc, Clariant AG, Honeywell UOP, Haldor Topsoe A/S, Albemarle Corporation, W. R. Grace & Co., Axens S.A., LyondellBasell Industries N.V., Evonik Industries AG, Mitsubishi Chemical Corporation, China Petroleum & Chemical Corporation (Sinopec), Shell Catalysts & Technologies, CRI Catalyst Company, Zeolyst International contribute to innovation, geographic expansion, and service delivery in this space.

The future of the catalyst market appears promising, driven by ongoing technological advancements and increasing regulatory pressures. As industries pivot towards sustainability, the demand for innovative catalyst solutions is expected to rise. Furthermore, the integration of digital technologies in catalyst management will enhance operational efficiencies. Companies that adapt to these trends will likely gain a competitive edge, positioning themselves favorably in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Heterogeneous Catalysts Homogeneous Catalysts Biocatalysts (Enzyme Catalysts) Zeolite Catalysts Metal Catalysts Chemical Compound Catalysts Others |

| By End-User | Chemical Industry Petrochemical Industry Automotive Industry Oil & Gas Industry Environmental Sector Pharmaceutical Industry Others |

| By Application | Petroleum Refining Chemical Synthesis Polymer & Petrochemicals Environmental Applications (Emission Control, Water Treatment) Others |

| By Catalyst Form | Powder Catalysts Pellet Catalysts Liquid Catalysts Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Fixed Bed Reactors Fluidized Bed Reactors Continuous Stirred Tank Reactors Others |

| By Market Segment | Industrial Catalysts Specialty Catalysts Research Catalysts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Refining Catalysts | 45 | Process Engineers, Refinery Managers |

| Automotive Catalysts | 38 | Product Development Engineers, Quality Assurance Managers |

| Industrial Catalysts | 42 | Operations Managers, Chemical Plant Supervisors |

| Emission Control Catalysts | 35 | Environmental Compliance Officers, Sustainability Managers |

| Research & Development in Catalysis | 40 | R&D Directors, Innovation Managers |

The Global Catalyst Market is valued at approximately USD 32 billion, driven by increasing demand in sectors such as petrochemicals, automotive, and environmental applications. This valuation is based on a comprehensive five-year historical analysis.