Region:Global

Author(s):Geetanshi

Product Code:KRAC0009

Pages:96

Published On:August 2025

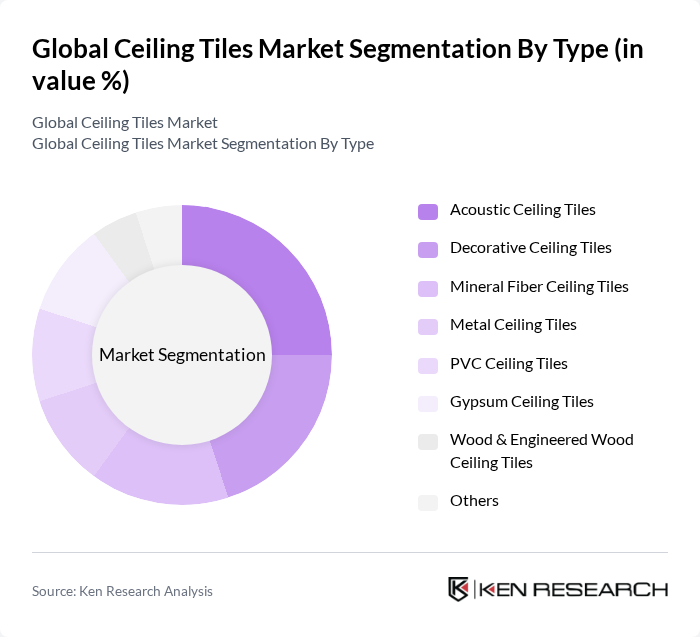

By Type:The ceiling tiles market can be segmented into various types, including Acoustic Ceiling Tiles, Decorative Ceiling Tiles, Mineral Fiber Ceiling Tiles, Metal Ceiling Tiles, PVC Ceiling Tiles, Gypsum Ceiling Tiles, Wood & Engineered Wood Ceiling Tiles, and Others. Each type serves distinct purposes, catering to different aesthetic and functional requirements in various settings.

By End-User:The end-user segmentation includes Residential, Commercial (Offices, Retail, Hospitality, Healthcare, Education), Industrial, and Government & Institutional sectors. Each segment has unique requirements and preferences, influencing the types of ceiling tiles used in various applications.

The Global Ceiling Tiles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Armstrong World Industries, Inc., USG Corporation, Saint-Gobain S.A. (including CertainTeed and Ecophon), Rockfon (ROCKWOOL Group), Knauf Gips KG, OWA Ceiling Systems (OWA Odenwald Faserplattenwerk GmbH), Chicago Metallic Corporation (subsidiary of ROCKWOOL International), Hunter Douglas N.V., Sika AG, Boral Limited, Gyptech, Tectum, Inc. (Armstrong subsidiary), Renhurst Ceiling Systems, Techno Ceiling Products, Zhejiang Youpon Integrated Ceiling Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ceiling tiles market appears promising, driven by ongoing trends in sustainability and technological integration. As consumers increasingly demand eco-friendly products, manufacturers are likely to innovate with sustainable materials and designs. Additionally, the rise of smart buildings will create opportunities for integrating advanced technologies into ceiling solutions, enhancing functionality and energy efficiency. These trends suggest a dynamic market landscape, with potential for growth in both established and emerging markets as consumer preferences evolve.

| Segment | Sub-Segments |

|---|---|

| By Type | Acoustic Ceiling Tiles Decorative Ceiling Tiles Mineral Fiber Ceiling Tiles Metal Ceiling Tiles PVC Ceiling Tiles Gypsum Ceiling Tiles Wood & Engineered Wood Ceiling Tiles Others |

| By End-User | Residential Commercial (Offices, Retail, Hospitality, Healthcare, Education) Industrial Government & Institutional |

| By Application | New Construction Renovation & Remodeling Ceiling Repair & Replacement |

| By Distribution Channel | Direct Sales Online Retail Distributors/Wholesalers Specialty Stores |

| By Material | Mineral Fiber Metal Gypsum PVC Wood & Engineered Wood |

| By Price Range | Economy Mid-Range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Ceiling Tile Market | 120 | Homeowners, Interior Designers |

| Commercial Ceiling Tile Applications | 90 | Facility Managers, Architects |

| Industrial Ceiling Solutions | 60 | Construction Managers, Engineers |

| Retail Sector Ceiling Installations | 50 | Store Managers, Retail Designers |

| Hospitality Industry Ceiling Trends | 70 | Hotel Managers, Interior Decorators |

The Global Ceiling Tiles Market is valued at approximately USD 10.3 billion, driven by increasing demand for aesthetic and functional ceiling solutions in both residential and commercial spaces, alongside a rise in global construction activities.