Region:Global

Author(s):Shubham

Product Code:KRAD0719

Pages:86

Published On:August 2025

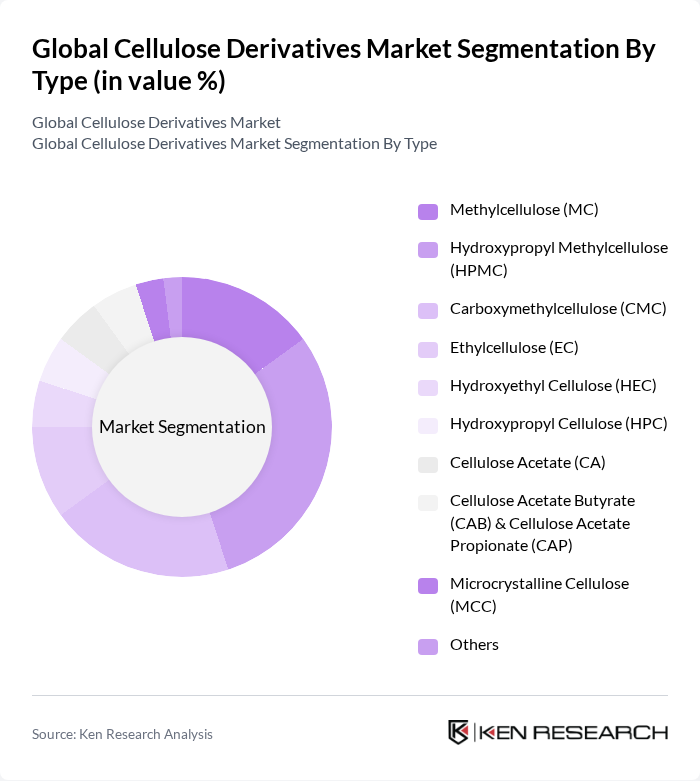

By Type:The cellulose derivatives market is segmented into various types, including Methylcellulose (MC), Hydroxypropyl Methylcellulose (HPMC), Carboxymethylcellulose (CMC), Ethylcellulose (EC), Hydroxyethyl Cellulose (HEC), Hydroxypropyl Cellulose (HPC), Cellulose Acetate (CA), Cellulose Acetate Butyrate (CAB) & Cellulose Acetate Propionate (CAP), Microcrystalline Cellulose (MCC), and Others. Among these, Hydroxypropyl Methylcellulose (HPMC) is the leading subsegment due to its extensive use in pharmaceuticals and construction applications, driven by its excellent binding and film-forming properties.

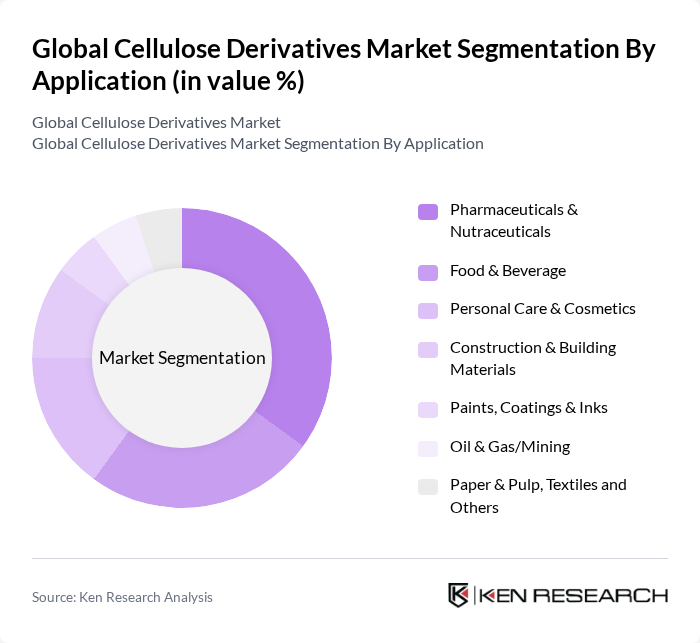

By Application:The applications of cellulose derivatives span across various sectors, including Pharmaceuticals & Nutraceuticals, Food & Beverage, Personal Care & Cosmetics, Construction & Building Materials, Paints, Coatings & Inks, Oil & Gas/Mining, and Paper & Pulp, Textiles and Others. The Pharmaceuticals & Nutraceuticals segment is the most significant, driven by the increasing demand for excipients in drug formulations and the growing trend of health and wellness products.

The Global Cellulose Derivatives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ashland Inc., Dow Inc. (cellulose acetate derivatives, coatings intermediates), Nouryon (formerly AkzoNobel Specialty Chemicals), Celanese Corporation (cellulose esters, cellulose acetate), DuPont de Nemours, Inc., Mitsubishi Chemical Group Corporation, BASF SE, Solvay S.A., Lamberti S.p.A., IFF (International Flavors & Fragrances) – Pharma Solutions, JRS PHARMA (J. Rettenmaier & Söhne), DKS Co. Ltd., LOTTE Fine Chemical Co., Ltd., Daicel Corporation, Eastman Chemical Company, Shandong Head Co., Ltd., Shandong Yiteng New Material Co., Ltd. (Yiteng New Material), Anhui Shanhe Pharmaceutical Excipients Co., Ltd., Fenchem Biotek Ltd., Sinopec Sichuan Vinylon Works (SVW) contribute to innovation, geographic expansion, and service delivery in this space.

The cellulose derivatives market is poised for significant growth, driven by increasing consumer demand for sustainable and natural products. Innovations in product development, particularly in bioplastics and food applications, are expected to enhance market dynamics. Additionally, the expansion of cellulose derivatives into emerging economies will create new opportunities. As companies invest in research and development, the integration of digital technologies will streamline production processes, further driving efficiency and sustainability in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Methylcellulose (MC) Hydroxypropyl Methylcellulose (HPMC) Carboxymethylcellulose (CMC) Ethylcellulose (EC) Hydroxyethyl Cellulose (HEC) Hydroxypropyl Cellulose (HPC) Cellulose Acetate (CA) Cellulose Acetate Butyrate (CAB) & Cellulose Acetate Propionate (CAP) Microcrystalline Cellulose (MCC) Others (Nitrocellulose, Carboxymethyl Hydroxyethyl Cellulose, etc.) |

| By Application | Pharmaceuticals & Nutraceuticals (binders, disintegrants, film-coatings, controlled release) Food & Beverage (thickeners, stabilizers, fat replacers) Personal Care & Cosmetics (rheology modifiers, film formers) Construction & Building Materials (tile adhesives, renders, mortars) Paints, Coatings & Inks (coalescing aids, film-formers, viscosity control) Oil & Gas/Mining (drilling fluids, EOR, flocculants) Paper & Pulp, Textiles and Others (sizing, finishing, packaging films) |

| By End-User | Pharmaceutical Manufacturers Food & Beverage Processors Personal Care & Home Care Brands Construction Chemical Producers Paints, Coatings & Inks Manufacturers Oilfield Service Companies Paper, Packaging & Textile Industries Others |

| By Distribution Channel | Direct Sales (contract manufacturing, key accounts) Authorized Distributors & Channel Partners Online B2B Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Product Form | Powder Granules Liquid/Dispersions Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | R&D Managers, Quality Assurance Officers |

| Food Industry Utilization | 80 | Product Development Managers, Regulatory Affairs Specialists |

| Personal Care Products | 70 | Formulation Chemists, Brand Managers |

| Textile Industry Applications | 60 | Textile Engineers, Supply Chain Managers |

| Construction and Coatings | 50 | Product Managers, Technical Sales Representatives |

The Global Cellulose Derivatives Market is valued at approximately USD 9.6 billion, reflecting a comprehensive analysis of demand across various sectors, including pharmaceuticals, food and beverages, personal care, construction, and coatings.