Region:Global

Author(s):Shubham

Product Code:KRAD0743

Pages:89

Published On:August 2025

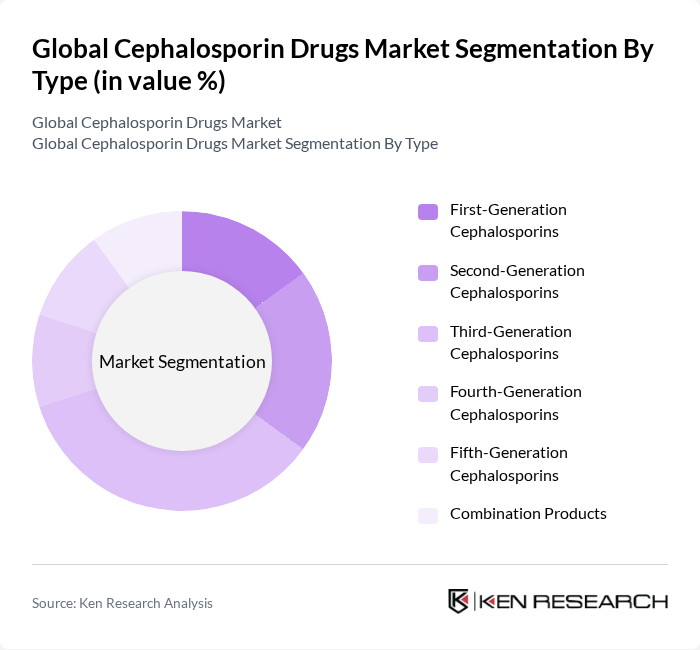

By Type:The cephalosporin drugs market is segmented into various types, including first-generation, second-generation, third-generation, fourth-generation, fifth-generation, and combination products. Each generation of cephalosporins has distinct characteristics and applications, catering to different bacterial infections. The third-generation cephalosporins are particularly prominent in clinical use because of their broad-spectrum activity, including enhanced gram-negative coverage, and their role as standards of care for serious infections (e.g., ceftriaxone), making them a frequent choice among healthcare providers .

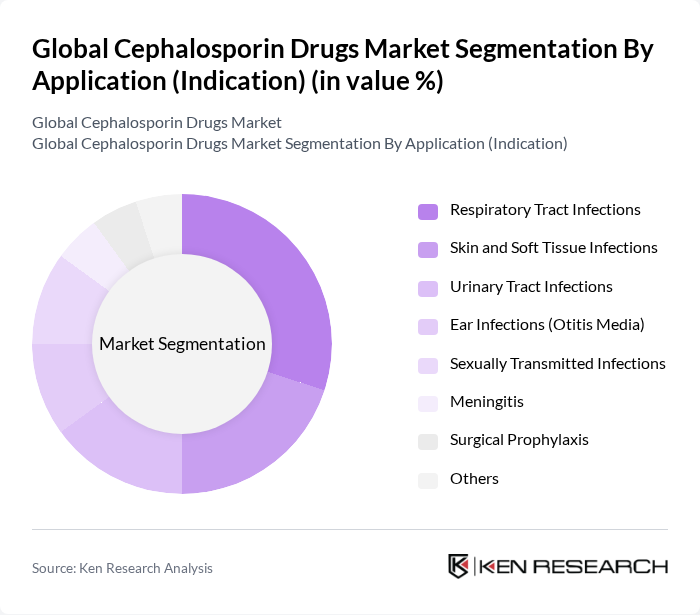

By Application (Indication):The applications of cephalosporin drugs are diverse, including treatment for respiratory tract infections, skin and soft tissue infections, urinary tract infections, ear infections, sexually transmitted infections, meningitis, surgical prophylaxis, and others. Respiratory tract infections are a leading application area due to the high incidence of community-acquired pneumonia and acute bacterial exacerbations requiring guideline-supported agents such as ceftriaxone and cefuroxime; cephalosporins are also widely used for UTIs, SSTIs, otitis media, gonorrhea, and perioperative prophylaxis in hospitals .

The Global Cephalosporin Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Merck & Co., Inc., GlaxoSmithKline plc, Sandoz Group AG, Viatris Inc., Lupin Limited, Aurobindo Pharma Limited, Glenmark Pharmaceuticals Ltd., Alembic Pharmaceuticals Limited, Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Shanghai Fosun Pharmaceutical (Group) Co., Ltd., CSPC Pharmaceutical Group Limited, Hikma Pharmaceuticals plc, Shionogi & Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cephalosporin drugs market appears promising, driven by ongoing advancements in pharmaceutical research and a heightened focus on combating antibiotic resistance. As healthcare systems increasingly prioritize effective infection management, the demand for innovative cephalosporin formulations is expected to rise. Additionally, strategic partnerships between pharmaceutical companies and research institutions will likely accelerate the development of new antibiotics, ensuring that cephalosporins remain a vital component of treatment regimens in the face of evolving bacterial threats.

| Segment | Sub-Segments |

|---|---|

| By Type | First-Generation Cephalosporins Second-Generation Cephalosporins Third-Generation Cephalosporins Fourth-Generation Cephalosporins Fifth-Generation Cephalosporins Combination Products (e.g., ceftazidime/avibactam, ceftolozane/tazobactam) |

| By Application (Indication) | Respiratory Tract Infections Skin and Soft Tissue Infections Urinary Tract Infections Ear Infections (Otitis Media) Sexually Transmitted Infections (e.g., gonorrhea) Meningitis Surgical Prophylaxis Others |

| By Route of Administration | Oral Injection (Intravenous/Intramuscular) Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Others |

| By End-User | Hospitals Ambulatory Surgery Centers Clinics Home Healthcare Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Medium Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Pharmacists | 120 | Clinical Pharmacists, Pharmacy Directors |

| General Practitioners | 110 | Family Medicine Physicians, Internal Medicine Specialists |

| Infectious Disease Specialists | 80 | Infectious Disease Physicians, Clinical Researchers |

| Pharmaceutical Sales Representatives | 90 | Sales Managers, Territory Representatives |

| Regulatory Affairs Experts | 60 | Regulatory Managers, Compliance Officers |

The Global Cephalosporin Drugs Market is valued at approximately USD 19.5 billion, reflecting steady demand driven by the clinical use of these antibiotics in both community and hospital settings.