Region:Global

Author(s):Shubham

Product Code:KRAD0640

Pages:80

Published On:August 2025

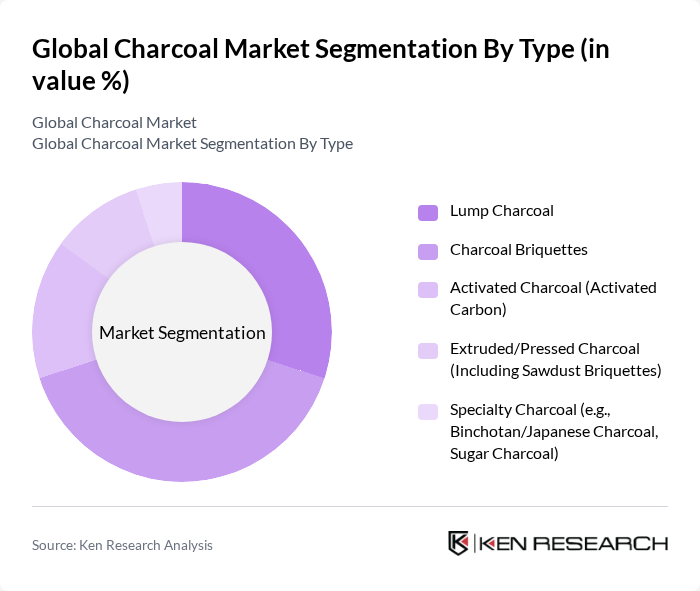

By Type:The market is segmented into various types of charcoal, including Lump Charcoal, Charcoal Briquettes, Activated Charcoal (Activated Carbon), Extruded/Pressed Charcoal (Including Sawdust Briquettes), and Specialty Charcoal (e.g., Binchotan/Japanese Charcoal, Sugar Charcoal). Each type serves different consumer needs and preferences, influencing market dynamics.

The Charcoal Briquettes segment is currently dominating the market due to its convenience and consistent burning properties, making it a preferred choice for both residential and commercial grilling. The growing trend of outdoor cooking and barbecuing has further fueled the demand for briquettes, as they are easy to use and provide a longer burn time compared to lump charcoal. Additionally, the availability of various brands and flavors has attracted a diverse consumer base, solidifying its market leadership.

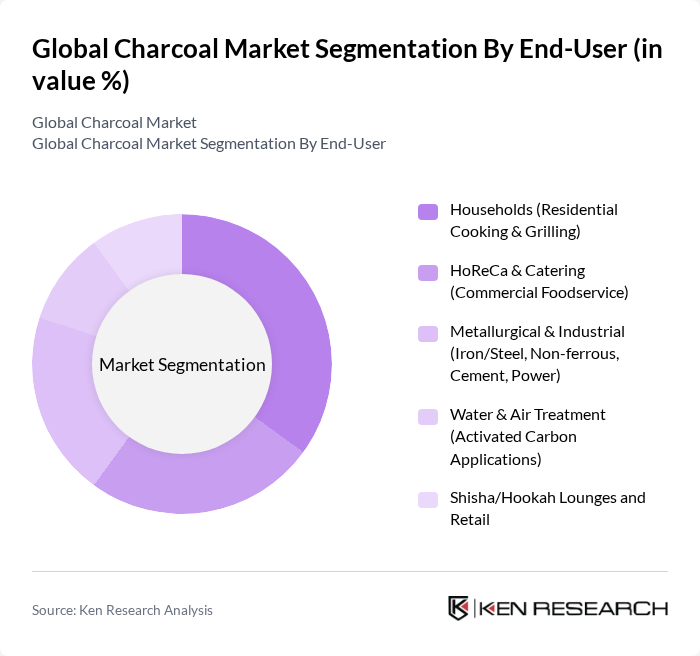

By End-User:The market is segmented based on end-users, including Households (Residential Cooking & Grilling), HoReCa & Catering (Commercial Foodservice), Metallurgical & Industrial (Iron/Steel, Non-ferrous, Cement, Power), Water & Air Treatment (Activated Carbon Applications), and Shisha/Hookah Lounges and Retail. Each segment has unique requirements and consumption patterns that influence market trends.

The Households segment is the leading end-user category, driven by the increasing popularity of outdoor cooking and grilling activities. The rise in home-based gatherings and barbecues has significantly boosted the demand for charcoal among consumers. Additionally, the convenience and ease of use associated with charcoal products have made them a staple in many households, further solidifying their market dominance.

The Global Charcoal Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Kingsford Products Company (The Clorox Company), Royal Oak Enterprises, LLC, Duraflame, Inc., FOGO Charcoal, Inc., B&B Charcoal, Inc., Jealous Devil, LLC, Big Green Egg, Inc., Kamado Joe (Middleby Outdoor Living), Weber-Stephen Products LLC, Gryfskand Sp. z o.o., Bricapar S.A. (Brazil), Maurobera S.A. (Uruguay), The Dorset Charcoal Company Ltd. (UK), Rancher Charcoal Company, Mesjaya Abadi Sdn Bhd (Malaysia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the charcoal market appears promising, driven by innovations in production technologies and a growing emphasis on sustainability. As consumer preferences shift towards eco-friendly products, the market is likely to see an increase in demand for sustainably sourced charcoal. Additionally, the expansion of e-commerce platforms is expected to facilitate greater access to charcoal products, enhancing market reach and consumer engagement. These trends indicate a dynamic market landscape poised for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Lump Charcoal Charcoal Briquettes Activated Charcoal (Activated Carbon) Extruded/Pressed Charcoal (Including Sawdust Briquettes) Specialty Charcoal (e.g., Binchotan/Japanese Charcoal, Sugar Charcoal) |

| By End-User | Households (Residential Cooking & Grilling) HoReCa & Catering (Commercial Foodservice) Metallurgical & Industrial (Iron/Steel, Non-ferrous, Cement, Power) Water & Air Treatment (Activated Carbon Applications) Shisha/Hookah Lounges and Retail |

| By Application | Barbecue & Cooking Residential & Commercial Heating Metallurgy & Foundry (Reducing Agent/Carburizer) Water and Wastewater Filtration (Activated Carbon) Air Purification & Gas Processing (Activated Carbon) |

| By Distribution Channel | Offline Retail (Grocery, DIY, Hardware, Specialty Stores) Online Retail & Marketplaces Wholesale/B2B (Foodservice, Industrial) Direct Sales & Private Label |

| By Region | North America Europe Asia-Pacific Middle East & Africa South America |

| By Price Range | Value/Economy Mid-range Premium/Professional |

| By Packaging Type | Paper/Poly Bags (2–20 kg) Boxes/Cartons Bulk/IBC/Super Sacks (500–1,000 kg) Retail-ready Pouches (Small Packs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Charcoal Production Facilities | 95 | Plant Managers, Production Supervisors |

| Retail Charcoal Distributors | 85 | Sales Managers, Distribution Coordinators |

| Food Service Industry Users | 70 | Restaurant Owners, Catering Managers |

| Export Market Stakeholders | 55 | Export Managers, Trade Compliance Officers |

| Environmental Regulatory Bodies | 45 | Policy Analysts, Environmental Compliance Officers |

The Global Charcoal Market is valued at approximately USD 6.06.4 billion, driven by increased outdoor cooking, grilling activities, and industrial applications. This valuation reflects a comprehensive analysis of various charcoal segments, including BBQ charcoal and briquettes.