Region:Global

Author(s):Rebecca

Product Code:KRAD0308

Pages:96

Published On:August 2025

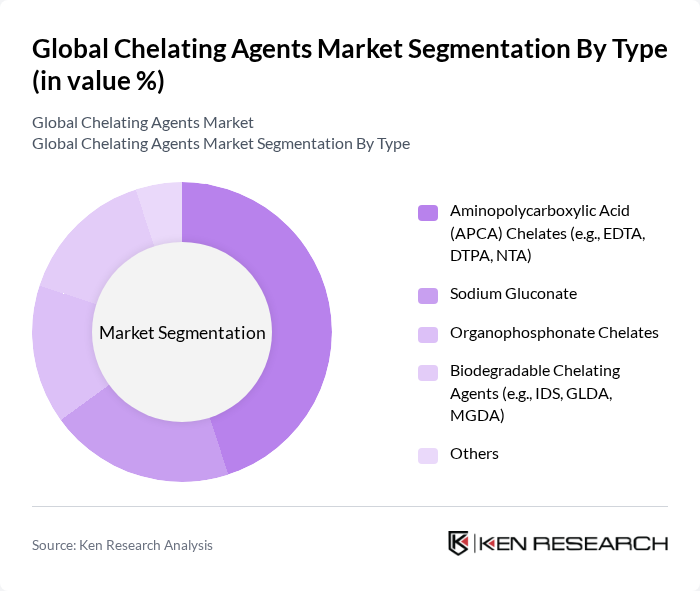

By Type:

The chelating agents market is segmented into various types, including Aminopolycarboxylic Acid (APCA) Chelates, Sodium Gluconate, Organophosphonate Chelates, Biodegradable Chelating Agents, and Others. Among these,Aminopolycarboxylic Acid (APCA) Chelates(such as EDTA, DTPA, and NTA) dominate the market due to their extensive use in water treatment, pulp and paper, and agriculture. The increasing demand for eco-friendly solutions has also led to a rise in the adoption ofbiodegradable chelating agents(such as IDS, GLDA, and MGDA), which are gaining traction among environmentally conscious consumers and industries seeking to comply with regulatory requirements .

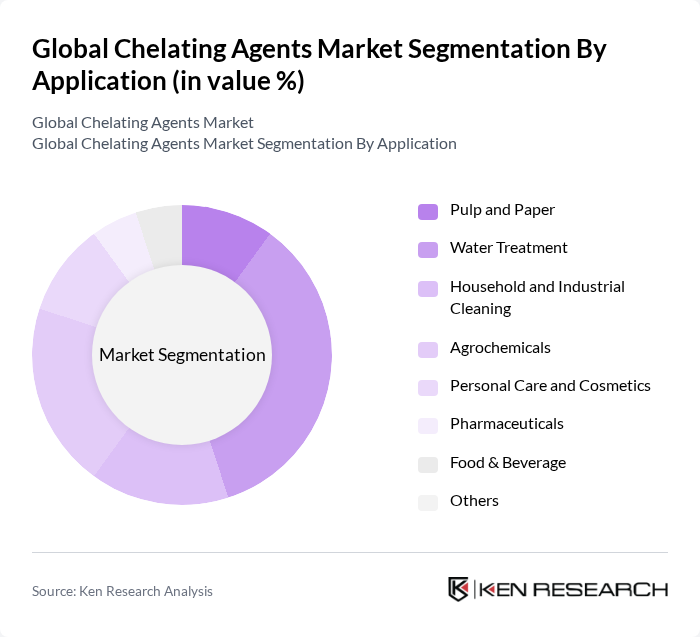

By Application:

The applications of chelating agents are diverse, including pulp and paper, water treatment, household and industrial cleaning, agrochemicals, personal care and cosmetics, pharmaceuticals, food & beverage, and others. Thewater treatment segmentis the largest, driven by the increasing need for water purification, industrial wastewater management, and regulatory compliance. Theagrochemicals sectoris also a significant growth driver, with chelating agents used in fertilizers and crop protection products to enhance micronutrient availability and crop yields. Additionally, the demand for chelating agents in cleaning products and personal care is rising due to consumer preference for high-performance and environmentally friendly formulations .

The Global Chelating Agents Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Inc., Nouryon (formerly part of AkzoNobel), Mitsubishi Chemical Group Corporation, Lanxess AG, Archer Daniels Midland Company (ADM), Solvay S.A., Eastman Chemical Company, Clariant AG, Chemetall GmbH (a subsidiary of BASF SE), Tate & Lyle PLC, Evonik Industries AG, Huntsman Corporation, Kemira Oyj, Innospec Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the chelating agents market appears promising, driven by increasing demand for sustainable and biodegradable products. Innovations in formulation technologies are expected to enhance product performance while meeting environmental standards. Additionally, the expansion of manufacturing capabilities in emerging economies will provide new growth avenues. As industries increasingly focus on sustainability, the adoption of circular economy principles will further shape the market landscape, fostering collaboration among stakeholders to develop eco-friendly solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Aminopolycarboxylic Acid (APCA) Chelates (e.g., EDTA, DTPA, NTA) Sodium Gluconate Organophosphonate Chelates Biodegradable Chelating Agents (e.g., IDS, GLDA, MGDA) Others |

| By Application | Pulp and Paper Water Treatment Household and Industrial Cleaning Agrochemicals Personal Care and Cosmetics Pharmaceuticals Food & Beverage Others |

| By End-User | Pulp and Paper Industry Water Treatment Facilities Agriculture Sector Food and Beverage Industry Pharmaceutical Industry Household and Industrial Cleaning Sector Personal Care Industry Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Asia-Pacific North America Europe Latin America Middle East & Africa |

| By Product Form | Liquid Chelating Agents Solid Chelating Agents Powder Chelating Agents |

| By Price Range | Economy Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Chelating Agents | 100 | Agronomists, Crop Protection Specialists |

| Industrial Cleaning Applications | 80 | Facility Managers, Chemical Engineers |

| Pharmaceutical Chelating Agents | 70 | Quality Control Managers, R&D Scientists |

| Water Treatment Solutions | 90 | Environmental Engineers, Water Quality Analysts |

| Consumer Products Sector | 50 | Product Development Managers, Marketing Executives |

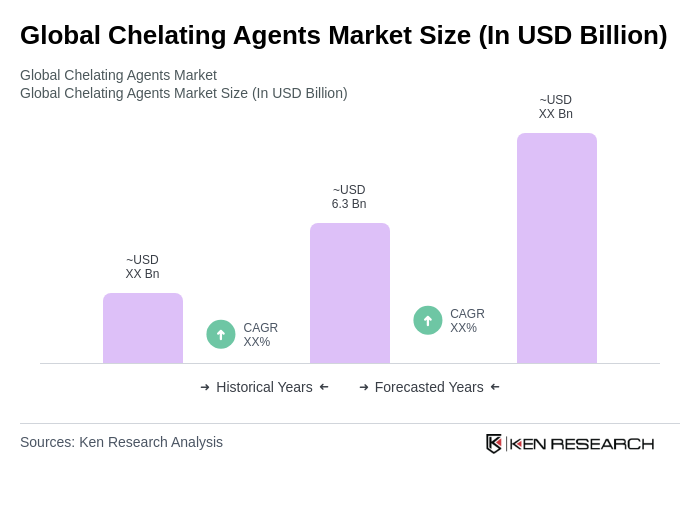

The Global Chelating Agents Market is valued at approximately USD 6.3 billion, reflecting a robust growth trajectory driven by increasing demand across various applications, including water treatment, agriculture, and personal care products.