Region:Global

Author(s):Dev

Product Code:KRAD0569

Pages:87

Published On:August 2025

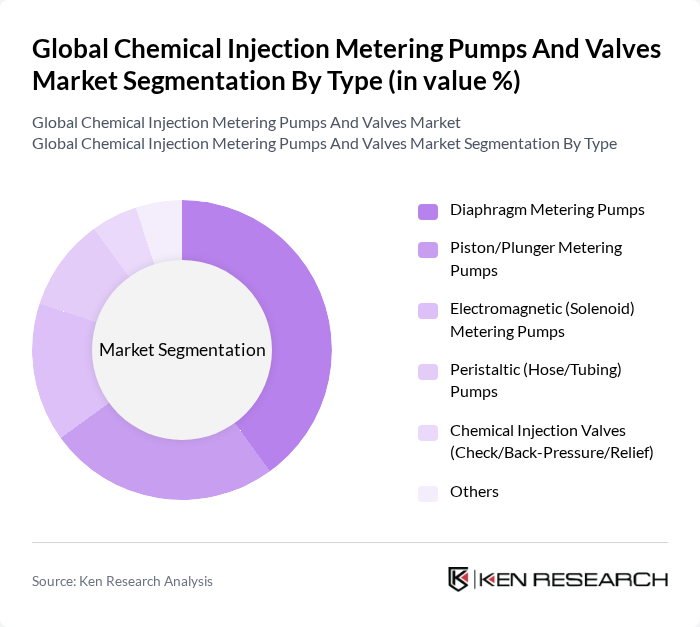

By Type:The market is segmented into various types of metering pumps and valves, each serving specific applications and industries. The dominant sub-segment is the diaphragm metering pumps, which are widely used due to their reliability and precision in chemical dosing. These pumps are preferred in industries such as water treatment and chemicals, where accurate dosing is critical. Other types, such as piston/plunger and electromagnetic pumps, also hold significant market shares, catering to diverse industrial needs.

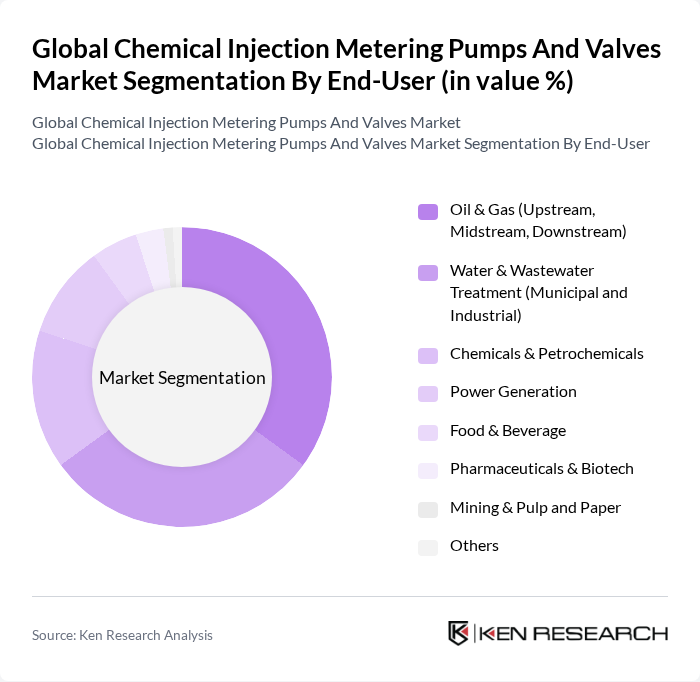

By End-User:The end-user segmentation highlights the diverse applications of chemical injection metering pumps and valves across various industries. The oil and gas sector is the leading end-user, driven by the need for precise chemical dosing in upstream, midstream, and downstream processes. Water and wastewater treatment also represent a significant portion of the market, as municipalities and industries seek efficient solutions for chemical management. Other sectors, including chemicals, power generation, and food and beverage, contribute to the overall demand.

The Global Chemical Injection Metering Pumps And Valves Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grundfos Holding A/S, Flowserve Corporation, ProMinent GmbH, Milton Roy Company, Iwaki Co., Ltd., KSB SE & Co. KGaA, Verder Group, Blue-White Industries, Ltd., Watson-Marlow Fluid Technology Solutions (a Spirax Group company), ARO (Ingersoll Rand), Graco Inc., Haskel, SEKO S.p.A., LMI (A Brand of Ingersoll Rand), SPX FLOW, Inc. (including Bran+Luebbe) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the chemical injection metering pumps and valves market appears promising, driven by technological advancements and increasing regulatory pressures. As industries continue to prioritize automation and energy efficiency, the integration of IoT technologies in pump systems is expected to enhance operational capabilities. Furthermore, the growing emphasis on sustainable practices will likely lead to increased investments in smart pump solutions, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Diaphragm Metering Pumps Piston/Plunger Metering Pumps Electromagnetic (Solenoid) Metering Pumps Peristaltic (Hose/Tubing) Pumps Chemical Injection Valves (Check/Back-Pressure/Relief) Others |

| By End-User | Oil & Gas (Upstream, Midstream, Downstream) Water & Wastewater Treatment (Municipal and Industrial) Chemicals & Petrochemicals Power Generation Food & Beverage Pharmaceuticals & Biotech Mining & Pulp and Paper Others |

| By Application | Corrosion Inhibition, Scale & Paraffin Control pH Control & Disinfection (Chlorination/Dechlorination) Coagulation/Flocculation & Polymer Dosing Fuel Additive & Combustion Treatment Injection Well/Reservoir Chemical Treatment Others |

| By Distribution Channel | Direct Sales (OEMs and EPCs) Authorized Distributors/Value-Added Resellers Online/Indirect Channels Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Entry (CapEx-sensitive) Mid Range (Standard Duty) High Range (Severe Service/Smart-Enabled) |

| By Technology | Manual/Mechanical Control Automatic/Electronic Control (VFD/PLC) Smart/IIoT-Enabled (Remote Monitoring, Diagnostics) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chemical Manufacturing Sector | 120 | Production Managers, Process Engineers |

| Oil & Gas Industry | 100 | Field Engineers, Procurement Managers |

| Water Treatment Facilities | 80 | Plant Managers, Environmental Compliance Officers |

| Pharmaceutical Manufacturing | 60 | Quality Control Managers, R&D Directors |

| Agricultural Chemical Applications | 70 | Agronomists, Supply Chain Coordinators |

The Global Chemical Injection Metering Pumps and Valves Market is valued at approximately USD 7.2 billion, reflecting strong demand for precise dosing in various industries, including oil and gas, water treatment, and chemicals, supported by technological advancements.