Region:Global

Author(s):Rebecca

Product Code:KRAA2433

Pages:88

Published On:August 2025

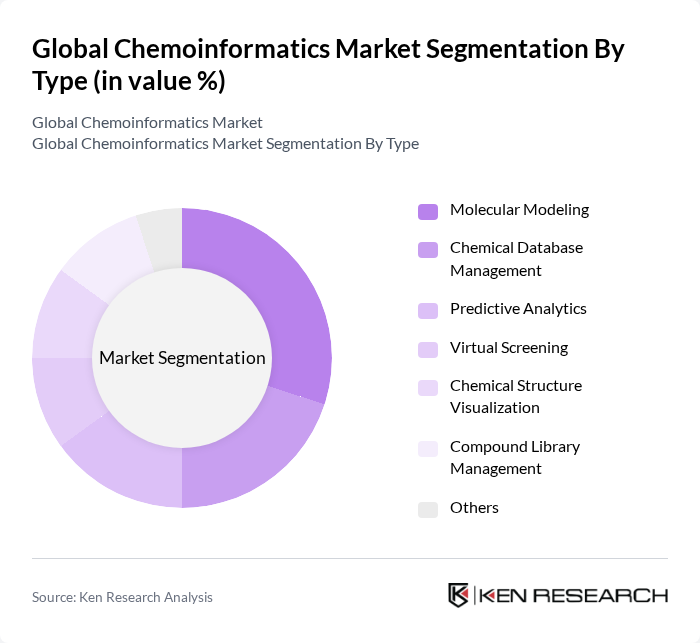

By Type:The chemoinformatics market is segmented into various types, including Molecular Modeling, Chemical Database Management, Predictive Analytics, Virtual Screening, Chemical Structure Visualization, Compound Library Management, and Others. Among these, Molecular Modeling is currently the leading sub-segment due to its critical role in simulating molecular interactions and predicting the behavior of chemical compounds. This technology is widely adopted in drug discovery and material science, driving significant demand from pharmaceutical companies and research institutions. The growing use of predictive analytics and virtual screening is also notable, reflecting the industry's focus on accelerating drug development and improving accuracy in compound selection .

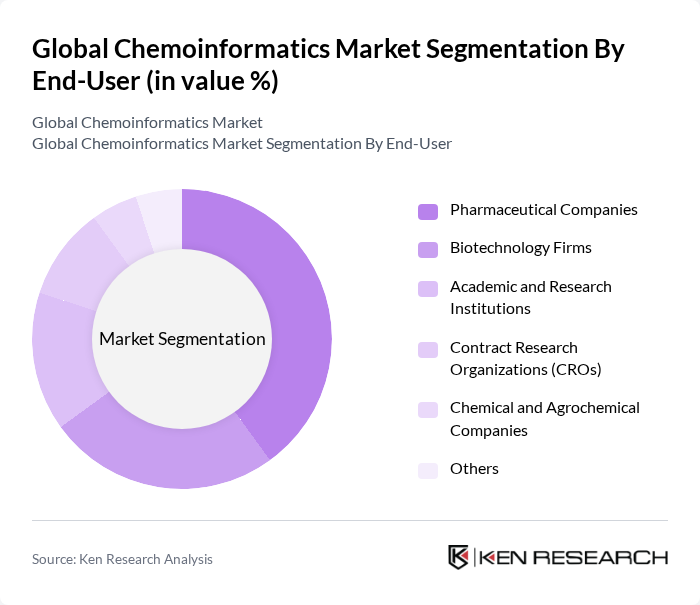

By End-User:The end-user segmentation includes Pharmaceutical Companies, Biotechnology Firms, Academic and Research Institutions, Contract Research Organizations (CROs), Chemical and Agrochemical Companies, and Others. Pharmaceutical Companies dominate this segment, driven by their need for advanced computational tools to streamline drug development processes. The increasing focus on personalized medicine and the rising costs associated with drug discovery are pushing these companies to adopt chemoinformatics solutions to enhance efficiency and reduce time-to-market. Biotechnology firms and CROs are also rapidly increasing their adoption of chemoinformatics platforms to support innovation and outsourcing trends in drug research .

The Global Chemoinformatics Market is characterized by a dynamic mix of regional and international players. Leading participants such as ChemAxon, BIOVIA (Dassault Systèmes), Schrödinger Inc., Thermo Fisher Scientific, PerkinElmer, Agilent Technologies Inc., Bio-Rad Laboratories Inc., Dotmatics, Cresset, OpenEye Scientific Software Inc., Molecular Discovery Ltd., BioSolveIT GmbH, Eurofins CEREP SA (Eurofins Panlabs Inc.), Jubilant Biosys Inc., Elsevier contribute to innovation, geographic expansion, and service delivery in this space.

The future of the chemoinformatics market appears promising, driven by technological advancements and increasing demand for innovative drug discovery methods. As organizations continue to invest in AI and machine learning, the efficiency of data analysis will improve significantly. Furthermore, the expansion of cloud-based solutions will facilitate greater collaboration among researchers, enhancing the overall research ecosystem. These trends indicate a robust growth trajectory for the chemoinformatics sector, with a focus on integrating sustainable practices and personalized medicine approaches.

| Segment | Sub-Segments |

|---|---|

| By Type | Molecular Modeling Chemical Database Management Predictive Analytics Virtual Screening Chemical Structure Visualization Compound Library Management Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Academic and Research Institutions Contract Research Organizations (CROs) Chemical and Agrochemical Companies Others |

| By Application | Drug Discovery Toxicology Material Science Environmental Chemistry Chemical Safety Assessment Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Customer Type | Large Enterprises Small and Medium Enterprises Startups |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | R&D Managers, Drug Development Scientists |

| Biotechnology Sector | 60 | Biotech Analysts, Product Managers |

| Environmental Chemistry | 50 | Environmental Scientists, Regulatory Affairs Specialists |

| Academic Research Institutions | 40 | Professors, Research Fellows |

| Software Development Firms | 45 | Software Engineers, Product Development Leads |

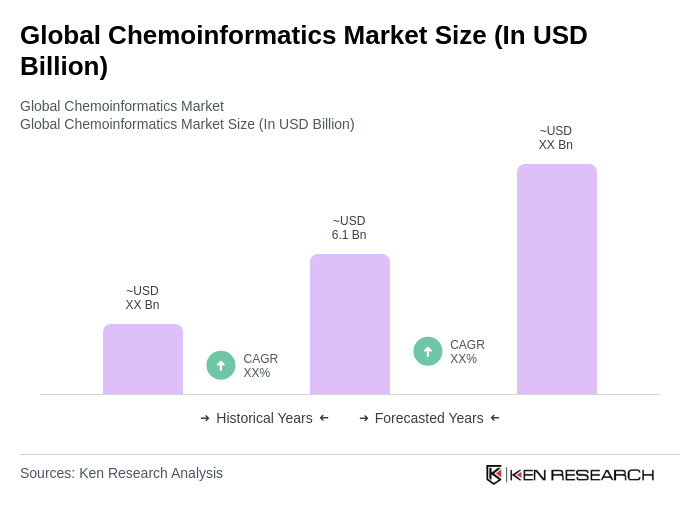

The Global Chemoinformatics Market is valued at approximately USD 6.1 billion, driven by advancements in drug discovery, computational technologies, and the integration of AI and machine learning in chemical data analysis.