Region:Global

Author(s):Shubham

Product Code:KRAD0760

Pages:83

Published On:August 2025

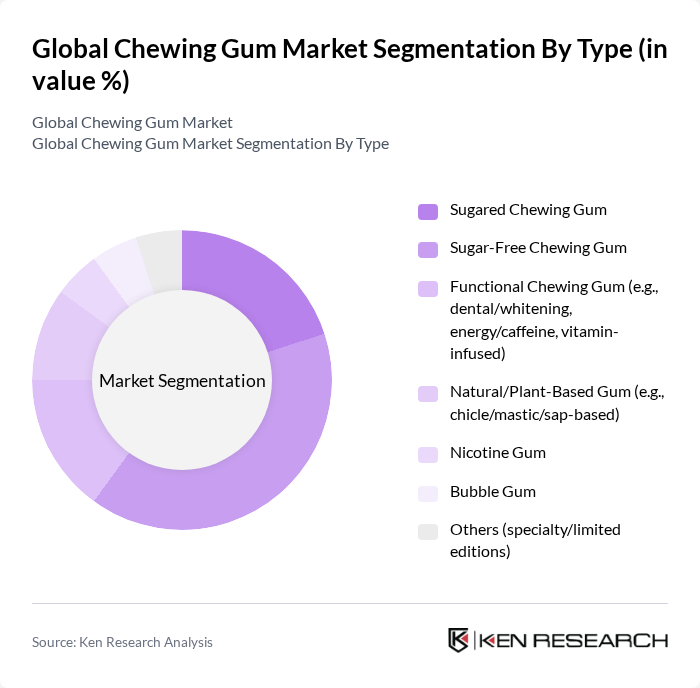

By Type:The chewing gum market is segmented into various types, including Sugared Chewing Gum, Sugar-Free Chewing Gum, Functional Chewing Gum, Natural/Plant-Based Gum, Nicotine Gum, Bubble Gum, and Others. Among these,Sugar-Free Chewing Gumis currently the leading sub-segment, driven by increasing health awareness, dental-health positioning, and lower-calorie preferences; functional gums (e.g., whitening, energy/caffeine, vitamins) are expanding via pharmacies, convenience retail, and direct-to-consumer channels .

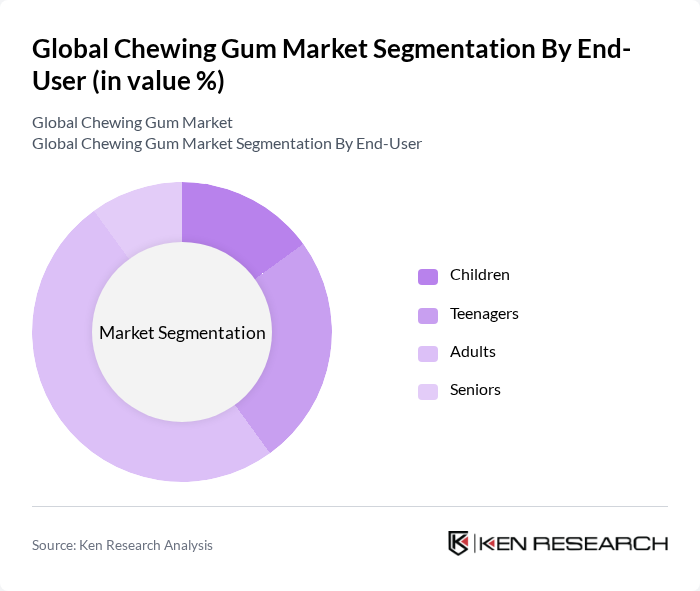

By End-User:The chewing gum market is segmented by end-user into Children, Teenagers, Adults, and Seniors. TheAdultsegment is the most significant contributor to market growth, with usage tied to fresh-breath needs, stress management, and oral-health benefits; adults are also more likely to select sugar-free and functional varieties .

The Global Chewing Gum Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mars Wrigley (Wm. Wrigley Jr. Company), Mondel?z International (Trident, Dentyne), Perfetti Van Melle (Mentos, Chupa Chups Gum), Lotte Confectionery Co., Ltd., Haribo GmbH & Co. KG, Ferrero Group (Tic Tac Gum), Meiji Holdings Co., Ltd. (Gum brands incl. Xylish), Cloetta AB (Jenkki, Läkerol Dents), The Hershey Company (Ice Breakers), Lotte Chemical Titan Holding Berhad, Ezaki Glico Co., Ltd. (Fit’s), Tootsie Roll Industries, Inc. (Charms Blow Pop, Dubble Bubble), and Simply Gum, Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the chewing gum market appears promising, driven by evolving consumer preferences and innovative product offerings. As health consciousness continues to rise, brands are likely to invest in functional and sugar-free options, catering to a more discerning consumer base. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility to diverse products, enhancing market reach. Companies that embrace sustainability and eco-friendly practices are expected to gain a competitive edge, aligning with consumer values and driving future growth in the future region.

| Segment | Sub-Segments |

|---|---|

| By Type | Sugared Chewing Gum Sugar-Free Chewing Gum Functional Chewing Gum (e.g., dental/whitening, energy/caffeine, vitamin-infused) Natural/Plant-Based Gum (e.g., chicle/mastic/sap-based) Nicotine Gum Bubble Gum Others (specialty/limited editions) |

| By End-User | Children Teenagers Adults Seniors |

| By Sales Channel | Supermarkets/Hypermarkets Convenience Stores Pharmacies/Drugstores Online Retail/E-commerce Vending Machines Specialty & Duty-Free Retail |

| By Flavor | Mint (peppermint, spearmint, menthol) Fruit (berry, citrus, tropical) Cinnamon/Spicy Herbal/Botanical Novel/Seasonal Flavors |

| By Packaging Type | Stick/Tab Packs Bottles/Jars Blister Packs Pouches Bulk/Value Packs |

| By Price Range | Economy Mid-Range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Distribution of Chewing Gum | 140 | Store Managers, Category Buyers |

| Consumer Preferences in Chewing Gum | 150 | Regular Chewing Gum Consumers, Health-Conscious Buyers |

| Market Trends in Sugar-Free Gum | 100 | Health and Wellness Advocates, Nutritionists |

| Impact of Marketing on Gum Sales | 80 | Marketing Executives, Brand Managers |

| Distribution Channel Effectiveness | 120 | Wholesale Distributors, E-commerce Managers |

The Global Chewing Gum Market is valued at approximately USD 29 billion, based on a five-year historical analysis. This valuation is supported by estimates from recognized market intelligence providers, indicating a stable market within the high-twenty to sub-thirty billion range.