Region:Global

Author(s):Shubham

Product Code:KRAD0638

Pages:84

Published On:August 2025

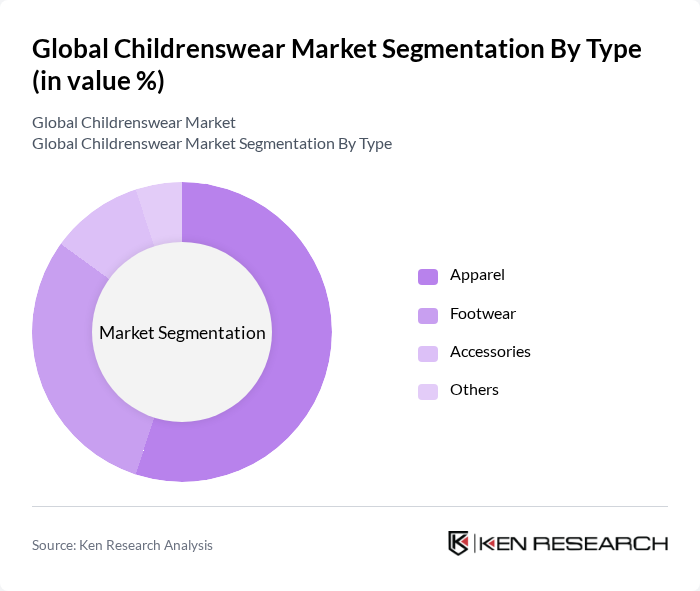

By Type:The Global Childrenswear Market can be segmented into various types, including Apparel, Footwear, Accessories, and Others. Among these, Apparel is the leading segment, driven by the continuous demand for fashionable and comfortable clothing for children, supported by fast-fashion cycles, social-media-led trends, and expansion of organized retail. The growing trend of dressing children in stylish outfits for various occasions has significantly boosted the apparel segment. Footwear follows as parents prioritize quality and durability in children's shoes, while accessories and other categories contribute at a smaller scale.

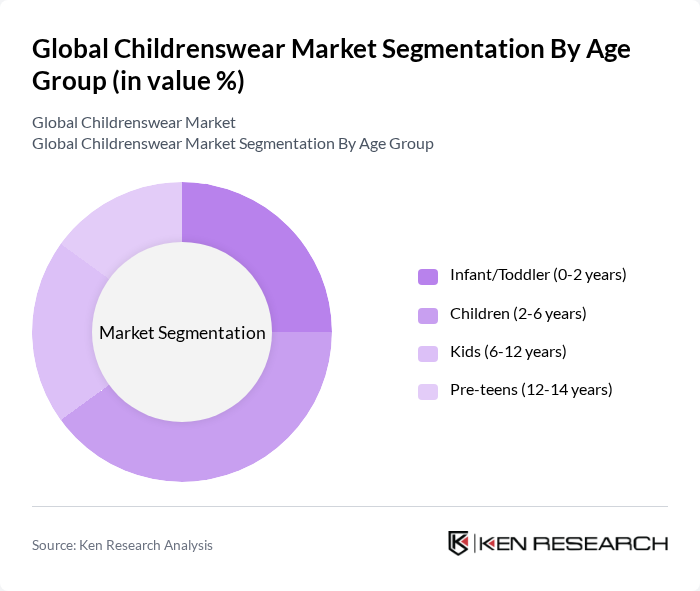

By Age Group:The market is also segmented by age group, including Infant/Toddler (0-2 years), Children (2-6 years), Kids (6-12 years), and Pre-teens (12-14 years). The Children (2-6 years) segment is currently the most dominant, as this age group is often the focus of parents looking for trendy and comfortable clothing, with frequent size changes and higher purchase frequency. The Infant/Toddler segment is also significant, driven by the need for practical and easy-to-wear clothing and rapid turnover due to growth. The Kids and Pre-teens segments are growing as children become more fashion-conscious and influenced by media and peer trends.

The Global Childrenswear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carter’s, Inc., The Children’s Place, Inc., H&M Hennes & Mauritz AB, Inditex (Zara Kids), Nike, Inc., Adidas AG, Gap Inc. (GapKids, BabyGap), Levi Strauss & Co. (Levi’s Kids), Ralph Lauren Corporation (Polo Ralph Lauren Kids), Primark Stores Limited, NEXT plc (Next Kids), Mothercare plc, Burberry Group plc (Burberry Children), Petit Bateau, Bonpoint contribute to innovation, geographic expansion, and service delivery in this space.

The future of the childrenswear market in the None region appears promising, driven by evolving consumer preferences and technological advancements. As parents increasingly prioritize sustainability, brands that adopt eco-friendly practices are likely to gain a competitive edge. Additionally, the integration of augmented reality in online shopping experiences is expected to enhance customer engagement, allowing parents to visualize products better. These trends indicate a shift towards more personalized and responsible shopping experiences, positioning the market for continued growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Footwear Accessories Others |

| By Age Group | Infant/Toddler (0-2 years) Children (2-6 years) Kids (6-12 years) Pre-teens (12-14 years) |

| By Gender/Category | Boys Girls Unisex |

| By Distribution Channel | Offline Stores (Department, Specialty, Supermarkets/Hypermarkets) Online Stores (Brand eCommerce, Marketplaces, Social Commerce) |

| By Material | Cotton Polyester/Synthetics Denim Wool Blends Others |

| By Price Range | Mass/Budget Mid-range Premium |

| By Occasion/Use | Casual/Everyday Formal/Partywear Activewear/Athleisure Sleepwear/Nightwear Outerwear/Seasonal Schoolwear/Uniforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 120 | Store Managers, Merchandising Directors |

| Consumer Preferences Survey | 150 | Parents of children aged 0-12 years |

| Brand Perception Analysis | 100 | Marketing Executives, Brand Strategists |

| Trends in E-commerce Sales | 110 | E-commerce Managers, Digital Marketing Specialists |

| Focus Group Discussions | 60 | Children aged 5-12 years, Parents |

The Global Childrenswear Market is valued at approximately USD 300 billion, reflecting a robust growth driven by increasing disposable incomes, changing fashion trends, and a focus on children's health and comfort, alongside sustainability initiatives.