Region:Global

Author(s):Geetanshi

Product Code:KRAD7194

Pages:82

Published On:December 2025

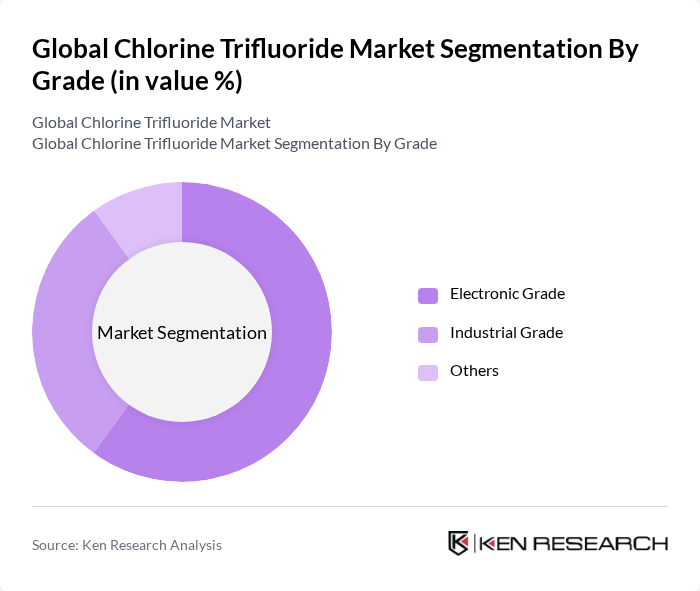

By Grade:The market is segmented into Electronic Grade, Industrial Grade, and Others. The Electronic Grade segment is particularly dominant due to the increasing demand for high-purity chemicals in semiconductor manufacturing processes. This segment is favored for its stringent quality requirements, which are essential for the production of advanced electronic components. The Industrial Grade segment also holds a significant share, driven by its applications in various industrial cleaning and decontamination processes.

By Purity Level (Type):This segmentation includes 3N, 4N, 5N, and Others. The 5N purity level is the most sought after in the market, primarily due to its critical role in semiconductor manufacturing, where ultra-high purity is essential for optimal performance. The 4N and 3N levels are also significant, catering to various industrial applications that require less stringent purity standards. The Others category includes specialty grades that serve niche markets.

The Global Chlorine Trifluoride Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Chemours Company, Solvay S.A., Air Products and Chemicals, Inc., Kanto Chemical Co., Inc., Linde plc, Merck KGaA, SHOWA DENKO K.K. (Resonac Holdings Corporation), Air Liquide S.A., Mitsui Chemicals, Inc., SK Materials Co., Ltd., Entegris, Inc., Versum Materials, Inc. (Merck KGaA), Hyosung Chemical Corporation, Taiyo Nippon Sanso Corporation, Matheson Tri-Gas, Inc. (MATHESON, a Nippon Sanso Holdings company) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the chlorine trifluoride market appears promising, driven by technological advancements and increasing applications across various industries. As manufacturers adopt sustainable production methods and enhance safety protocols, the market is likely to witness a shift towards greener practices. Additionally, the integration of automation in manufacturing processes is expected to improve efficiency and reduce costs, further supporting market growth. The focus on specialty chemicals will also create new avenues for innovation and expansion in the chlorine trifluoride sector.

| Segment | Sub-Segments |

|---|---|

| By Grade | Electronic Grade Industrial Grade Others |

| By Purity Level (Type) | N N N Others |

| By Form | Gas Liquid Solid |

| By Application | Semiconductor Manufacturing (CVD/etch chamber cleaning, wafer processing) Nuclear Fuel Processing Rocket Propellant Systems and Aerospace Industrial Cleaning and Decontamination Chemical Processing and Fluorination Others |

| By End-Use Industry | Semiconductor & Electronics Aerospace & Defense Nuclear Energy Chemical & Specialty Chemicals Others |

| By Distribution Channel | Direct Sales (Manufacturer to End User) Industrial Gas Distributors Online and Contract-based Sales Others |

| By Geography | North America (U.S., Canada) Europe (Germany, U.K., France, Rest of Europe) Asia-Pacific (Japan, China, South Korea, Taiwan, India, Rest of Asia-Pacific) Latin America Middle East & Africa |

| By Packaging Type | Cylinders Bulk Containers / Tank Trailers Others |

| By Regulatory Compliance | ISO and Quality Management Standards Environmental and Emissions Regulations Occupational Health & Safety Standards Transportation and Hazardous Materials Regulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Semiconductor Manufacturing | 100 | Process Engineers, Production Managers |

| Aerospace Applications | 80 | Quality Assurance Managers, R&D Directors |

| Pharmaceutical Industry Usage | 70 | Regulatory Affairs Specialists, Production Supervisors |

| Industrial Cleaning Solutions | 60 | Facility Managers, Chemical Safety Officers |

| Research Institutions | 50 | Research Scientists, Laboratory Managers |

The Global Chlorine Trifluoride Market is valued at approximately USD 50 million, driven by increasing demand for high-purity chemicals in semiconductor manufacturing and aerospace applications, along with advancements in technology and industrial cleaning processes.