Region:Global

Author(s):Shubham

Product Code:KRAD0663

Pages:97

Published On:August 2025

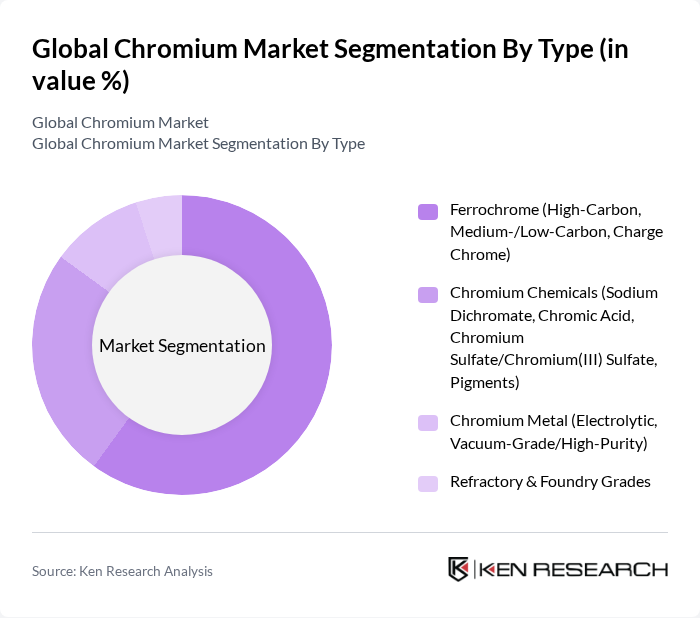

By Type:The market is segmented into various types, including Ferrochrome, Chromium Chemicals, Chromium Metal, and Refractory & Foundry Grades. Among these, Ferrochrome, particularly high-carbon ferrochrome, dominates the market due to its extensive use in stainless steel production; independent sources indicate ferrochromium held the largest share among product types. The demand for high-quality stainless steel in construction and automotive sectors drives the growth of this subsegment. Chromium Chemicals, including sodium dichromate and chromic acid, also hold a significant share, primarily used in leather tanning and surface treatment applications.

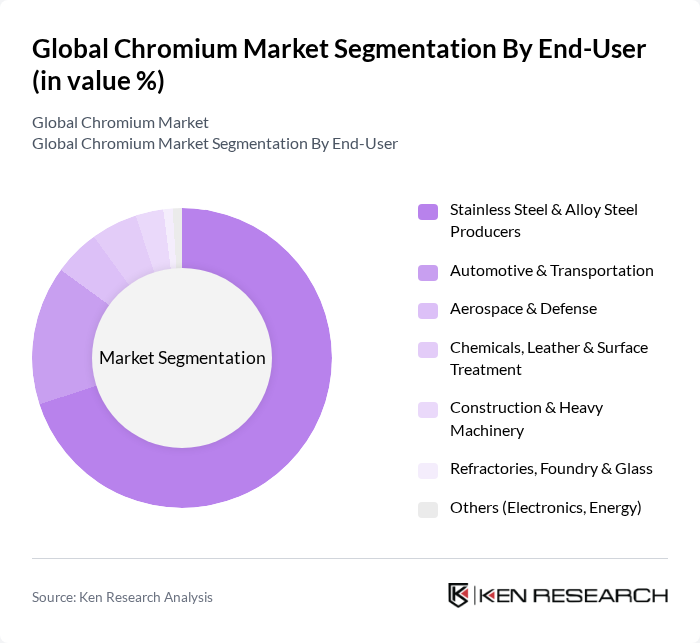

By End-User:The end-user segmentation includes Stainless Steel & Alloy Steel Producers, Automotive & Transportation, Aerospace & Defense, Chemicals, Leather & Surface Treatment, Construction & Heavy Machinery, Refractories, Foundry & Glass, and Others. The Stainless Steel & Alloy Steel Producers segment is the largest consumer of chromium, consistent with the dominance of metallurgy/stainless steel in chromium consumption across end uses. The automotive sector also significantly contributes to the market, as chromium is essential for producing durable and corrosion-resistant components and surface finishes.

The Global Chromium Market is characterized by a dynamic mix of regional and international players. Leading participants such as Glencore plc, Eurasian Resources Group (ERG), South32 Limited, Anglo American plc, Merafe Resources Limited, Samancor Chrome, Afarak Group Plc (including Mogale Alloys; formerly Kermas assets), TNC Kazchrome JSC (ERG), Assmang Proprietary Limited, YILMADEN Holding A.?. (YILDIRIM Group), Eti Krom A.?. (YILDIRIM Group), International Ferro Metals Ltd (IFM), Hernic Ferrochrome (Pty) Ltd, Odisha Mining Corporation Ltd, Zimasco (Pvt) Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the chromium market in the None region appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt eco-friendly practices, the demand for recycled chromium is expected to rise, potentially reducing reliance on primary sources. Additionally, innovations in chromium processing technologies are likely to enhance efficiency and reduce costs, further stimulating market growth. The focus on high-performance alloys will also create new opportunities for chromium applications across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Ferrochrome (High-Carbon, Medium-/Low-Carbon, Charge Chrome) Chromium Chemicals (Sodium Dichromate, Chromic Acid, Chromium Sulfate/Chromium(III) Sulfate, Pigments) Chromium Metal (Electrolytic, Vacuum-Grade/High-Purity) Refractory & Foundry Grades |

| By End-User | Stainless Steel & Alloy Steel Producers Automotive & Transportation Aerospace & Defense Chemicals, Leather & Surface Treatment Construction & Heavy Machinery Refractories, Foundry & Glass Others (Electronics, Energy) |

| By Application | Stainless Steel Production Alloy and Superalloy Production Plating, Coating & Passivation (Hard Chrome, Decorative, Trivalent/Hexavalent) Chemical Intermediates (Tanning, Pigments, Catalysts, Water Treatment) Refractory Additives & Foundry Sands Others |

| By Distribution Channel | Direct Sales & Long-term Offtake Distributors & Trading Houses Online Platforms & Exchanges Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price |

| By Quality Grade | High Purity Standard Grade Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Stainless Steel Manufacturers | 120 | Production Managers, Supply Chain Directors |

| Chromium Alloy Producers | 90 | Operations Managers, Quality Control Specialists |

| Chemical Processing Firms | 70 | Procurement Officers, R&D Managers |

| Mining and Extraction Companies | 60 | Geologists, Operations Supervisors |

| Environmental Regulatory Bodies | 50 | Policy Analysts, Environmental Compliance Officers |

The Global Chromium Market is valued at approximately USD 15.5 billion, driven primarily by the increasing demand for stainless steel, which constitutes a significant portion of chromium consumption across various industrial applications.